Offerpad Solutions Inc (OPAD) Reports Mixed Year-End Results Amid Real Estate Challenges

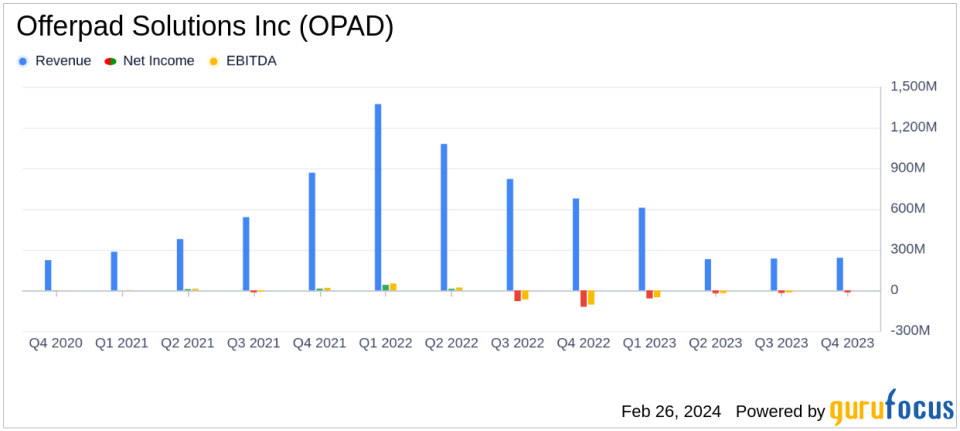

Quarterly Revenue Increase: Q4 2023 revenue rose 3% quarter over quarter to $240.5 million.

Annual Revenue Decline: Full year 2023 revenue decreased by 67% to $1.3 billion compared to 2022.

Gross Profit Margin: Q4 2023 saw a gross profit of $16.7 million, recovering from a loss in Q4 2022.

Net Loss Improvement: Annual net loss improved by 21%, from $148.6 million in 2022 to $117.2 million in 2023.

Adjusted EBITDA: Adjusted EBITDA loss reduced by 21% year over year, with a reiteration of achieving profitability in 2024.

Liquidity Position: Cash and cash equivalents at year-end 2023 stood at $76.0 million, a 22% decrease from 2022.

On February 26, 2024, Offerpad Solutions Inc (NYSE:OPAD), a leading tech-enabled platform for residential real estate, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative approach to buying and selling homes, reported a sequential increase in quarterly revenue but faced a significant year-over-year decline.

Offerpad's mission to streamline the home selling and buying experience through its digital platform has been met with both operational successes and market challenges. The company's CEO, Brian Bair, emphasized the strategic cost reductions and operational streamlining that have positioned Offerpad for improved growth and profitability in the coming year.

Financial Performance and Challenges

Offerpad's Q4 2023 results showed a modest quarter-over-quarter revenue increase to $240.5 million, up 3% from Q3 2023. However, the full year 2023 revenue of $1.3 billion represented a significant 67% decrease from the previous year. The company's gross profit for Q4 2023 was $16.7 million, a notable recovery from a gross loss in Q4 2022, but a 30% decrease from Q3 2023. The net loss for the year improved by 21%, indicating a positive trend in cost management and operational efficiency.

Despite these improvements, the company faced a 69% and 65% year-over-year reduction in homes acquired and sold, respectively. This contraction reflects the broader challenges in the real estate market, including fluctuating demand and pricing pressures.

Financial Achievements and Industry Impact

The company's ability to reduce its net loss and improve its gross profit margin is particularly important in the real estate industry, where market volatility can significantly impact profitability. Offerpad's focus on an asset-light model and diversification of revenue streams, such as through its Agent Partnership Program, is a strategic move to mitigate these challenges.

Key Financial Metrics

Important metrics from Offerpad's financial statements include a year-over-year improvement in gross profit per home sold, from $17,200 in 2022 to $19,100 in 2023. However, contribution profit after interest per home sold turned negative, reflecting the increased cost of capital and the impact of interest expenses on profitability. The company's liquidity, as measured by cash and cash equivalents, decreased by 22% year over year, signaling a tighter cash position.

"We successfully navigated 2023 from a position of operational excellence," said Brian Bair, chairman and CEO. "During the year, we acted decisively to streamline the business and reduce costs, setting us up to drive improved top line growth and profitability in 2024 and beyond."

Outlook and Analysis

Offerpad's outlook for the first quarter of 2024 projects homes sold to range between 750 and 850, with revenue anticipated to be between $245 million and $285 million. The Adjusted EBITDA is expected to show a loss between $10 million and $2.5 million, indicating ongoing efforts towards profitability.

The company's performance in 2023, while showing sequential quarterly improvements, underscores the challenges faced in the real estate sector. Offerpad's strategic initiatives aimed at reducing friction in real estate transactions and advancing asset-light product lines are critical as the company navigates a path to sustainable profitability.

For a more detailed analysis and commentary on Offerpad Solutions Inc (NYSE:OPAD)'s financial results, investors and interested parties can access the company's Quarterly Letter to Shareholders on the Offerpad investor relations website.

Explore the complete 8-K earnings release (here) from Offerpad Solutions Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance