Old Dominion's (ODFL) Q3 Earnings Surpass Estimates, Up Y/Y

Old Dominion Freight Line’s ODFL third-quarter 2021 earnings per share of $2.47 outpaced the Zacks Consensus Estimate by 10 cents. The bottom line surged 44.4% year over year. The upside was driven by improvement in the operating ratio (operating expenses, as a percentage of revenues) on the back of higher revenues.

Revenues of $1400 million also surpassed the Zacks Consensus Estimate of $1,360.3 million and increased 32.3% year over year. The uptick was backed by a 13.7% increase in LTL (Less-Than-Truckload) tons and a 15.7% rise in LTL revenue per hundredweight.

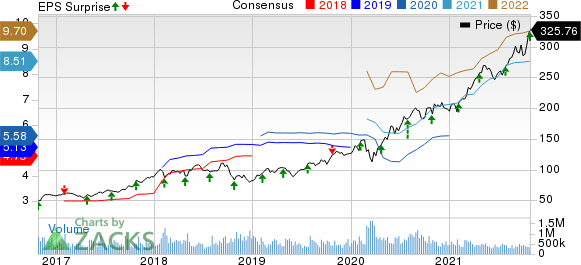

Old Dominion Freight Line, Inc. Price, Consensus and EPS Surprise

Old Dominion Freight Line, Inc. price-consensus-eps-surprise-chart | Old Dominion Freight Line, Inc. Quote

Other Details

In the quarter under review, LTL weight per shipment fell 4.8%, while LTL revenue per shipment rose 10.2%. Both LTL shipments and LTL shipments per day were up 19.4% year over year.

The company’s major revenue-generating segment LTL services logged a total of $1,378.3 million, up 31.9% year over year. Revenues from other services rallied 60.5% to $21.7 million.

Total operating expenses moved up 29% to $1,016.6 million, mainly due to a 23.8% rise in costs pertaining to salaries, wages & benefits, 62.2% increase in operating supplies and expenses as well as a more than 100% surge in purchased transportation costs.

The operating ratio improved 190 basis points to 72.6%. Lower the value of this metric, the better.

Old Dominion exited the quarter with cash and cash equivalents worth $339.8 million compared with $401.43 million at the end of 2020. Capital expenditures incurred in the reported quarter were $178.6 million. Old Dominion expects a capex of $565 million for 2021 (previous expectation: $605 million). Of the total, $235 million is anticipated to be invested in real estate and service-center expansion. The company expects to spend $290 million and $40 million on tractors/trailers and information technology and other assets, respectively.

During the third quarter, Old Dominion — carrying a Zacks Rank #2 (Buy) — rewarded its shareholders through dividend and share repurchase programs, including a $250-million accelerated share repurchase agreement that will expire no later than March 2022. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sectorial Snapshot

Within the broader Transportation sector, Delta Air Lines DAL, J.B. Hunt Transport Services JBHT and Kansas City Southern KSU recently reported third-quarter 2021 results.

Delta reported third-quarter earnings (excluding $1.59 from non-recurring items) of 30 cents per share, outpacing the Zacks Consensus Estimate of 15 cents. Revenues of $9,154 million also beat the Zacks Consensus Estimate of $8,370.6 million.

J.B. Hunt reported third-quarter earnings of $1.88 per share, surpassing the Zacks Consensus Estimate of $1.77. Total operating revenues of $3144.8 million outperformed the Zacks Consensus Estimate of $3002.1 million. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kansas City Southern reported third-quarter earnings (excluding 31 cents from non-recurring items) of $2.02 per share, missing the Zacks Consensus Estimate of $2.07. Quarterly revenues of $744 million surpassed the Zacks Consensus Estimate of $725.9 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance