Ocado stock rockets 10% after M&S confirms joint venture talks

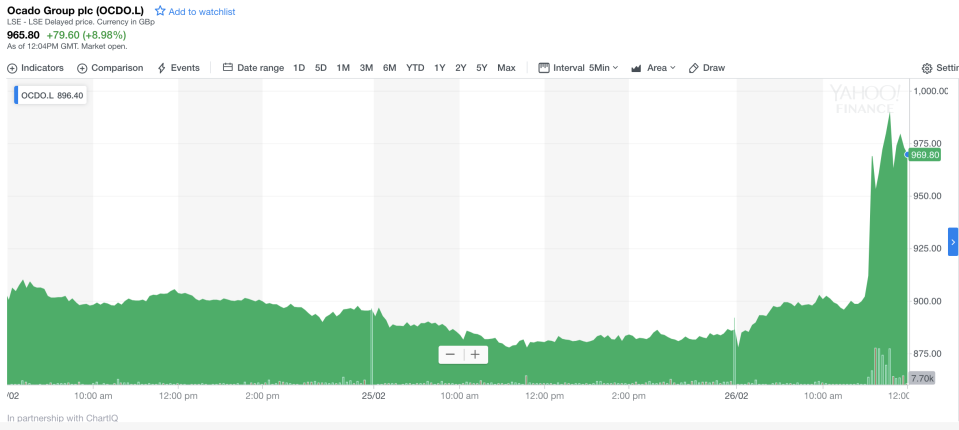

Shares in online supermarket company Ocado (OCDO.L) jumped over 10% on Tuesday after Marks & Spencer (MKS.L) confirmed earlier media reports that the pair are discussing a possible joint venture.

The Evening Standard reported on Tuesday morning that Ocado and M&S are set to announce plans for a joint venture as soon as Wednesday. M&S will pay up to £900m for 50% of the new venture, according to the report.

Marks & Spencer said in a statement shortly after the report: “Following press speculation, Marks and Spencer Group PLC confirms that it is in discussions with Ocado Group plc regarding a joint venture in UK Retail.

“There is no certainty that these discussions will result in any agreement or as to the timing of any such agreement. Further updates will be provided as appropriate.”

Ocado issued a nearly identical statement.

Ocado shares jumped as much as 12% after the confirmation, but settled back to a gain of around 9% at just after 12.15pm in London.

Shares in Marks & Spencer also rose and were up around 3.2% at the same time.

“We think the deal makes lots of strategic sense for both M&S (not-covered) and Ocado, therefore we would expect that some kind of deal at some point will develop,” said Bruno Monteyne, an analyst with Bernstein who covers the sector.

“It is too early to lose their retail business as it is an essential and unbeatable part of the sales pitch to global customers (i.e. they are not just selling you some hardware/software, they operate it very successfully in the most competitive grocery e-commerce market in the world). As a JV it would also avoid legal complications from other existing Ocado partners (Morrisons and Waitrose).”

The mooted deal terms value Ocado’s retail business at £1.6-1.8bn, which Monteyne said “would add £0.86 to our £14.4 target price at the £1.8bn valuation.”

He added that M&S could be a useful partner for the launch of Ocado Zoom, a one-hour delivery service.

“Ocado Zoom could be a major growth path for Ocado,” Monteyne said. “We believe the food of M&S (ready meals, quality food) is perfectly suited for this more upmarket convenience shopping. M&S would boost the potential of Zoom in the UK.”

The potential deal was first reported in late January, prompting a rise in Ocado’s share that was later wiped out when a fire broke out at its Andover warehouse and dented sales expectations.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Pound hits 4-month high on Brexit delay hopes

Britain strikes another deal to protect a multi-trillion dollar City market from Brexit

Tech startup Blippar, once worth $1bn, went bust with just $65,000 in the bank

Boss of Google’s new hiring tool says UK ‘very, very attractive market’ despite Brexit

Partners at top law firm Norton Rose Fulbright share £106m profit pot

Yahoo Finance

Yahoo Finance