Is Now The Time To Put Queen's Road Capital Investment (CVE:QRC) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Queen's Road Capital Investment (CVE:QRC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Queen's Road Capital Investment

How Fast Is Queen's Road Capital Investment Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Queen's Road Capital Investment's EPS went from US$0.03 to US$0.23 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

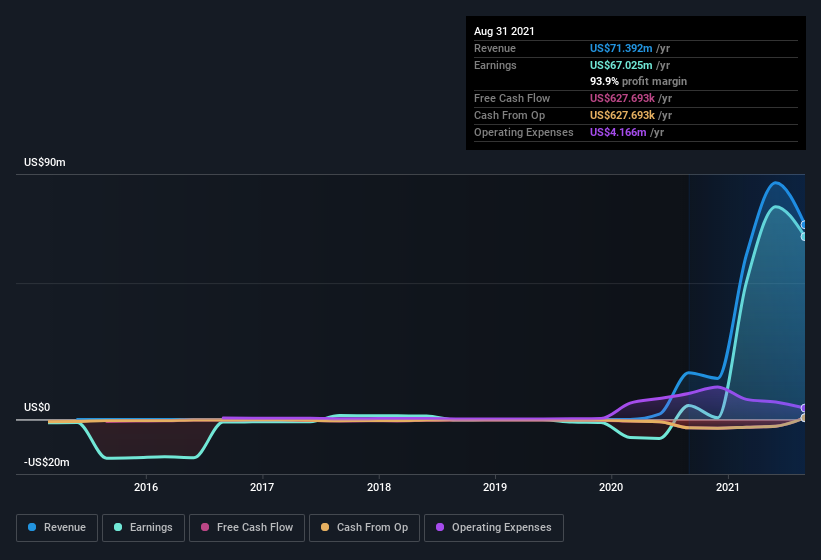

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Queen's Road Capital Investment's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that Queen's Road Capital Investment is growing revenues, and EBIT margins improved by 49.8 percentage points to 94%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Queen's Road Capital Investment isn't a huge company, given its market capitalization of CA$226m. That makes it extra important to check on its balance sheet strength.

Are Queen's Road Capital Investment Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Queen's Road Capital Investment insiders walking the walk, by spending US$391k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the , Jack Cowin, who made the biggest single acquisition, paying CA$143k for shares at about CA$0.63 each.

On top of the insider buying, we can also see that Queen's Road Capital Investment insiders own a large chunk of the company. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about US$112m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Warren Philip Gilman, is paid less than the median for similar sized companies. For companies with market capitalizations between US$100m and US$400m, like Queen's Road Capital Investment, the median CEO pay is around US$479k.

The Queen's Road Capital Investment CEO received US$316k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Queen's Road Capital Investment Worth Keeping An Eye On?

Queen's Road Capital Investment's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Queen's Road Capital Investment deserves timely attention. Even so, be aware that Queen's Road Capital Investment is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

The good news is that Queen's Road Capital Investment is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance