Oil heads higher amid positive vaccine news and tensions in the Middle East

Oil futures headed higher in early trade in London, as investors parsed more positive vaccine news and rising tensions in the Middle East.

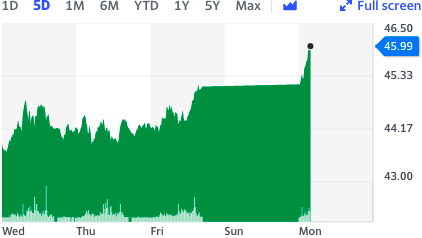

Brent Crude (BZ=F) ticked 2.3% higher, while Crude futures (CL=F) were up 2% at 8.50am in London.

Hopes of an imminent vaccine are supporting the expectation of a pick-up in global travel, one of the biggest consumers of oil.

News broke this morning that the vaccine in development from the University of Oxford and AstraZeneca (AZN) has shown efficacy of 70.4% in two large-scale trials. If a lower dose is used, then a second, full dose, the efficacy is up to 90%, the company said.

“Hopes that vaccines will return the world to a semblance of normality in 2021 continue to drive consumption forecasts higher, supporting oil which has also seen a rise in speculative long futures positioning,” said Jeffrey Halley, senior market analyst for Asia Pacific at OANDA.

“Oil's next major risk point will be the full OPEC+ meeting next Monday,” he continued.

READ MORE: Positive vaccine news from AstraZeneca and Oxford boosts stock markets

OPEC+ is due to meet on 30 November and 1 December. The group is assessing its options in delaying production cuts by at least three months from January. The cuts would see production go from 7.7 million barrel per day (bpd) cuts by around 2 million bpd.

Despite this global agreement, however, smaller Russian oil companies have said they still plan to pump more crude, due to the fact they have little leeway in managing the output of start-up fields, according to a report by Reuters.

Tensions in the Middle East are also mounting. Yemen’s Iran-aligned Houthi group said on Monday it has fired a missile that struck a Saudi Aramco oil company operated distribution station in the Red sea city of Jeddah.

Reuters reported that this hasn’t been confirmed on the Saudi side.

Watch: Why can’t governments just print more money?

Yahoo Finance

Yahoo Finance