Novavax (NVAX) to Report Q1 Earnings: What's in the Cards?

We expect investors to focus on the pipeline when Novavax, Inc. NVAX reports first-quarter 2023 results.

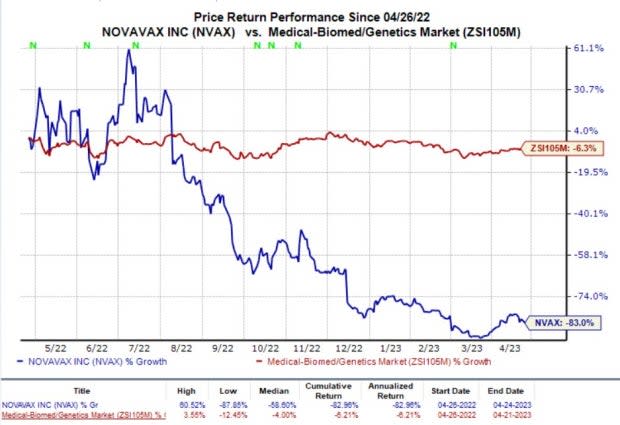

In the past year, shares of Novavax have plummeted 83% compared with the industry’s 6.3% decline.

Image Source: Zacks Investment Research

NVAX’s surprise record has been dismal so far, as its earnings missed expectations in each of the last four quarters. It has a trailing four-quarter negative earnings surprise of 146.69%, on average. In the last reported quarter, Novavax’s earnings missed estimates by 147.83%.

Let’s see how things have shaped up for the quarter to be reported.

Factors to Note

Novavax generates all its product revenues from the sale of its protein-based COVID-19 vaccine. The protein-based COVID-19 vaccine gained authorization for use as a primary two-dose regimen in more than 40 countries, including the United States and European countries. The vaccine has also been authorized in many of these markets for use as a third/booster dose.

However, on the last earnings call, Novavax reported that it has been witnessing an emerging seasonality in the demand for COVID-19 vaccines globally. The COVID-19 market has been evolving and stabilizing during the transition from the pandemic to the endemic phase. Due to this, the company does not anticipate any new vaccine sales for the first quarter of 2023. Thus, our estimate for Novavax’s first-quarter 2023 revenues is pegged at $0.

Novavax is advancing the clinical development of its Omicron-based COVID vaccine. The company reported that part II of its phase III study on the COVID-19 Omicron BA.1 vaccine candidate will evaluate the candidate vaccine compared with an Omicron BA.5 vaccine as well as a bivalent containing prototype and Omicron BA.5 vaccine. The study is expected to be completed in July 2023.

In February 2023, the company also announced reaching a modified agreement with the U.S. government for up to 1.5 million additional doses of Nuvaxovid for delivery in 2023. The company shared its intent to deliver updated mono- or bivalent-strain vaccine for the 2023 fall vaccination season, which is consistent with public health recommendations. An update regarding the strain selection for the same is expected on the upcoming earnings call. Novovax also reported the European Medicines Agency and FDA approvals of Nuvaxovid five-dose vial variation.

We also expect management to provide an update on Novavax’s other pipeline candidates.

NVAX has been evaluating a COVID-19-influenza combination (CIC) vaccine candidate in a phase II study in older adults (50-80 years), initiated in December 2022. The CIC vaccine is a combination of NVX-CoV2373 and the influenza vaccine in a single formulation. Management plans to announce initial data from the phase II study in mid-2023. Based on this data, Novavax will decide whether to advance the CIC vaccine to late-stage development.

Novavax is also developing ResVax for the prevention of Respiratory syncytial virus disease in infants via maternal immunization for children between 2-6 years old and older adults in separate studies in different stages. The company also completed its phase III study evaluating NanoFlu, a recombinant quadrivalent seasonal influenza vaccine candidate with Matrix-M adjuvant, in 2020. The study achieved its primary endpoints as well as statistically significant key secondary endpoints.

Updates on ResVax and NanoFlu are also expected on the forthcoming earnings call.

Combined SG&A and R&D expense in first-quarter 2023 is expected to be $370 million or less, per the company’s operating expenses guidance on the last earnings call.

Earnings Whispers

Our proven model does not predict an earnings beat for Novavax this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Novavax’s Earnings ESP is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are at a loss of $3.04 per share.

Zacks Rank: Novavax currently carries a Zacks Rank #3.

Novavax, Inc. Price, Consensus and EPS Surprise

Novavax, Inc. price-consensus-eps-surprise-chart | Novavax, Inc. Quote

Stocks to Consider

Here are some stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this time around.

ADMA Biologics ADMA has an Earnings ESP of +20% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

ADMA’s stock has risen 79.2% in the past year. ADMA beat earnings estimates in three of the last four quarters while missing the mark on one occasion. ADMA has an earnings surprise of 2.88%, on average.

Akero Therapeutics AKRO currently has an Earnings ESP of +6.45% and a Zacks Rank #2.

Akero’s stock has shot up 343.4% in the past year. Akero beat earnings estimates in three of the last four quarters while missing the mark on one occasion. AKRO has an earnings surprise of 8.38%, on average.

Allakos ALLK has an Earnings ESP of +14.63% and a Zacks Rank #3 at present.

Allakos’ stock has risen 16.6% in the past year. Allakos beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions. ALLK has a negative earnings surprise of 17.81%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novavax, Inc. (NVAX) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Allakos Inc. (ALLK) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance