Number of homebuyers aged 18-35 drops 21pc as Millennials continue to be squeezed out of property market

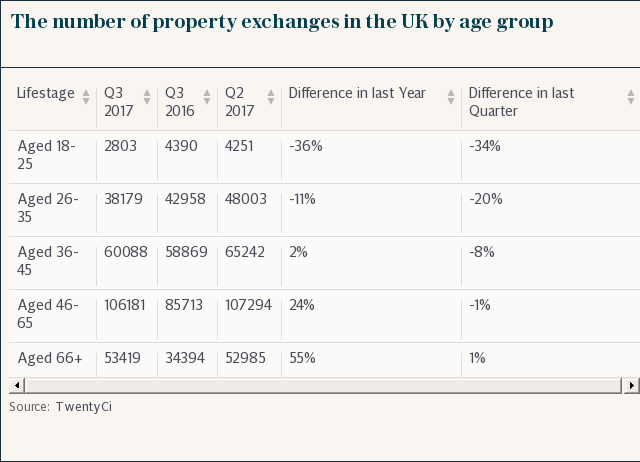

The so-called silver economy appears to be the driving force behind growth in the UK housing market, with those aged 66 and over the only age group to see an increase in the number of property exchanges over the past quarter.

Although the period between April and June has seen 17,000 (6.2pc) fewer home moves overall, there were 1pc more homemovers aged 66 and over compared to the previous quarter, and 55pc more than during the same period last year.

By comparison, the number of homemovers in all other age brackets has fallen over the past three months, with those in the 18-25 and 26-35 age groups seeing the biggest drops.

Overall, the number of homebuyers aged 18-35 has fallen by 21.6pc over the past quarter, and 13.4pc year-on-year, according to a report by analysts TwentyCi.

Reader service: Get mortgage advice with The Telegraph's Money Comparison Service, in association with London & Country

"As the rise of the more affluent and older homeowner continues, we are seeing real evidence of the Millennial squeeze," said Colin Bradshaw, chief customer officer at TwentyCI.

The report also found that growth is being driven by the top end of the market, with an increase in buyers in higher income brackets. There has been a significant jump this quarter for sales of properties over £750,000, figures show.

The data underscores the difficulties faced by young people wanting to get onto the property ladder. House prices are so inflated, particularly in London, that the Bank of Mum and Dad now helps fund 26pc of all property transactions in the UK, providing deposits for more than 298,000 mortgages in 2016.

That means the Bank of Mum and Dad has become the equivalent of the ninth-biggest mortgage lender in the UK, making it bigger than Clydesdale Bank in the mortgage market.

The average age of a first-time buyer in the UK is now 30, rising to 34 in London.

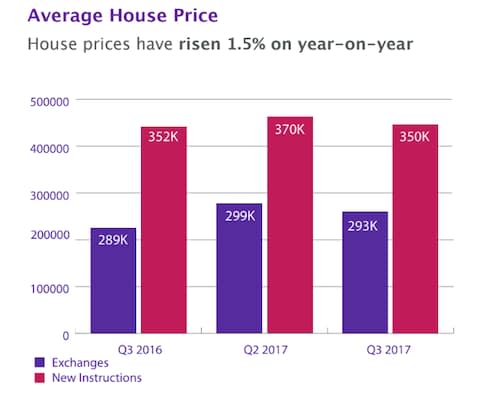

TwentyCi's data also revealed that the UK property market is showing signs of stabilising. Despite the slowdown in London having a negative impact on average house prices across the UK, overall prices are up by 1.5pc compared to the same quarter last year, and exchanges are up by 15.2pc year-on-year, suggesting that the unpredictable market that emerged in the wake of the Brexit vote is starting to calm down.

Mr Bradshaw added: “Last year’s volatile market is starting to subside as people begin to experience ‘Brexit fatigue’ and are getting on with their lives.

"The drop in house prices compared to the previous quarter is likely to be due in part to the slowing economy, and concerns about the potential rise of interest rates on top of the usual summer slowdown.”

Yahoo Finance

Yahoo Finance