Is Now The Time To Put finnCap Group (LON:FCAP) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like finnCap Group (LON:FCAP). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for finnCap Group

How Fast Is finnCap Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud finnCap Group's stratospheric annual EPS growth of 38%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

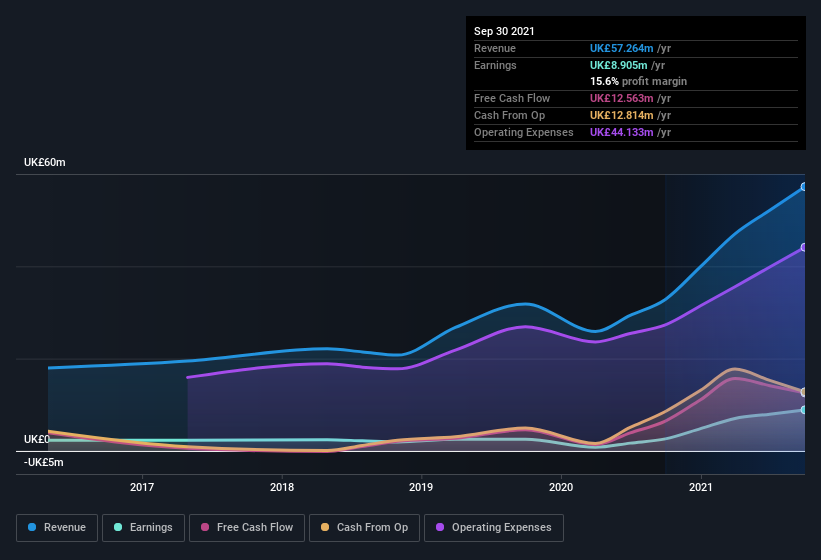

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. finnCap Group maintained stable EBIT margins over the last year, all while growing revenue 74% to UK£57m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since finnCap Group is no giant, with a market capitalization of UK£56m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are finnCap Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did finnCap Group insiders refrain from selling stock during the year, but they also spent UK£60k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. We also note that it was the Group CEO & Director, Samantha Smith, who made the biggest single acquisition, paying UK£40k for shares at about UK£0.30 each.

On top of the insider buying, we can also see that finnCap Group insiders own a large chunk of the company. In fact, they own 57% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about UK£32m riding on the stock, at current prices. That's nothing to sneeze at!

Should You Add finnCap Group To Your Watchlist?

finnCap Group's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest finnCap Group belongs on the top of your watchlist. It is worth noting though that we have found 3 warning signs for finnCap Group that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of finnCap Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance