Norwegian Cruise (NCLH) Q3 Earnings & Revenues Beat Estimates

Norwegian Cruise Line Holdings Ltd. NCLH has reported better-than-expected results in the third quarter of 2019. The company’s earnings and revenues surpassed the Zacks Consensus Estimate for the third straight quarter. The quarterly results were aided by strong demand and a record booking trend.

Earnings & Revenue Discussion

Adjusted earnings of $2.23 per share surpassed the Zacks Consensus Estimate of $2.15. However, the bottom line declined 1.8% from the year-ago quarter’s reported figure.

Revenues amounted to $1,913.9 million in the third quarter, surpassing the consensus mark of $1,902 million and increasing 3% year over year. Revenues were driven by an increase of 2.9% in passenger ticket revenues as well as 3.1% rise in onboard and other revenues.

Strong onboard spending had a positive impact on the quarter’s revenues as well. Moreover, an increase in net yield, driven by the repositioning of Norwegian Joy to North America, boosted revenues.

Gross yield (total revenues per Capacity Day) rose 4.8% in the quarter on a year-over-year basis. On a constant-currency (cc) basis, net yield rose 3.9% in the third quarter of 2019.

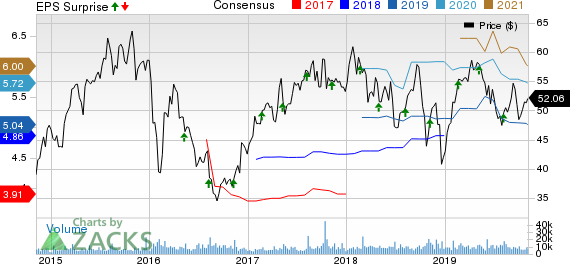

Norwegian Cruise Line Holdings Ltd. Price, Consensus and EPS Surprise

Expenses & Operating Results

Total cruise operating expenses rose 6.7% in the quarter under review from the year-ago quarter’s level. The increase can be attributed to redeployment of Norwegian Joy as well as rise direct costs owing to air promotions.

Gross cruise costs per capacity day rose 8.9%. Adjusted Net cruise costs (excluding fuel) per Capacity Day grew 11% at cc and 10.2% on a reported basis. Fuel price per metric ton (net of hedges) was down 1.2% to $504 in the quarter under review.

Net interest expenses were $60.2 million in the third quarter, down from $69.5 million in the year-ago quarter.

Balance Sheet

Cash and cash equivalents as of Sep 30, 2019, were $407.3 million, up from $163.9 million as of Dec 31, 2018. Long-term debt at the end of the third quarter totaled $5.7 billion, lower than $5.8 billion at the end of 2018.

Q4 Guidance

For the fourth quarter of 2019, Norwegian Cruise expects adjusted earnings to be approximately 69 cents.

Net yield is expected to be flat at cc. The company expects net cruise costs (excluding Fuel per Capacity Day) to be roughly 2.25% at cc.

2019 Outlook

For 2019, Norwegian Cruise expects adjusted earnings per share of approximately $5.05 compared with previous guidance of $5.00-$5.10. The Zacks Consensus Estimate for 2019 earnings is at $5.04.

Net yield is expected to be 3% compared with Norwegian Cruise’s prior guidance of 2.6%. Meanwhile adjusted net cruise costs are anticipated to be nearly 5.75% at cc, higher than previous expectation of 4.5%.

Zacks Rank & Stock to Consider

Norwegian Cruise, which share space with Royal Caribbean Cruises Ltd RCL, currently has a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the same space include WW International, Inc WW and Twin River Worldwide Holdings, Inc TRWH. Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

WW International has an impressive long-term earnings growth rate of 15%.

Shares of Twin River Worldwide Holdings have gained 11.8% in the past month.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Click to get this free report Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report WW International, Inc. (WW) : Free Stock Analysis Report Twin River Worldwide Holdings, Inc. (TRWH) : Free Stock Analysis Report To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance