Oil Advances as Risk-On Sentiment Helps to Support Commodities

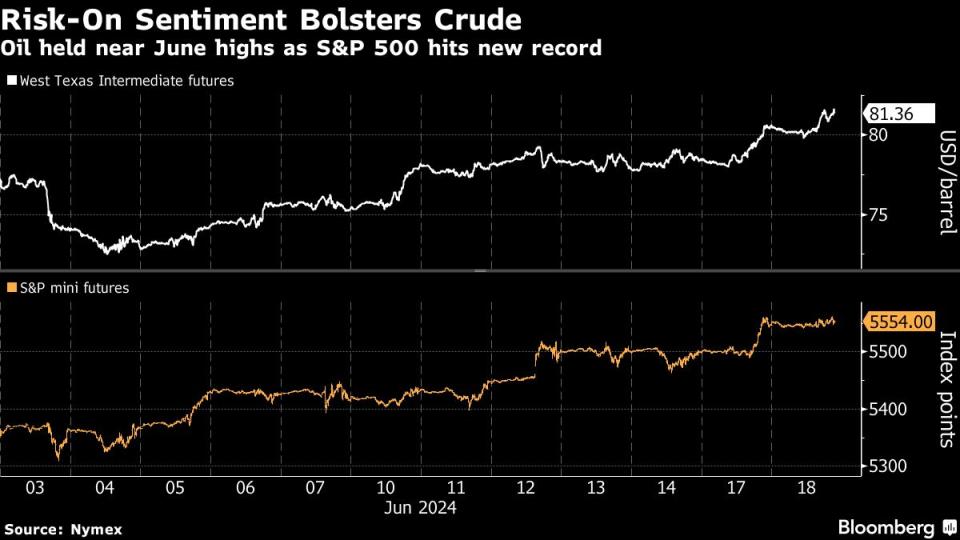

(Bloomberg) -- Oil rose to the highest in more than a month as risk-on sentiment bolsters broader global markets.

Most Read from Bloomberg

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

Nvidia Becomes World’s Most Valuable Company as AI Rally Steams Ahead

West Texas Intermediate climbed 1.5% to settle above $81 a barrel, reaching the highest closing price in seven weeks. Equity markets have been on a tear, with the S&P 500 hitting its 30th record this year, aiding crude in recent sessions. Key oil timespreads have also indicated a tightening market.

Crude has advanced this month, paring a quarterly drop, after OPEC+ clarified that any boost in production would depend on market conditions. Demand in Asia has showed signs of softness, with indications of lower gasoline consumption in India and slower Chinese refining activity.

“I’m comfortable being bullish for Q3 still,” said Aldo Spanjer, a senior commodities strategist at BNP Paribas SA. “While June looks weak, I think demand comes up for diesel, gasoline and particularly jet. That’s a pretty strong demand increase over the next two to three months.”

Key timespreads have leaped in recent sessions, a sign that some of the market’s recent weakness could be turning. Brent’s prompt spread, which gauges near-term strength in physical markets, closed at the strongest level since April on Monday.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance