Norwegian oil major denies takeover plot as it grows stake in Faroe Petroleum

The Norwegian oil major eager for a piece of North Sea oil firm Faroe Petroleum has grown its share to within a breath of a controlling stake while denying plans for an outright takeover.

Det Norske Oljeselskap (DNO) was forced to publicly quash speculation that it would swallow the Aberdeen-based firm after yesterday’s deal to buy a 15.37pc share in the company from Israel’s Delek for £7m.

But this morning it emerged that DNO had also approached Faroe’s existing shareholders to buy a further 10pc of the company at the same price of 125p a share. It also snapped up a further 2.32pc of the company’s outstanding shares for the same price.

The hefty 27.68pc combined stake in the oil explorer falls narrowly shy of the 30pc threshold at which DNO would be forced to make a takeover offer under the rules of the UK’s takeover code.

DNO has denied an interest in acquiring Faroe and said the “long-term strategic shareholding” will be used to “support Faroe Petroleum management's growth focused North Sea strategy”.

In response Faroe’s management has said the price paid by DNO “substantially undervalues the company and its prospects”.

Faroe revealed on Wednesday a better than expected gas discovery at two fields - Hades and Iris - in the Norwegian North Sea where DNO hopes to rebuild its presence after a six year hiatus.

The oil major, which has focused on the troubled Kurdistan oil region, has already acquired Origo Exploration as part of its return to the basin and analysts have suggested its play for Faroe may have secured a relatively cheap foundation on which to base a future deal.

Oil market commentator Malcolm Graham-Wood said DNO has “secured base camp very much on the cheap”.

“Faroe is one of the sector's finest explorers and has a track record second to none, ironically showed by yesterday’s discoveries at Hades and Iris,” he said.

The Aim-listed minnow owns a 20pc stake in the pair of gas fields, alongside European oil majors OMV and Norway’s Statoil, which revealed better than expected gas reserves after drilling to depths of more than two miles.

Faroe boss Graham Stewart said it was “extremely gratifying” to unearth the findings which confirm the group’s “consistent and industry-leading exploration track record”.

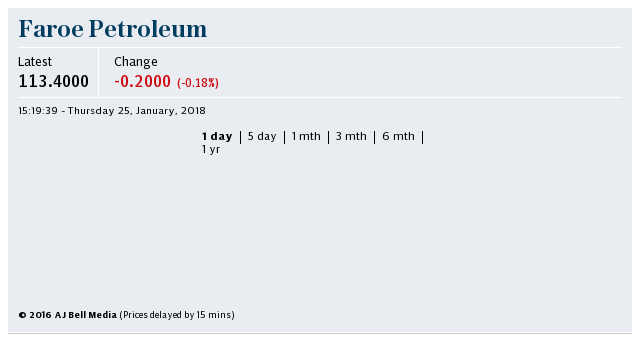

The company's share price has climbed for a second day to just below 122p a share, its highest price since before the global oil market downturn in late 2014.

Yahoo Finance

Yahoo Finance