Northfield Bancorp Inc (NFBK) Q1 2024 Earnings: Aligns with Analyst EPS Projections Amidst ...

Earnings Per Share (EPS): Reported at $0.15 for Q1 2024, meeting the analyst estimate of $0.15.

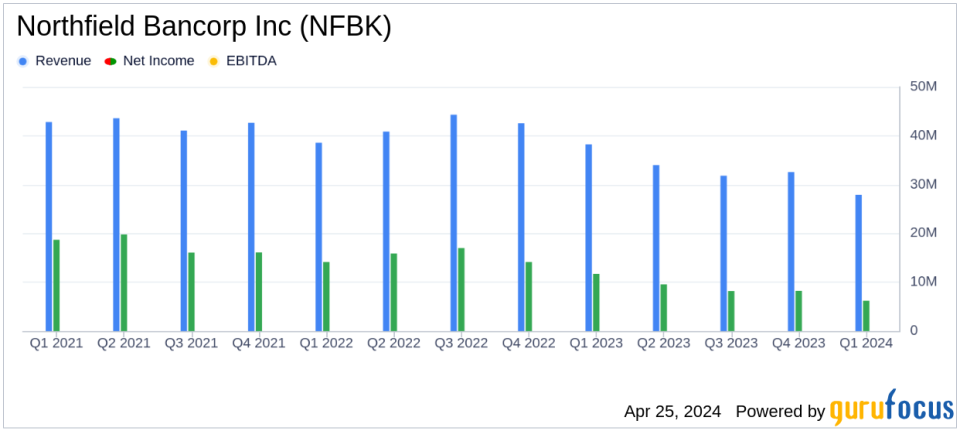

Net Income: Recorded at $6.2 million for Q1 2024, falling short of the estimated $6.60 million.

Revenue: Net interest income for Q1 2024 was $27.9 million, below the estimated revenue of $28.99 million.

Net Interest Margin: Decreased to 2.03% in Q1 2024 from 2.17% in the previous quarter, reflecting higher funding costs and lower loan balances.

Loan Portfolio: Total loan balances declined modestly, with a noted increase in commercial and industrial loans but decreases in other categories.

Dividends: Declared a cash dividend of $0.13 per share, payable on May 22, 2024.

Stock Repurchase: Repurchased 252,631 shares at a cost of $3.1 million and approved a new $5.0 million repurchase plan.

On April 24, 2024, Northfield Bancorp Inc (NASDAQ:NFBK), the holding company for Northfield Bank, disclosed its first quarter results for 2024 through its 8-K filing. The company reported a net income of $6.2 million, or $0.15 per diluted share, aligning with the analyst's estimated earnings per share but slightly below the estimated net income of $6.60 million. This performance marks a decrease from the $0.19 per diluted share in the previous quarter and $0.26 per diluted share from the first quarter of the previous year.

Company Overview

Northfield Bancorp Inc operates through its subsidiary, Northfield Bank, offering banking services to individuals and corporate customers primarily in New York and New Jersey. The bank focuses on attracting deposits and providing loans and other banking services, navigating through market challenges with a strategic approach to maintain a robust financial standing.

Financial Performance Insights

The reported decrease in net income was primarily driven by a $7.0 million drop in net interest income, which fell to $27.9 million. This decline reflects heightened funding costs and a decrease in loan balances, exacerbated by an inverted yield curve and elevated market interest rates. Despite these challenges, Northfield Bancorp managed to increase its total deposits by approximately $44 million, indicating strong deposit gathering efforts and customer trust.

Steven M. Klein, Chairman, President, and CEO of Northfield Bancorp, emphasized the company's strategic focus on managing loan portfolios and maintaining strong asset quality amidst significant market risks, including inflation and interest rate fluctuations. He highlighted the continuation of the bank's "Locally Grown" approach to community commercial banking.

Operational Challenges and Achievements

The first quarter saw a modest decline in loan balances, with increases in commercial and industrial loans offset by decreases in other categories. Despite these challenges, the bank's asset quality remains strong, with non-performing loans to total loans slightly increasing to 0.41% from 0.27% at the end of the previous quarter. This uptick is attributed to rises in commercial mortgage and commercial and industrial non-performing loans.

In response to the evolving financial landscape, Northfield Bancorp has also been proactive in shareholder returns, repurchasing 252,631 shares for $3.1 million and declaring a cash dividend of $0.13 per share of common stock, payable on May 22, 2024.

Analysis of Financial Statements

Further analysis reveals a decrease in net interest margin by 60 basis points to 2.03%, primarily due to the faster repricing of interest-bearing liabilities compared to interest-earning assets. Non-interest income remained stable at $3.4 million, with slight fluctuations in various income components. Non-interest expenses rose by $1.2 million, driven mainly by increases in employee compensation and benefits.

The balance sheet shows a healthy increase in total assets, up by $253.2 million to $5.85 billion, with significant growth in available-for-sale debt securities. This financial strengthening underscores Northfield Bancorp's strategic asset management and liquidity preservation amidst uncertain market conditions.

Conclusion

As Northfield Bancorp Inc navigates through a challenging economic environment, its first-quarter performance demonstrates a resilient operational strategy focused on asset quality and strategic growth. While facing headwinds from rising interest rates and market volatility, the bank's consistent focus on maintaining a strong capital base and liquidity position bodes well for its ability to manage future uncertainties.

For detailed insights and further information about Northfield Bancorp Inc's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Northfield Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance