Olo's (NYSE:OLO) Q1: Beats On Revenue, Stock Soars

Restaurant software company (NYSE:OLO) announced better-than-expected results in Q1 CY2024, with revenue up 27.3% year on year to $66.51 million. Guidance for next quarter's revenue was also optimistic at $67.75 million at the midpoint, 2.2% above analysts' estimates. It made a non-GAAP profit of $0.05 per share, improving from its profit of $0.03 per share in the same quarter last year.

Is now the time to buy Olo? Find out in our full research report.

Olo (OLO) Q1 CY2024 Highlights:

Revenue: $66.51 million vs analyst estimates of $64.27 million (3.5% beat)

EPS (non-GAAP): $0.05 vs analyst expectations of $0.05 (in line)

Revenue Guidance for Q2 CY2024 is $67.75 million at the midpoint, above analyst estimates of $66.31 million

The company lifted its revenue guidance for the full year from $270.5 million to $275.5 million at the midpoint, a 1.8% increase

Gross Margin (GAAP): 55.9%, down from 64.1% in the same quarter last year

Free Cash Flow of $2.81 million, similar to the previous quarter

Net Revenue Retention Rate: 120%, in line with the previous quarter

Market Capitalization: $784.3 million

“In Q1, we got off to a great start in delivering on our 2024 financial targets, including 27% year-over-year revenue growth and non-GAAP operating margin expansion to 8%,” said Noah Glass, Olo’s Founder and CEO.

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Sales Growth

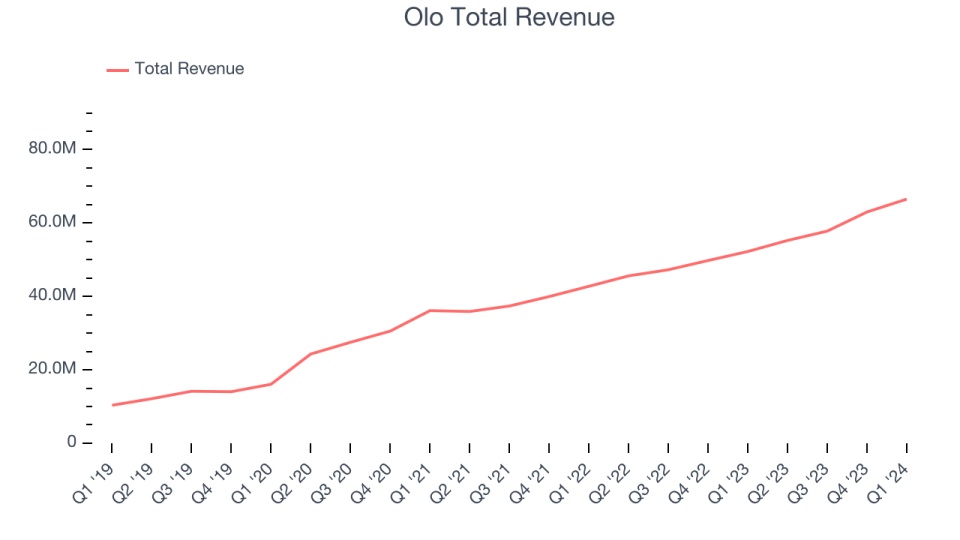

As you can see below, Olo's revenue growth has been strong over the last three years, growing from $36.12 million in Q1 2021 to $66.51 million this quarter.

This quarter, Olo's quarterly revenue was once again up a very solid 27.3% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $3.51 million in Q1 compared to $5.21 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Olo is expecting revenue to grow 22.6% year on year to $67.75 million, in line with the 21.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 15.9% over the next 12 months before the earnings results announcement.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Olo's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 120% in Q1. This means that even if Olo didn't win any new customers over the last 12 months, it would've grown its revenue by 20%.

Trending up over the last year, Olo has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Olo's Q1 Results

We enjoyed seeing Olo exceed analysts' billings and revenue expectations this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Overall, we think this was a strong quarter that should satisfy shareholders. The stock is up 9.6% after reporting and currently trades at $5.15 per share.

Olo may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance