We are now witnessing Elon Musk’s slow-motion disruption of the global auto industry

In 2007, Nokia was the biggest and most fashionable name in cell phones, with an unassailable lead in hand-held technology. Things had been so good for so long that company executives saw little chance for any competitive challenge–phones were a tough business, they said, and Nokia was reaping the harvest of decades of hard work that no one else could hope to match.

That June, Steve Jobs introduced the iPhone. And seven years later, Nokia—worth a quarter of a trillion dollars at its apex—abjectly sold off its much-diminished phone division to Microsoft. The price was $7 billion, less than 3% of its former value.

Apple hasn’t introduced as revolutionary a product since, to the relief of incumbent players in all kinds of sectors. But Elon Musk, whose acumen and showmanship get him frequently compared with Jobs, has worked eagerly to fill the void.

On March 31, his Tesla Motors unveiled its long-promised Model 3, a $35,000 electric car that will go 215 miles per charge. The market response suggests to some the potential as a category killer, not just in electric vehicles, but mainstream cars in general: in the week since, more than 325,000 Model 3s have been pre-ordered by people putting down $1,000 per reservation, the company said April 7.

Even deep Tesla skeptics call this demand unprecedented. There simply may be no example of a new car attracting as much interest in more than a century of automative history. Veteran auto analyst Bertel Schmidt says the closest comparison would be the 1955 Citroen DS (below), which was pre-ordered by 12,000 motorists on launch day. Wall Street has responded by sending Tesla’s share price up by about 12% since the Model 3’s debut.

So are we witnessing Nokia redux?

It’s natural to ask whether we are observing an iPhone moment, the release of a blockbuster product that reconfigures the commercial landscape and transforms society. And, if we are, whether Tesla’s rivals face possible Nokiafication–a savage commercial blow in the face of a missed technological advance. (With a blog post today titled, “The Week that Electric Vehicles Went Mainstream,” Tesla seems to suggest the answer is yes.)

If traditional automakers fear obsolescence, they aren’t showing it. “While we applaud and welcome any new competitors to market, BMW remains focused on delivering the most innovative, efficient and technologically advanced vehicles to our customers,” BMW spokeswoman Rebecca Kiehne told Quartz.

“We’ll react to the competition,” says Tim Grewe, General Motors’ lead manager for electrification. “But our master plan hasn’t changed.”

Such resolve, typical of people you talk to at the major car companies these days, is perhaps a sign of strength, a byproduct of confidence in the new electrics now in the pipeline, and ultimately skepticism that Musk will get much beyond the fringes of the worldwide automotive market.

Or it could be a sign of complacency, a Nokia-like assumption that the moat is simply too wide for any new rival to traverse.

“I definitely think that the auto industry has been surprised by the success of the [Model 3] pre-orders,” says Sam Jaffe, an analyst with Cairn Energy Research. “But I doubt that they will do anything in reaction to it. The whole concept of pre-ordering is so foreign to the car industry that they will probably willfully ignore it.”

But if there is one area in which Musk is objectively behind, it’s the speed with which mid-priced electrics will come to market. GM’s Chevy Bolt, for example—also priced at about $35,000, with a range exceeding 200 miles on a charge—will be in showrooms by the end of this year, the company says; Tesla customers won’t get their hands on a Model 3 until the end of 2017 at the earliest, and possibly not until 2019.

Grewe says that GM’s plant in Orion, Michigan is “ready to go now. We have no hurdles. We are ready for high-volume production. You can go buy the Bolt.”

Left unsaid but implied was that Musk is not quite so prepared. The question is whether he can catch up.

There is plenty of room for Musk to fall flat on his face

Tony Posawatz, who was part of the GM management team that developed the company’s plug-in hybrid Volt, argues that the onus of Tesla’s thick order book is not on its major rivals, but on Tesla itself.

Posawatz, now a private consultant, points out that Musk has been late—seriously late—delivering all three current Tesla models. When he finally delivered the Model X crossover in September 2015, it was three and a half years after the promised date.

In addition, some Teslas produced to date have had quality issues. In October, Consumer Reports removed the Model S from its recommended list because of complaints including “squeaks, rattles and leaks,” not to mention problematic motors and breaks. Tesla largely repaired these flaws for free, and the company’s image hasn’t noticeably suffered.

