Nordstrom (JWN) on Track With Aggressive Store Expansion Efforts

Nordstrom, Inc. JWN disclosed plans to open stores as part of its expansion efforts. The company intends to open four Nordstrom Rack stores in California in 2024 and one in 2025. These stores will be located in Davis, Elk Grove, Gilroy, Oceanside and San Mateo, CA. Following the openings, JWN will boast 68 Nordstrom Rack stores, 23 Nordstrom stores, five Nordstrom Locals and one asos Nordstrom in California.

JWN announced the opening of additional stores in Jacksonville Beach, FL; Macedonia, OH; Snellville, GA, and Wheaton, IL, during spring 2024. For all these stores, customers will have benefits like pick-up online orders and make returns.

JWN opened 20 Rack stores in fiscal 2022. Rack stores continue to be the largest source of customer acquisition, accounting for more than 40% of newly acquired customers in 2022. Consequently, management expects to drive greater engagement and higher profitability at nordstromrack.com.

To improve customers' shopping experiences, Nordstrom Rank is an important driver of the closer-to-you strategy. Notably, the strategy aims to link stores and services to expedite deliveries, expanding online offerings, and add cheaper merchandise at its Rack off-price stores. Increased focus on distribution capabilities, along with improved connectivity of physical and digital inventory, is likely to contribute to Nordstrom Rack sales by $2 billion in the long term.

As part of the strategy, Nordstrom earlier issued a long-term outlook. It predicted revenue growth in the low-single digits on an annual basis, with operating income likely to outpace revenues in the long term. The EBIT margin is expected to be more than 6%, with the annual operating cash flow anticipated to be more than $1 billion. Capital expenditure is likely to be 3-4% of sales.

The company has been focusing on better assortment, increased brand awareness and introducing more premium brands at Rack. Driven by these factors, it expects to optimize the Rack product mix by mid-2023.

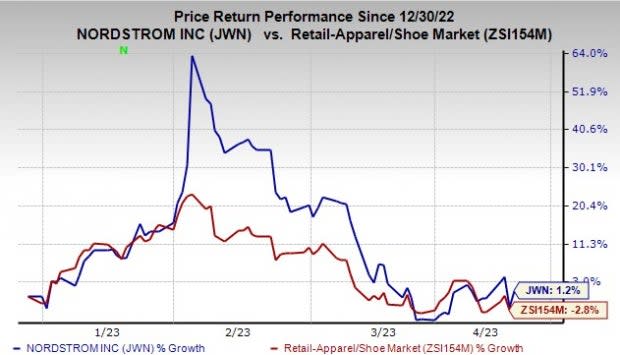

Image Source: Zacks Investment Research

This Zacks Rank #3 (Hold) stock has gained 1.2% year to date against the industry’s decline of 2.8%.

Stocks to Consider

Here are some better-ranked stocks you may want to consider — Urban Outfitters URBN, DICK’S Sporting Goods DKS and American Eagle Outfitters AEO.

Urban Outfitters, a leading lifestyle product and services company, currently carries a Zacks Rank #2 (Buy). Its expected EPS growth rate for three to five years is 18%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year revenues suggests growth of 5% from the year-ago reported figure.

DICK’S Sporting, which operates as a major omni-channel sporting goods retailer, offering athletic shoes, apparel, accessories and a broad selection of outdoor and athletic equipment, carries a Zacks Rank #2 at present. Its expected EPS growth rate for three to five years is 5.4%.

The Zacks Consensus Estimate for DICK’S Sporting’s current fiscal-year revenues and EPS suggests growth of 2.2% and 10%, respectively, from the year-ago reported figures. DKS has a trailing four-quarter earnings surprise of 10%, on average.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently carries a Zacks Rank of 2. AEO delivered an earnings surprise of 82.6% in the last reported quarter.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year sales and EPS suggests growth of 1.3% and 58.9%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance