Norfolk Southern (NSC) Q2 Earnings Beat, Revenues Up 34% Y/Y

Norfolk Southern Corporation’s NSC second-quarter 2021 earnings of $3.28 per share surpassed the Zacks Consensus Estimate of $2.94. Moreover, the bottom line skyrocketed more than 100% year over year on higher revenues.

Railway operating revenues in the quarter under review came in at $2,799 million, outperforming the Zacks Consensus Estimate of $2,751.3 million. The top line increased 34% year over year owing to 25% rise in volumes and a 7% increase in revenue per unit. Second-quarter results reflect significant recovery from the year-ago period when coronavirus-led woes dented volumes.

Income from railway operations surged 91% year over year to $1,167 million. Railway operating expenses increased 11% on a year-over-year basis to $1,632 million, mainly due to significant rise in fuel costs. Norfolk Southern’s operating ratio (operating expenses as a percentage of revenues), on a reported basis, improved to 58.3% in the second quarter from 70.7% in the year-ago quarter. With respect to this metric, lower the value, the better.

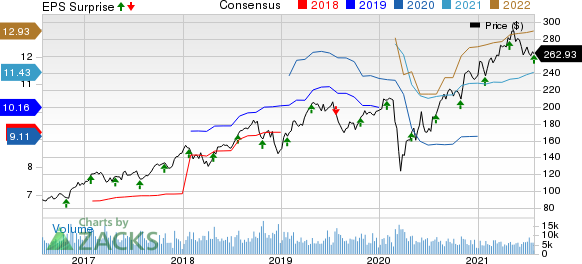

Norfolk Southern Corporation Price, Consensus and EPS Surprise

Norfolk Southern Corporation price-consensus-eps-surprise-chart | Norfolk Southern Corporation Quote

Segmental Performance

Coal revenues totaled $318 million, up 52% year over year. Coal volumes rose 55%. However, revenue per unit dipped 1% in the reported quarter.

Merchandise revenues jumped 29% year over year to $1,680 million. Volumes also increased 29% while revenue per unit was flat year over year.

Intermodal revenues augmented 41% year over year to $801 million. While segmental volumes rose 20%, revenue per unit ascended 17%.

Liquidity & Share Buyback

This Zacks Rank #3 (Hold) company exited the second quarter with cash and cash equivalents of $1,670 million compared with $1,115 million at the end of 2020. The company had long-term debt of $12,669 million at the end of the reported quarter compared with $12,102 million at December 2020-end.

During the first half of 2021, the company repurchased and retired 5.7 million and 3.9 million shares for $1.5 billion and $669 million, respectively.

Sectorial Snapshot

Let’s take a look at some of the other recently released earnings reports from companies within the Zacks Transportation sector.

Knight-Swift Transportation Holdings KNX, carrying a Zacks Rank #2 (Buy), reported second-quarter 2021 earnings (excluding 6 cents from non-recurring items) of 98 cents per share, surpassing the Zacks Consensus Estimate of 87 cents. Total revenues of $1,315.7 million also outperformed the Zacks Consensus Estimate of $1,300.8 million. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

United Parcel Service UPS, carrying a Zacks Rank #3, reported second-quarter 2021 earnings (excluding a penny from non-recurring items) of $3.06 per share, beating the Zacks Consensus Estimate of $2.75. Quarterly revenues of $23,424 million also outperformed the Zacks Consensus Estimate of $23,085.4 million.

Ryanair Holdings RYAAY, carrying a Zacks Rank #4 (Sell), incurred a loss of $1.46 per share in the first quarter of fiscal 2022 (ended Jun 30, 2021), narrower than the Zacks Consensus Estimate of a loss of $1.50. Quarterly revenues of $446.4 million fell short of the Zacks Consensus Estimate of $459 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

KnightSwift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance