Nurix Therapeutics Inc (NRIX) Misses Earnings Predictions But Shows Revenue Growth in Q1 Fiscal 2024

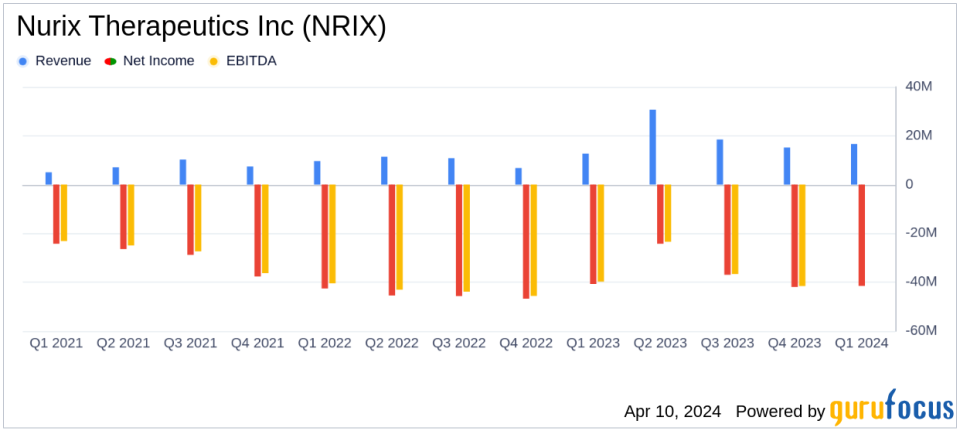

Revenue: $16.6 million, up from $12.7 million in the same quarter last year, surpassing analyst estimates of $17.2288 million.

Net Loss: $41.5 million, or ($0.76) per share, slightly missing analyst estimates of a net loss of $46.6215 million and an EPS of -$0.831.

Research and Development Expenses: Increased to $50.0 million from $45.8 million year-over-year.

General and Administrative Expenses: Rose to $11.8 million from $9.8 million in the previous year.

Cash Position: $254.3 million in cash, cash equivalents, and marketable securities as of February 29, 2024.

Nurix Therapeutics Inc (NASDAQ:NRIX), a clinical-stage biopharmaceutical company, released its 8-K filing on April 10, 2024, reporting financial results for the first quarter ended February 29, 2024. The company has made significant strides in its collaborations and clinical programs, despite reporting a net loss that was slightly better than analyst expectations.

Nurix Therapeutics Inc is at the forefront of developing oral, small molecule therapies for cancer and immune disorders. Its innovative approach to modulating cellular protein levels through targeted protein degraders and E3 ligase inhibitors has positioned it as a leader in the biotechnology industry. The company's pipeline includes promising candidates like NX-2127 for B-cell malignancies and NX-1607 for immuno-oncology indications.

Financial Performance and Strategic Collaborations

The company's revenue for the quarter was $16.6 million, a notable increase from the $12.7 million reported in the same quarter of the previous year. This rise was primarily attributed to the recognition of revenue from a collaboration with Pfizer and the progression of performance obligations related to the collaboration with Sanofi. The company also achieved a $2.0 million research milestone under its collaboration with Sanofi.

Research and development expenses rose to $50.0 million, up from $45.8 million, driven by increased clinical and contract manufacturing costs as Nurix advances its clinical trial programs. General and administrative expenses also saw an uptick to $11.8 million, mainly due to higher stock-based compensation and professional service costs.

The net loss for the quarter was $41.5 million, or ($0.76) per share, which is a slight increase from the net loss of $40.7 million, or ($0.75) per share, in the previous year. This loss reflects the company's ongoing investment in its clinical pipeline and research efforts.

Operational Highlights and Future Prospects

Nurix's recent business highlights include extending strategic collaborations with Gilead Sciences and Sanofi, both of which underline the potential of Nurix's platform. The company presented new clinical data for NX-5948, showcasing meaningful responses in patients with CNS lymphoma and CLL with CNS involvement. Additionally, Nurix's involvement in the Cancer Grand Challenges competition as part of a team working on pediatric cancer treatments demonstrates its commitment to addressing critical unmet medical needs.

Looking ahead, Nurix anticipates several milestones, including the presentation of additional clinical data for NX-5948, the reinitiation of enrollment for NX-2127, and the presentation of Phase 1a trial data for NX-1607. These milestones are expected to further validate the company's scientific approach and platform.

Conclusion

While Nurix Therapeutics Inc (NASDAQ:NRIX) reported a net loss that was slightly better than analyst expectations, the company's increased revenue and extended collaborations indicate a strong start to fiscal 2024. The company's robust pipeline and innovative approach to drug discovery position it well for future growth in the biotechnology industry. Investors and stakeholders will be watching closely as Nurix advances its clinical programs and strives to achieve its upcoming milestones.

For detailed financial figures and more information on Nurix Therapeutics Inc's strategic plans and clinical advancements, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Nurix Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance