NuStar Energy (NS) Q1 Earnings & Revenues Miss Estimates

Oil pipeline operator NuStar Energy L.P. NS reported first-quarter adjusted earnings per unit of 5 cents, below the Zacks Consensus Estimate of 28 cents and lower than the year-ago income of 39 cents. The partnership’s bottom line was unfavorably impacted by lower volumes through its systems.

Meanwhile, NuStar Energy reported revenues of $361.6 million that missed the Zacks Consensus Estimate of $385 million and fell 7.9% year over year.

NuStar recorded an operating income of $98.3 million against a loss of $93.1 million in the last year’s corresponding quarter. This upside could be attributed to non-cash impairment losses of $225 million associated with its Pipeline unit in the previous-year quarter, which drove costs and expenses significantly higher.

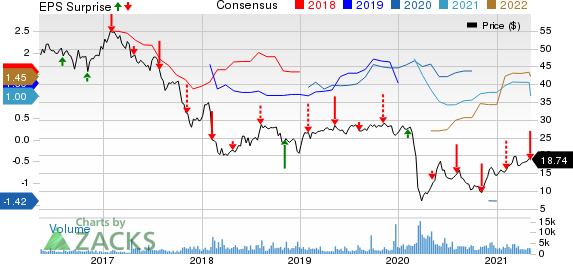

NuStar Energy L.P. Price, Consensus and EPS Surprise

NuStar Energy L.P. price-consensus-eps-surprise-chart | NuStar Energy L.P. Quote

Segment Performance

Pipeline: Total quarterly throughput volumes were 1,610,053 barrels per day (Bbl/d), down 24.3% from the year-ago period and missed the Zacks Consensus Estimate of 1,679,738 Bbl/d. Throughput volumes from crude oil pipelines fell 28.1% to 1,101,327 Bbl/d while throughput from refined product pipelines witnessed a decrease to 508,726 Bbl/d from 594,432 Bbl/d. In particular, the negative impacts from the winter storm Uri and lower volumes in comparison to last year’s record levels led to the slump in pipeline throughputs. As a result, the segment’s revenues declined 13.5% year over year to $169.2 million. However, the absence of a $225 million impairment charge incurred in the first quarter of 2020 meant that the partnership’s Pipeline unit reported an operating profit of $79.4 million, turning around from the operating loss of $122.9 million in the year-ago period.

Storage: Throughput volumes dipped to 400,302 Bbl/d from 678,830 Bbl/d in the prior-year quarter and missed the Zacks Consensus Estimate of 400,699 Bbl/d. The unit’s quarterly revenues fell 11.9% year over year to $108.6 million owing to lower throughput terminal revenues (from $38.7 million to $24.8 million). NuStar’s Storage segment was dragged down by storm shut-ins and throughput declines on the partnership’s Corpus Christi crude system. Consequently, the segment’s operating income came in at $42.7 million compared with $48.6 million in the corresponding quarter of 2020.

Fuels Marketing: Product sales increased to $83.9 million from $73.9 million in the year-ago quarter. But on a bearish note, cost of goods rose 23.1% from the prior-year period to $82.4 million. Moreover, NuStar experienced weak margins from its bunkering business and tepid performance from its butane blending operations. The segment recorded earnings of $1.5 million in the quarter under review compared with $6.9 million in first-quarter 2020.

Cash Flow, Debt and Guidance

First-quarter 2021 distributable cash flow available to limited partners was $80.5 million (providing 1.84X distribution coverage), lower than $122.3 million (2.80X) in the year-ago period. Despite falling year over year, a coverage ratio far in excess of 1 implies that the partnership is generating more than enough cash in the period to cover its distribution.

As of Mar 31, the partnership’s total consolidated debt was $3.4 billion.

NuStar remains on track to generate 2021 EBITDA “comparable to 2020’s strong results, after taking into account our sale of the Texas City terminal in December of last year.” The partnership expects improving demand, utilization and price through the remainder of this year with a potential recovery on the horizon. Finally, NuStar looks well positioned to finance all of its 2021 spending of $140-$170 million from the internally generated cash flows.

Zacks Rank & Stock Picks

NuStar currently carries a Zacks Rank #4 (Sell).

Some better-ranked players in the energy space are Exxon Mobil Corporation XOM, APA Corporation APA and Suncor Energy SU. Both companies sport a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

ExxonMobil has an expected earnings growth rate of 1,187.88% for the current year.

APA has an expected earnings growth rate of 309.26% for the current year.

Suncor Energy has an expected earnings growth rate of 223.64% for the current year.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance