Ohio Train Disaster: What does it mean for the industry?

East Palestine Train Derailment

On February 3rd, Ohioans learned of the devastating news that a Norfolk NSC train carrying 150 rail cars suffered a mechanical issue, causing 50 of the cars to derail near the tiny town of East Palestine, Ohio. before the derailment, camera footage from earlier in the day showed sparks emerging from beneath some of the rail cars. Though the number of train derailments has dramatically decreased over the past 20 years, some 31 trains derail in the United States on average each year. Beyond the derailment itself, what makes this particular accident noteworthy is the cargo that the train was carrying.

An Environmental & Public Health Disaster

According to the Environmental Protection Agency (EPA), the train was carrying large amounts of environmentally harmful chemicals, including ethylene glycol mono butyl ether, butyl acrylate, and isobutylene, to name a few. Unfortunately, many substances and agents onboard the doomed train were carcinogens. A carcinogen is a substance known to cause cancer by altering or damaging the genetic material (DNA) within cells. As government officials realized the magnitude of the chemicals on board, officials ordered the evacuation of hundreds of residents in a 3-mile radius. Furthermore, the hazardous materials were burned in a “controlled” manner to eliminate the risk of an explosion, sending a massive plume of toxic fumes into the environment.

Reports have circulated illustrating the immediate environmental impact. Animals are dying or acting lethargic, the drinking water is contaminated, and humans are suffering from irritated skin and headaches. Though the immediate effect of the unprecedented accident is substantial, the full scope of the environmental and health consequences is likely to play out over a long period. For example, it took 15-20 years for many 9/11 first responders to suffer the consequences of inhaling toxic smoke.

What are the Impacts on Norfolk Southern?

Norfolk Southern, which has a market cap of more than $50 billion, is facing a massive amount of reputational damage considering its history. During the Obama administration, the company fought new safety rules aimed at transporting hazardous materials in an effort to save money. The company will likely be held accountable for a significant portion (if not all) of the required environmental cleanup. Multiple lawsuits have also been filed against the company, with more likely to be in the pipeline.

History of Similar Disasters on Stock Prices

The two most similar circumstances to the Norfolk Southern derailment are the British Petroleum BP “Deepwater Horizon” oil spill in the Gulf of Mexico and the Exxon Mobil XOM “Exxon Valdez” oil spill off Alaska. In the case of BP, an explosion under an offshore oil rig sent a large amount of oil spilling into the Gulf of Mexico., BP’s stock fell in the following months; however, the fall was in line with the general market and other oil stocks in 2010. In the case of the XOM spill, a large tanker crashed into a reef off Alaska, causing a massive oil spill in 1989. After the fallout, XOM’s stock stagnated for a short period and then proceeded to march higher on a multi-year run.

NSC Outlook

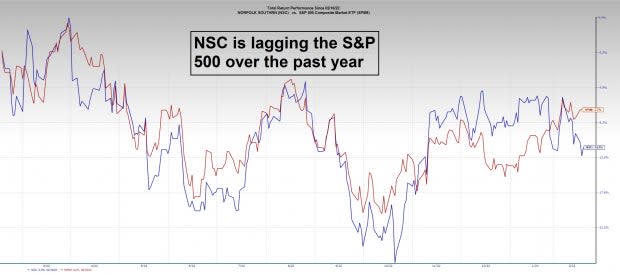

Looking at these two examples, it is safe to assume that NSC shares may lag for a while but will not entirely fall apart.

Image Source: Zacks Investment Research

While the costs are likely to be large from a dollar perspective, history tells us that the cost and reputational damage of the disaster should have little impact on a $50 billion company like Norfolk Southern. Taking that into account, the Zacks Transportation – Rail group is a low-ranked group and shares competitors such as Union Pacific UNP and CSX Corp CSX are lagging. From a price action perspective, the strongest name is Canadian National CNI. Though the fallout from the disaster is probably less than the consensus expects, investors should avoid this lagging group for now.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance