O-I Glass Inc (OI) Q1 2024 Earnings: Navigates Market Downturn with Strategic Adjustments

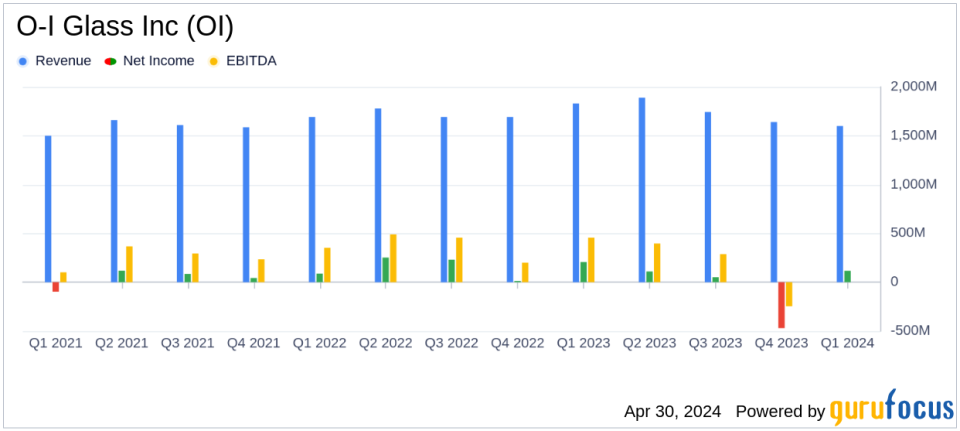

Earnings Per Share (EPS): Reported at $0.45 for Q1 2024, down from $1.29 in Q1 2023, falling short of the estimated $0.39.

Net Income: Reached $72 million in Q1 2024, a significant decrease from $206 million in the previous year, below the estimated $60.39 million.

Revenue: Totaled $1.6 billion, a decline from $1.8 billion year-over-year, falling short of the estimated $1697.56 million.

Segment Operating Profit: Dropped to $235 million from $398 million in Q1 2023, indicating reduced operational efficiency.

Net Sales Volume: Experienced a 12.5% decrease in sales volume, reflecting challenges in market demand and inventory management.

2024 Full-Year Guidance: Adjusted EPS forecast revised to $1.50 - $2.00, down from previous $2.25 - $2.65, with free cash flow expectations adjusted to $100 - $150 million from the prior $150 - $200 million range.

Corporate Costs: Retained corporate and other costs decreased to $40 million from $60 million, reflecting lower corporate spending and management incentives.

O-I Glass Inc (NYSE:OI), the world's largest manufacturer of glass bottles, released its 8-K filing on April 30, 2024, detailing its financial performance for the first quarter ended March 31, 2024. The company reported a diluted earnings per share (EPS) of $0.45, falling short of the analyst's estimate of $0.39. Net earnings stood at $72 million, significantly below the anticipated $60.39 million, amidst a backdrop of declining market conditions and softer consumer consumption.

Company Overview

O-I Glass, headquartered in Perrysburg, Ohio, commands a leading market position globally, with approximately 70% of its revenue generated from international markets, including Europe, North America, and Brazil. The company primarily serves the beer industry, along with other sectors such as wine, soda, spirits, condiments, and food. O-I Glass is committed to maintaining and expanding its market dominance through strategic initiatives and innovations.

Financial Performance Analysis

The first quarter of 2024 saw O-I Glass grappling with several challenges, including a 12.5% decline in sales volume and slightly lower average selling prices, which led to net sales dropping to $1.6 billion from $1.8 billion in the previous year. The decrease in segment operating profit from $398 million in Q1 2023 to $235 million in Q1 2024 and an increase in net interest expense were significant contributors to the reduced earnings.

Despite these hurdles, the company benefited from favorable foreign currency translation and reduced corporate and other costs, which decreased to $40 million from $60 million in the prior year. However, these gains were not sufficient to offset the overall decline in profitability.

Strategic Developments and Future Outlook

O-I Glass is poised for the summer 2024 start-up of its first MAGMA greenfield plant, which represents a significant technological advancement expected to provide a competitive edge. CEO Andres Lopez highlighted the gradual improvement in glass shipment trends and expressed confidence in the long-term prospects for glass packaging demand.

As expected, our first quarter net earnings per share (diluted) were down from historically high performance in the prior year quarter. Lower results primarily reflected the current market downturn that has impacted shipment levels due to softer consumer consumption and inventory destocking across the value chain," stated Andres Lopez, CEO of O-I Glass.

The company has revised its full-year 2024 guidance, now anticipating flat to low single-digit sales volume growth and adjusted EPS between $1.50 and $2.00, reflecting the ongoing market challenges and higher operational costs.

Investor and Market Implications

While O-I Glass faces short-term challenges, its strategic adjustments and innovations like the MAGMA technology could enhance its long-term growth trajectory. However, investors might exercise caution due to the current unpredictability in consumer markets and the potential for further adjustments to the company's financial outlook.

O-I Glass will hold a conference call on May 1, 2024, to discuss these results and provide more insights into its strategies and outlook. More information and access to the webcast are available on the O-I website in the News and Events section.

For detailed financial figures and further information, please refer to the full 8-K filing by O-I Glass Inc.

Explore the complete 8-K earnings release (here) from O-I Glass Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance