Nvidia Smashes Wall Street Expectations (EPS Recap)

Company Overview

Zacks Rank #1 stock (Strong Buy) Nvidia (NVDA) is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence (AI) based solutions that now support high-performance computing (HPC), gaming, and virtual reality (VR) platforms.

Context

As companies around the world race to participate in the coming AI revolution, the leading chip maker is gaining from solid growth in its chips used for artificial intelligence and demand from companies like Microsoft (MSFT), Alphabet (GOOGL), and Baidu (BIDU). Last quarter, Nvidia shocked Wall Street after raising revenue expectations for this quarter to a mind-boggling $11 billion ($4 billion more than consensus analyst estimates).

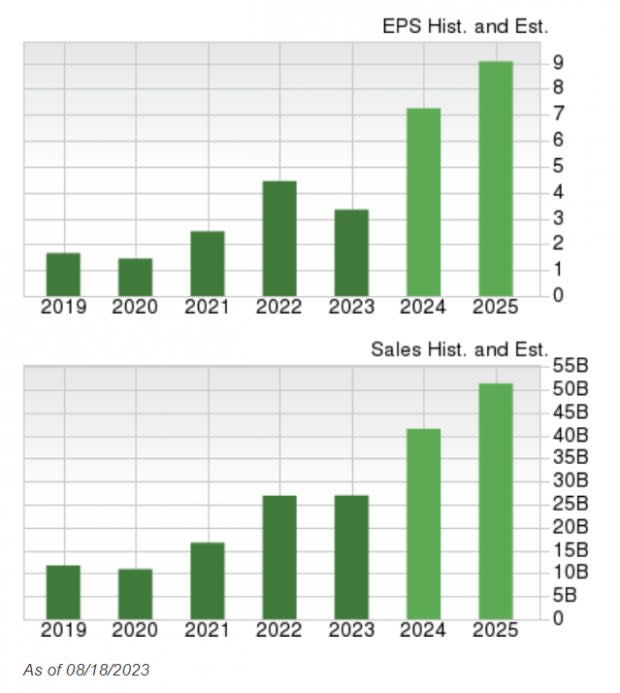

Image Source: Zacks Investment Research

By the Numbers

Wednesday, after the close, Nvidia blew away the already perceived lofty second-quarter expectations. Revenue exploded to a record $13.51 billion versus estimates of $11.04 billion.

EPS of $2.70 smashed expectations Wall Street estimates of $2.09.

The earnings beat marks the 17th quarter in the past 20 where NVDA beat Zacks Consensus EPS Estimates.

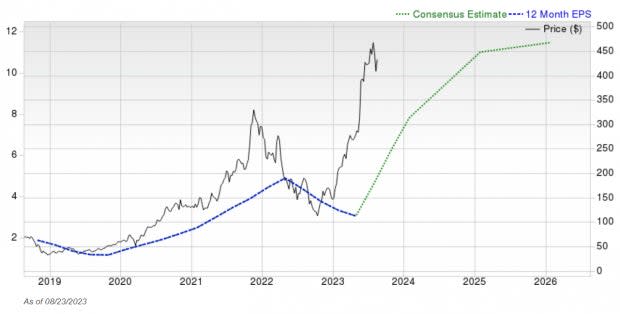

Image Source: Zacks Investment Research

Guidance

Nvidia sees third-quarter revenue of $16 billion (+ or 1 2%) versus estimates of $12.5 billion.

Beat on data center by 30% as revenue grew to $10.32 billion

Gaming revenues increased 22% year-over-year to $2.49

Management Commentary & Announcements

“During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry. The race is on to adopt generative AI.”

The company approved buyback program worth $25 billion without expiration.

China Worries: Management quelled short-term fears about the current tensions between China and the United States.

Sympathy Movers & Related Stocks

It is becoming clear from Nvidia numbers that NVDA faces a supply problem, not a demand issue. For this reason, Advanced Micro Devices (AMD), another chip maker, also popped on the news.

Taiwan Semiconductor (TSM), an Nvidia supplier, also popped on the news.

Palantir (PLTR), another AI-related stock, was a top mover and moved ~5%

Big Breakout Brewing

Unsurprisingly, Nvidia shares are exhibiting strength. Shares digested the gains from last quarter’s monster gap up and are now breaking out in after-hours trading. NVDA bulls will want to see the previous all-time high of $481.87 hold in the short term. At the time of this writing, shares are trading at roughly $516 up 9.5%.

Image Source: TradingView

Bottom Line

Through the massive earnings beat, Nvidia quelled any doubters and illustrated why it is the market leader and the undisputed leader in the AI realm. AI is here to stay, and NVDA is king.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance