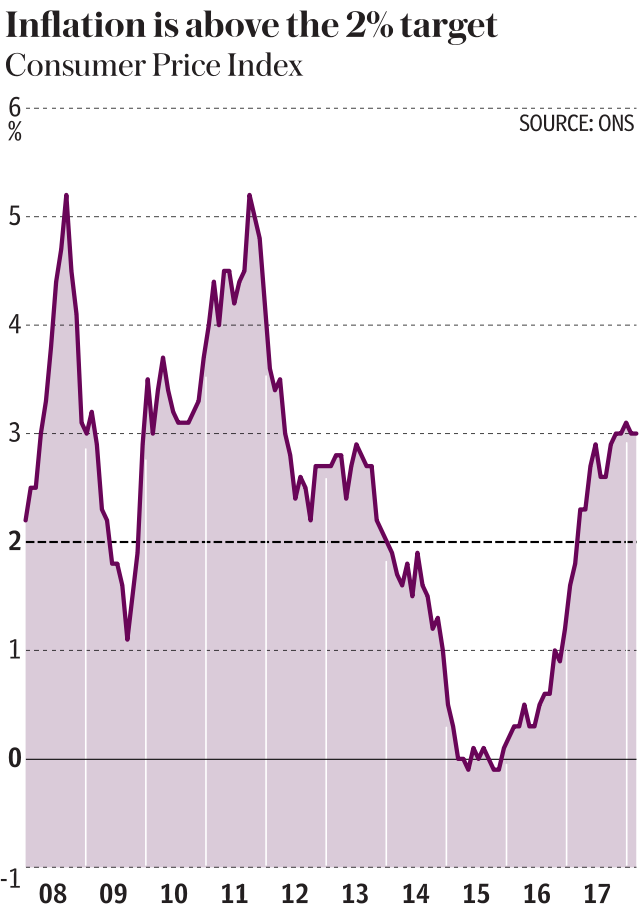

Now the sterling effect is fading, inflation is a warning sign

Inflation should be on its way down. The fall in the pound through 2016 forced up the price of imports and sent prices spiralling. Most of that should have passed through the supply chain by now, allowing inflation to fall.

Yet inflation stayed stubbornly high at 3pc in January, rather than falling a touch as economists had forecast.

There are several forces at play in the domestic and global economies pushing prices in different directions.

One is that the economy is growing more strongly than expected. COmbined with low unemployment, wages edging up and productivity growth remaining miserable, this may start to push upwards on inflation.

The latest price numbers contain hints this is already happening.

Which of these forces will win out? And will the squeeze on our wallets end any time soon?

Food and fuel

Two critical components of British families’ weekly spend - food and fuel costs - do seem to be slowing down.

These prices are influenced by the exchange rate as large portions of each are imported.

Food prices rose by 4pc over the past year, contributing to the above-target level of inflation. But this is also the second consecutive monthly fall in inflation, so appears to be moving in the right direction.

Some heavily imported foods saw particularly sharp falls in price rises - rice price inflation, for instance, slowed from 6.8pc in December to 2.3pc in January.

Petrol inflation fell to 2pc, down from 4.6pc in December and from a high of 18.5pc last February.

This is not the end of the story, however - the pound's movements do not determine these costs in isolation.

Global commodities markets

The global economy is surging ahead, and that typically pushes commodities prices up.

Demand rises, manufacturers and industrial companies need more raw materials, and so the costs increase.

Currently that is most obvious in the oil market as OPEC, the old cartel which lacks its traditional power but retains some market clout, is keen to restrict supply to boost prices.

This may not pass through entirely to British inflation - the pound has risen against the dollar in recent months, and most commodities are traded in US dollars, so the edge has been taken off the rise in costs.

Nonetheless, Britain’s economy is not immune from these global forces and so petrol prices and other costs linked to oil could rise further in the months to come.

Goods vs services

Goods costs are important for calculating the cost of living, but services are almost as big a component of a typical household’s spending. The Office for National Statistics weights it as roughly 52pc of expenditure going to goods and 48pc to services.

Goods inflation is coming down - the annual inflation rate slipped to 3.2pc in January - but services costs are accelerating, rising from 2.5pc in December to 2.8pc last month.

This reflects a shift in the factors affecting prices, as the effect of currency movements on solid, tangible, physical imports fades, and services pressures increase.

Those include catering, where inflation edged up to 3.1pc, transport services where it hit 5.2pc, and recreational services including zoos where inflation shot up to 5.1pc.

In some senses, this is positive.

A particularly important part of services costs is labour, and if wages increase then so does the cost of providing those services.

Pay growth has been weak for several years so signs this is picking up may herald a much-needed rise in living standards.

Top Bank of England policymaker Gertjan Vlieghe said this week he is spotting increasing signs of rising wages, helped along in large part by very low levels of unemployment which force companies to pay more to find workers and then to keep them.

However, there is also a negative aspect. If workers were becoming more productive, then companies could pay them more without increasing the cost of the services sold - their staff would be able to serve more customers over the same time period, spreading the cost across more sales.

But if productivity is not rising and wages are rising because of a shortage of workers, then customers do have to shell out more, hitting their living standards.

This is the sort of ‘bad inflation’ which officials including Mr Vlieghe want to avoid.

Higher interest rates

The result may well be higher interest rates.

Mark Carney, the Governor of the Bank of England, has warned as much.

Productivity is expected to grow at around half its historic pace, he said last week.

“That means this economy cannot grow as fast as it used to be able to, without generating inflationary pressures, until that productivity puzzle is solved and unwound, and we have to deal with the consequences of that,” the Governor said.

“The speed limit of the economy has changed. It’s lower, and we expect that the economy will grow a bit faster than that, and start to generate some of those domestic pressures on inflation.”

That means interest rates will have to go up, too.

One effect of higher rates is to reduce households’ spending power, pushing up the cost of mortgages and the price of consumer debt, and encouraging saving with better returns on bank accounts.

That would extract some of the “excess demand” from the economy, keeping a lid on inflation but also making the economy stick to this lower speed limit.

When higher inflation comes from domestic pressures - from good factors such as low unemployment, and bad ones including low productivity - then the economy may be overheating.

Wage growth may be long overdue but it is not always an unmitigated positive.

Inflation can be a warning sign, and it is one to watch like a hawk this year.

Yahoo Finance

Yahoo Finance