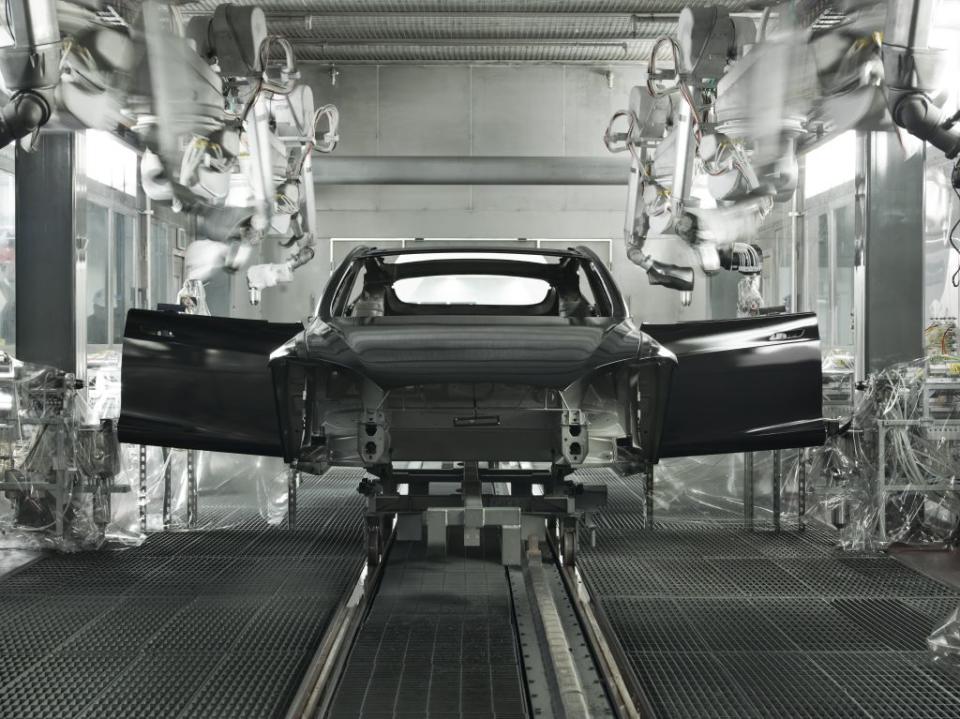

Musk’s challenge with the Model 3 isn’t just that he has ground to make up in terms of reliability, but that he again is starting from scratch: The Model 3 is derivative of no prior model; Musk must create entirely new assembly lines for the car in Tesla’s Fremont, California, factory (pictured above). The Model 3 battery, too, will be new. The place where it will be made–Musk’s vaunted Gigafactory, the gigantic lithium-ion battery plant he is building outside Reno, Nevada–“has yet to make a single cell,” Posawatz says.

Finally, it’s not as though Tesla’s rivals are standing still. In addition to GM’s Chevy Bolt, Nissan will produce a second-generation Leaf with the same 200-mile range and approximately $35,000 price; it will come in 2017. Before that, Toyota will deliver its Prius Prime, a plug-in hybrid; and BMW already has its pure electric i3. The other major carmakers are piling in as well by the end of the decade.

The hoopla in response to these vehicles may never approach that generated by the Model 3. But every time another electric shows up on the scene, Musk risks losing customers to the incumbents—and has less wiggle room to miss his own delivery deadlines.

But this is the kind of trouble that you want

Musk has his challenge laid out for him—really tough, no question about it. But, if you’re in the car business, or any business really, this is the sort of problem that you want, versus one of lackluster demand, which is what has plagued rivals since electrics came onto the market six years ago. In terms of whether Musk is up to it, remember, this is the man who over the last decade has single-handedly validated both electric cars and private commercial space travel.

Manufacturing experts might argue—with good reason—that making 325,000 identically reliable, $35,000 automobiles on deadline is harder than putting a commercial rocket into space and bringing it home. But it is not as though Musk has spent the last decade in an ivory tower.

And if you forget about 2017—which arguably was never a realistic deadline—and instead look to 2019, Musk has three years to make good on the Model 3’s promise. If he delivers, both literally and figuratively, then he will create the transformational moment he has sought, both for Tesla and the industry as a whole. In other words, he does have a chance to catch up.

At this point, Musk has already said that he is recontemplating his production plans. To fund the necessary manufacturing buildout, he is also probably talking with advisers about raising a lot of new capital. Barclays’ Brian Johnson reckons that Musk will sell $3 billion in new shares, and that seems a reasonable estimate.

So what we seem likely to be watching now is Tesla in a cool, cash-raising frenzy, and an incumbent industry on a risky precipice. In the middle of it all is Musk, aiming not necessarily for a Nokia moment for his rivals—though that could happen, he actually wants them to succeed—but most certainly aiming for an iPhone moment for himself.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz:

Yahoo Finance

Yahoo Finance