OGE Energy (OGE) Q1 Earnings Top Estimates, Revenues Drop Y/Y

OGE Energy Corp.’s OGE first-quarter 2020 adjusted earnings of 23 cents per share surpassed the Zacks Consensus Estimate of 18 cents by 27.8%.

Including one-time items, the company reported GAAP loss of $2.46 per share against earnings of 24 cents in the year-ago quarter.

The downside can be attributed to a $780 million impairment charge related to Enable Midstream.

Revenues

OGE Energy’s operating revenues of $431.3 million dropped 12% from the prior-year quarter’s $490 million. The decline in revenues primarily resulted from lower contract revenues.

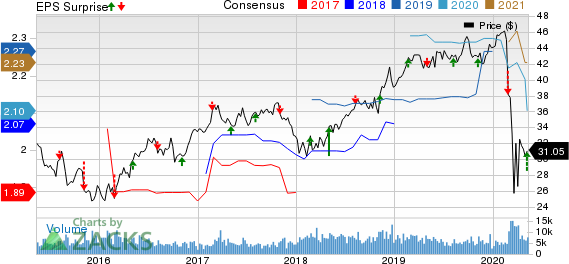

OGE Energy Corporation Price, Consensus and EPS Surprise

OGE Energy Corporation price-consensus-eps-surprise-chart | OGE Energy Corporation Quote

Operational Highlights

Total sales in the reported quarter amounted to 6.8 million megawatt-hours (MWh) compared with 7 million MWh in the prior-year quarter. Meanwhile, the company’s customer count inched up approximately 0.8% to 859,628.

Cost of sales was $135 million in the first quarter compared with $212.6 million in the prior-year quarter.

Total operating expenses rose 5.4% year over year to $240 million on account of higher operation and maintenance expenses as well as depreciation and amortization expenses.

The company’s operating income grew 13.3% from the year-ago quarter’s $49.7 million to $56.3 million.

Interest expenses totaled $38.3 million in the first quarter, compared with $34.6 million in the year-ago quarter.

Other Highlights of the Release

OGE Energy reported a net loss of $491.8 million in first-quarter 2020, significantly down from the prior year’s $47.1 million.

OG&E: Segment net income remained flat year over year at $20 million in the reported quarter, as the recovery of additional assets placed into service was partially offset by unfavorable weather.

Natural Gas Midstream Operations: The segment posted a net loss of $568 million in first- quarter 2020 against earnings of $22 million in the previous year quarter.

2020 Guidance

OGE Energy still expects its 2020 earnings in the range of $2.19-$2.31 per share. The Zacks Consensus Estimate for 2020 earnings is pegged at $2.11, lower than the company provided guidance.

Zacks Rank

OGE Energy currently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

Public Service Enterprise Group Inc. PEG reported first-quarter 2020 adjusted operating earnings of $1.03 per share, which came in line with the Zacks Consensus Estimate.

FirstEnergy Corporation FE delivered first-quarter 2020 operating earnings of 66 cents per share, which beat the Zacks Consensus Estimate of 64 cents by 3.13%.

NextEra Energy NEE reported first-quarter 2020 adjusted earnings of $2.38 per share, which surpassed the Zacks Consensus Estimate of $2.21 by 7.7%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

OGE Energy Corporation (OGE) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

NextEra Energy Inc (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance