NXP, Vanguard to Build $7.8 Billion Singapore Chip Wafer Plant as Tech Firms Hedge Against China

(Bloomberg) -- NXP Semiconductors NV is teaming up with a company partly owned by Taiwan Semiconductor Manufacturing Co. to build a $7.8 billion chip wafer plant in Singapore, marking a boost for the island nation’s tech ambitions.

Most Read from Bloomberg

Russia Is Sending Young Africans to Die in Its War Against Ukraine

Macron Gambles on Snap French Election in Bid to Stop Le Pen

Putin Is Running Out of Time to Achieve Breakthrough in Ukraine

Global Markets Rattled by Europe Political Jitters: Markets Wrap

TSMC-backed Vanguard International Semiconductor Corp. and NXP will begin constructing the facility in the second half of this year, with production starting in 2027, the two companies said Wednesday in a statement. Taiwan-based Vanguard will own 60% of the joint venture and the Netherlands-based NXP the rest.

The outlay is the latest win for Southeast Asia as global tech firms try to diversify the locations of their manufacturing bases, which have historically been highly concentrated in China and Taiwan. Chip customers are demanding this diversification as insurance against geopolitical risks such as escalating tensions between the US and China disrupting operations in Taiwan. Meanwhile, governments are pouring billions into new domestic factories, through initiatives such as the Chips Acts in the US and Europe.

“With all the geopolitical turmoil, we clearly have requirements from customers from the different regions for local manufacturing,” NXP Chief Executive Officer Kurt Sievers told Bloomberg in an interview. “That trend to geographically diversify is very strong.”

Southeast Asia is emerging as a force in technology manufacturing, helped by relatively low labor costs, ample technology talent and its proximity to major Asian consumer markets. Amazon.com Inc., Microsoft Corp. and Nvidia Corp. are among the companies spending billions of dollars in the region of nearly 700 million people, as China turns more hostile to US firms and India remains practically and politically challenging to navigate.

NXP chose Singapore largely thanks to its skilled workforce and because the company already has a joint venture factory with TSMC there, according to Sievers.

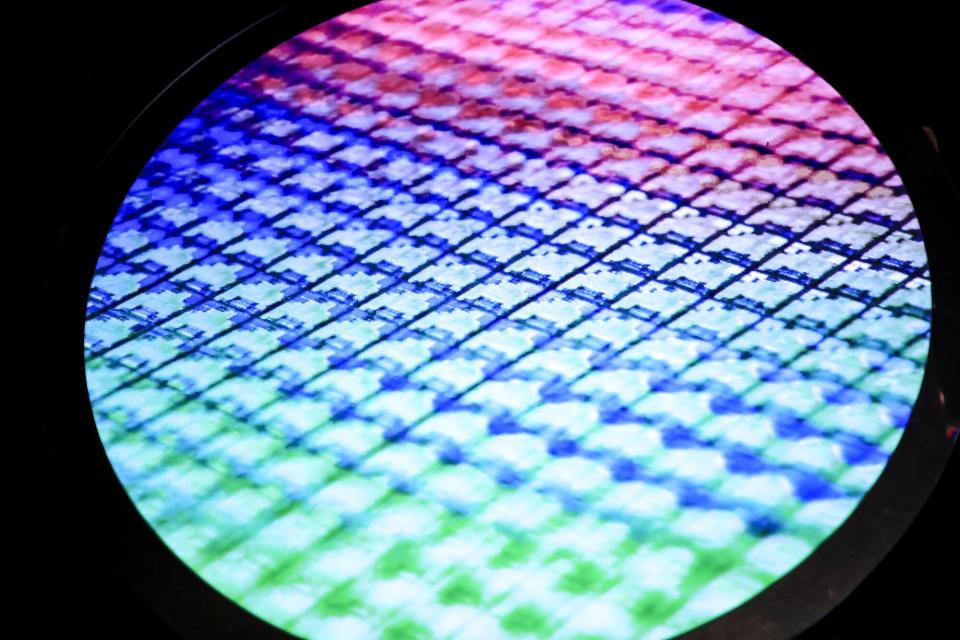

The new factory will make silicon wafers with a 12-inch diameter, which are more advanced than the 8-inch ones fabricated at Vanguard’s existing facility in Singapore. Most new chip plants globally use 12-inch wafers because that gives a higher chip output per wafer.

The wafers from the new facility will form the basis of relatively mature 130-nanometer to 40-nanometer chips that aren’t as cutting-edge as those made by TSMC in Taiwan. They will be used for functions such as power control in automotive, industrial, consumer and mobile products.

Vanguard will inject $2.4 billion into the joint venture and NXP $1.6 billion, and the firms have agreed to contribute an additional $1.9 billion later on. The remaining funding includes loans by third parties to the joint venture. Vanguard will operate the facility, which is set to create 1,500 jobs in Singapore.

That’s a potential boon for Singapore’s newly appointed prime minister, Lawrence Wong, whose tiny but wealthy country is navigating challenges including rising regional competition. Southeast Asian countries from Vietnam to Thailand are attracting more tech investment, and neighboring Malaysia last week pledged more than $5 billion in fiscal support to lure chipmakers into the country.

NXP and Vanguard join companies such as United Microelectronics Corp. in expanding in Singapore. UMC, Taiwan’s biggest chipmaker after TSMC, is building a $5 billion wafer fabrication plant in the equatorial city-state.

Vanguard acquired its existing Singapore facility from GlobalFoundries Inc. in 2019. NXP also has a foothold in the country through a manufacturing partnership with TSMC, called Systems on Silicon Manufacturing Co. Other chipmakers with a presence in Singapore include GlobalFoundries, Micron Technology Inc. and Infineon Technologies AG.

Vanguard and NXP’s latest global expansion tracks TSMC’s own growing global footprint. The chipmaker is planning new facilities in Arizona, Japan and Germany. Sievers said the joint venture with TSMC, Bosch and Infineon in Germany is on track to begin building at the end of the year. The factory still requires state aid approval from the European Commission.

TSMC owns about 28% of Vanguard and Taiwan’s National Development Fund owns nearly 17%, as of February. The fund is also the biggest shareholder of TSMC with a holding of more than 6%.

(Updates with comments from NXP CEO Kurt Sievers)

Most Read from Bloomberg Businessweek

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

As Banking Moves Online, Branch Design Takes Cues From Starbucks

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance