Nutanix (NTNX) Misses Q3 Earnings by a Penny, Revenues Up

Nutanix Inc. NTNX reported third-quarter fiscal 2018 loss of 21 cents per share, which was a penny wider than the Zacks Consensus Estimate but significantly narrower than year-ago quarter’s loss of 32 cents.

Revenues surged 40.7% from the year-ago quarter to $289.4 million. Product revenues climbed 38.1% year over year to $160.1 million, while support & other services revenues jumped 49.8% to $45.6 million.

Billings were up 50% year over year to $351.2 million. Software accounted for 83% and billings surged 67% from the year-ago quarter to $292 million.

The bill to revenue ratio in the quarter was 1.21 in line with the company’s previous estimate of approximately 1.2.

Customer Base Continues to Expand

Nutanix added 820 customers taking the total end-customer count to 9,690 at the end of the reported quarter.

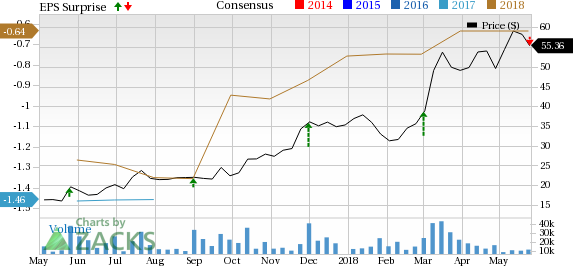

Nutanix Inc. Price, Consensus and EPS Surprise

Nutanix Inc. Price, Consensus and EPS Surprise | Nutanix Inc. Quote

New customer bookings represented 27% of total bookings. In the quarter, 44% of bookings came from large deals. Software related bookings from the company’s international regions were 45% of total software and support bookings against 37% in the year-ago quarter.

Nutanix currently has 67 customers with over $5 million in lifetime bookings, out of which 22 have lifetime bookings worth more than $10 million.

In the reported quarter, top four deals were all in excess of $5 million each and three of those deals were software only.

AHV adoption rose to 33% on a running four quarter basis, up from 30% in the previous quarter. Increasing adoption rate particularly among public sector entities has been a major growth factor.

Moreover, adoption of Prism Pro and AFS increased in the quarter. American Investment Management fund was notable customer. The fund signed a deal for more than a $1 million that included AHV and AFS across 13 locations all managed by Prism Pro.

Further, adoption of Nutanix solutions by G2K customers remained strong in the quarter.

Software-Centric Transition Drives Gross Margin

In the third quarter, non-GAAP gross margin expanded 710 basis points (bps) from the year-ago quarter to 68.4%.

Nutanix’s focus on becoming an enterprise cloud operating systems company is likely to boost gross margin in the long haul. The company has stopped recognizing pass-through hardware related revenues.

Research & Development (R&D) expenses, as percentage of revenues, declined 70 bps to 22.4%. Sales & Marketing (S&M) expenses fell 150 bps to 52.4%, while General & administrative (G&A) expenses remained flat at 5.5%.

Operating loss narrowed to $34.6 million compared with a loss of $43.8 million in the year-ago quarter.

Balance Sheet & Cash Flow

As of Apr 30, 2018, cash and cash equivalents were $923 million up from $918 million reported in the previous quarter.

Cash flow from operations was $13.3 million in third-quarter 2018 as compared with $46.4 million in previous quarter.

Free cash outflow was $0.8 million as compared with $32.4 million in previous quarter.

Deferred revenue surged 62% to $540 million in third-quarter 2018.

Guidance

For the fourth quarter of fiscal 2018, revenues are projected between $295 million and $300 million. The Zacks Consensus Estimate for revenues is pegged at $282.6 million for the quarter.

Management expects bill to revenue ratio to increase to 1.25 in the current quarter. Nutanix anticipates billings to be at least $25 million to $30 million higher than current street expectations.

Non-GAAP gross margin is projected between 73% and 74%. Moreover, management forecasts operating expenses to be in the range of $250-$260 million.

Nutanix forecasts non-GAAP net loss between 20 cents and 22 cents for the quarter.

Zacks Rank & Key Picks

Currently, Nutanix carries a Zacks Rank #3 (Hold).

Stocks worth considering in the same sector are CoStar Group CSGP, IDI FLNT and On Assignment ASGN. All the three stocks has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for CoStar, IDI and On Assignment are currently pegged at 16.75%, 40% and 10%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CoStar Group, Inc. (CSGP) : Free Stock Analysis Report

Nutanix Inc. (NTNX) : Free Stock Analysis Report

On Assignment, Inc. (ASGN) : Free Stock Analysis Report

IDI, Inc. (FLNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance