Oil prices steady above $42 as IEA cuts forecasts for global demand

The benchmark Brent (BZ=F) crude price has remained above $42 (£31.44) a barrel for a second day on Thursday as the International Energy Agency (IEA) cut forecasts for global oil demand in the face of ever increasing lockdown measures and a sobering reminder that a COVID-19 vaccine won’t quickly bolster the commodity market.

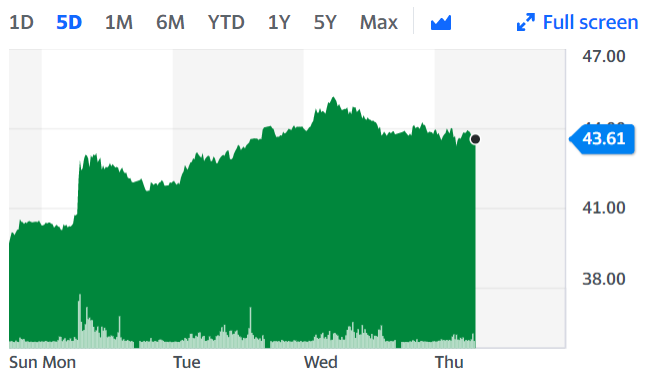

Brent (BZ=F) was up 0.32% and sitting at $43.94 on Thursday at around 12:30pm in London.

Crude prices rallied to a 10-week high above $45 a barrel this week alongside record-making gains in global equity markets as news hit of Pfizer’s (PFE) vaccine progress.

“With a COVID-19 vaccine unlikely to ride to the rescue of the global oil market for some time, the combination of weaker demand and rising oil supply provide a difficult backdrop” to the meeting, the IEA said in its monthly report. “Unless the fundamentals change, the task of rebalancing the market will make slow progress.”

The IEA’s statement is “all the more reason for OPEC+ to tweak the timetable for paring back production cuts next year, as numerous countries go back into lockdown,” said Craig Erlam, senior market analyst at OANDA Europe. “That forced the IEA to reduce demand forecasts for crude by 1.2 million barrels per day in Q4.”

READ MORE: Markets pare gains as coronavirus vaccine euphoria wears off

In the short term, IEA said that the poor outlook for demand and rising production in Libya where production has increased to 1 million barrels a day from only 0.1 million barrels a day in August, Iraq and the US, which is recovering from hurricane disruptions, suggest that the current fundamentals are too weak to offer firm support to prices.

Libya, which is one of three OPEC nations that are exempt from the agreement to restrain output, has tripled production to 450,000 barrels a day last month as its political tensions continue, the IEA said.

The country is now pumping more than 1 million barrels a day. It could average just below this level in November, the agency predicted.

WATCH: What does a Joe Biden presidency mean for the global economy?

Yahoo Finance

Yahoo Finance