Ocado stock jumps as it moves to spend $287m on robotics

Online grocery retailer Ocado (OCDO.L) shares jumped on Monday as it said it would buy two robotics companies, at a cost of $287m (£223m).

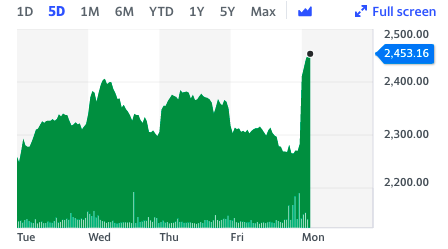

The stock moved as much as 7.6% higher in early trade on Monday.

It is adding Kindred Systems Inc and Haddington Dynamics Inc for $282m and $25m respectively. Kindred systems creates AI, while Haddington works with “ultra precision motion control for robotics.”

“In our mission to solve one of the world’s hardest challenges in robotics, the picking and packing of groceries, we’re acquiring two leading robotics companies,” Ocado said.

Tim Steiner, CEO of Ocado Group, said: “The robotic pick opportunity in online grocery is of huge value to us and our clients globally.”

“We’ve made meaningful progress in developing the machine learning, computer vision and engineering systems required for the robotic picking. For example, we’ve doubled the pick and pack speeds of our robotic arms at the five pick-stations that are currently live in our CFC in Erith, UK,” Steiner continued.

READ MORE: Ryanair posts first summer loss in decades as CEO slams UK government 'mismanagement'

The premium online food retailer also upgraded its full-year core earnings outlook for its joint venture with Marks & Spencer (MKS.L) due to a strong fourth quarter.

Ocado and Marks and Spencer last year agreed to create a joint venture — a move that saw M&S acquire a 50% stake in Ocado’s retail business for £750m.

It expects full year earnings before interest, depreciation and amortisation (EBITDA) for the joint venture, Ocado Retail, to be over £60m, versus previous guidance of over £40m.

Ocado has been one of the winners of the coronavirus pandemic, as consumers overwhelmingly moved online and food deliveries amid widespread lockdowns.

Its joint venture, Ocado Retail, is now the fastest-growing grocer in the UK, and as of July, had a 1.7% share of the country’s grocery market.

Watch: Why UK tax hikes may seem inevitable

Yahoo Finance

Yahoo Finance