Norwegian Cruise Line Holdings (NYSE:NCLH) Has Yet to Take Advantage of Positive Externalities

This article first appeared on Simply Wall St News.

Q3 expectations are negative.

The company has to find a way to take advantage of positive externalities

M&A activity looks unlikely

Over the last few years, Cruise operators like Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) could hardly catch a break as the world seemingly went from one crisis into another. With the travel sector recovering, the ongoing military conflict and problematic macroeconomic conditions resulted in yet another negative quarter.

While the stock rose on the news, this is likely more a result of external factors.

See our latest analysis for Norwegian Cruise Line Holdings

NCLH Second quarter 2022 results

US$1.22 loss per share (up from US$1.94 loss in 2Q 2021).

Revenue: US$1.19b (up US$1.18b from 2Q 2021).

Net loss: US$509.3m (loss narrowed 29% from 2Q 2021).

Revenue missed analyst estimates by 4.9%. Earnings per share (EPS) also missed analyst estimates by 31%.

Q3 Guideline

Occupancy: in the low 80% range

Total Revenue: US$1.5b-1.6b vs consensus US$1.85b

Interestingly, despite expected higher occupancy (from 65% in Q2 to 80% in Q3), the company is expecting a net loss in the ongoing quarter.

Over the last 3 years, on average, earnings per share have fallen by 57% per year, but the company’s share price has only decreased by 35% per year, which means it has not declined as severely as earnings.

The State of Norwegian Cruise Line Holdings' Net Debt?

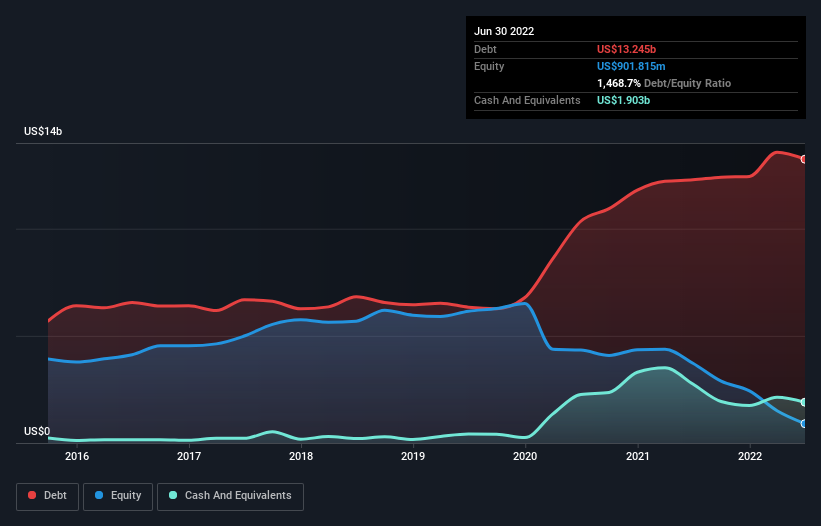

As you can see below, at the end of June 2022, Norwegian Cruise Line Holdings had US$13.2b of debt, up from US$12.3b a year ago. Click the image for more detail.

However, it also had US$1.90b in cash, so its net debt is US$11.3b.

Could Mergers and Acquisitions Save the Day?

We can see from the most recent balance sheet that Norwegian Cruise Line Holdings had liabilities of US$5.03b falling due within a year and liabilities of US$13.2b due beyond that. Offsetting these obligations, it had cash of US$1.90b and receivables valued at US$598.3m due within 12 months. So it has liabilities totaling US$15.7b more than its cash and near-term receivables combined.

The deficiency here weighs heavily on the US$5.80b company itself, so we'd watch its balance sheet closely. After all, Norwegian Cruise Line Holdings would likely require a significant re-capitalization if it had to pay its creditors today.

Naturally, investors could wonder if a merger or an acquisition could help somewhere down the road, but here is where we run into a problem. Its main competitors are, more or less, in the same position.

Carnival Corporation (NYSE: CCL) has a debt/equity ratio of 425% and about US$35.1b of debt.

Royal Caribbean Cruises (NYSE: RCL) has a ratio of 670% with around US$22.8b of debt.

Conclusion

Over the last 12 months, the company burned through around US$1.9b in cash. Although it has an additional US$2b left on the balance sheet, the fact that it expects a net loss in the quarter with 20% growing occupancy makes us worried.

While the entire sector rose after the latest CPI print indicated a potential peak of inflation, this is an external factor outside the company's control. Peaking inflation is positive in multiple ways as it lowers the likelihood of more interest rate hikes that could make the debt more expensive. It gives some peace of mind to consumers deciding whether to go on a cruise. Yet, the company has to find a way to take advantage of these developments.

The balance sheet is the obvious place to start when analyzing debt levels. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Norwegian Cruise Line Holdings you should be aware of.

If you'd instead focus on companies free from net debt, you can access our special list of such companies (all with a track record of profit growth).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance