The Notebook: How bank spying powers are being snuck into government bills

Where the City’s brightest thinkers get a few things off their chest. Today, Silkie Carlo, director of Big Brother Watch, takes the Notebook pen to talk about how spying powers are being edged into law

Bank spying powers

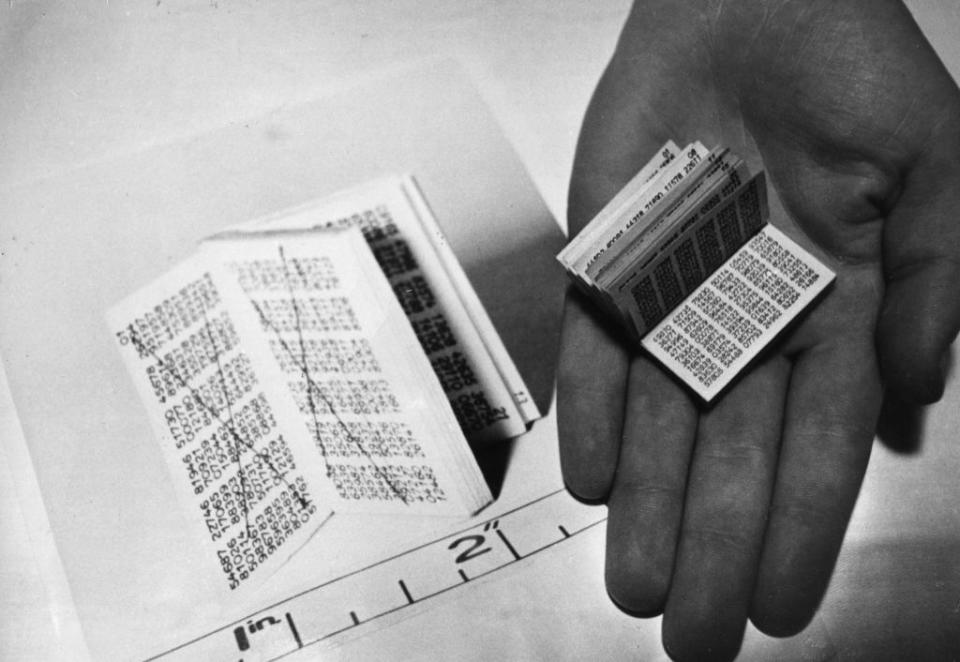

Soon, your bank could be spying on you. Unprecedented bank spying powers have been quietly edged into a little-known bill, the Data Protection and Digital Information Bill, which will be debated today in the House of Lords.

Doing away with Britain’s strong tradition of financial privacy, and even stronger principle of the presumption of innocence, the Department for Work and Pensions is taking a ‘surveillance first’ approach and forcing banks to monitor all accounts to find those connected to welfare payments – from people receiving the state pension, to landlords of housing benefit claimants – and check their banks accounts for signs of potential fraud or error.

The state already has powers to investigate fraud suspects – and questions have rightly been raised about whether more could be done to recoup the billions lost to Covid-related fraud, rather than creating a financial mass surveillance system that has all the ingredients of a Horizon-style scandal on steroids.

On DWP’s own estimates, this mass bank surveillance plan can only recoup up to three per cent of the public money lost to welfare fraud. But what these eye-watering powers would do very effectively is set a precedent whereby our bank accounts are no longer private spaces, but rather digital records to be constantly monitored for the state’s policy aims. It is a matter of time before other government departments ask for a peek into our accounts too.

The bank spying powers face a huge challenge from parliamentary heavyweights though – digital rights champion Baroness Kidron, former government surveillance law reviewer David Anderson KC, other eminent lawyers and liberal Tory MPs are urging the government to take the plans back to the drawing board. Watch this space.

Snooping powers for ministers

Talking of state spying, another rushed bill is before parliament today that will vastly increase the UK agencies’ internet surveillance, harvesting of mass datasets of personal information – and that even allows ministers to spy on MPs.

The Investigatory Powers (Amendment) Bill, which will be debated in the Commons today, expands the May government’s ‘Snooper’s Charter’ passed in 2016. In that Act, the government created powers for the Prime Minister to authorise the surveillance of parliamentarians, in what MPs were assured would be very exceptional circumstances. However, the government now says that other ministers should have the power to snoop on MPs in case the Prime Minister is unavailable.

Interestingly, the government is making its case by drawing reference to the hospitalisation of Boris Johnson, prompting some to ponder, which MPs were spied on during the pandemic? Just how exceptional are these powers? Civil libertarian David Davis MP is pushing an amendment today for MPs to find out.

Britcoin or spycoin?

Financial privacy is under threat like never before in the digital age – in no small part thanks to governments around the world realising the extraordinary surveillance potential of Central Bank Digital Currencies (CBDCs).

The Bank of England and HM Treasury are working on plans for a ‘Britcoin’, whilst all BRIC states are now piloting CBDCs. Not one retail CBDC pilot has yet been successful though.

Anonymous, private, low threshold ‘eCash’ could have a future – but Western countries like Britain won’t accept anything that looks like a ‘spycoin’.

My recommendation: office dogs

Research shows that dog-friendly workplaces increase employee commitment, career satisfaction and return-to-office rates. What’s not to like?

In my office, my jack-chi Alfie occupied the role of CMO (chief morale officer). Daily, he welcomed everyone who walked into the office and visited desks for treats in the afternoons, forcing a five minute break from the dullness of screens for the joy of his affection – and he had an instinct for when it was most needed.

My beloved boy passed away aged 15 last week – our team went to his favourite pub by the office to celebrate his life. My Greek rescue dog, Queenie, has since been doing an excellent job of CMO. She learnt from the best.

Yahoo Finance

Yahoo Finance