One bleak chart shows how awful the next few years will be for the British economy

Flickr / Mick_tn

Exactly one week ago, Britain voted to leave the European Union and, as predicted, chaos ensued in the markets.

Prior to the vote economists, banking analysts, central banks and pretty much every category of financial thinker warned of the potentially dire consequences of the referendum. Markets would crash, investment to Britain would dry out, and the country's economy would take a massive hit.

The first prediction came true on Friday last week, when stocks and the pound jumped off a cliff, with sterling falling to a three-decade low, and stocks dropping more than 10%.

The drying up of investment also seems to be beginning, with a Singaporean bank warning on Thursday that investors should avoid the UK property market: "As the aftermath of the UK referendum is still unfolding and given the uncertainties, we need to ensure our customers are cautious with their London property investments," United Overseas said on Thursday.

Away from financial markets and investment, probably one of the most dire of the pre-Brexit warnings was about the potential for a first recession in the UK since the 2008 global financial crisis. Among those to predict recession was Bank of England governor Mark Carney, who warned several times prior to the vote that the economic consequences of Brexit "could possibly include a technical recession."

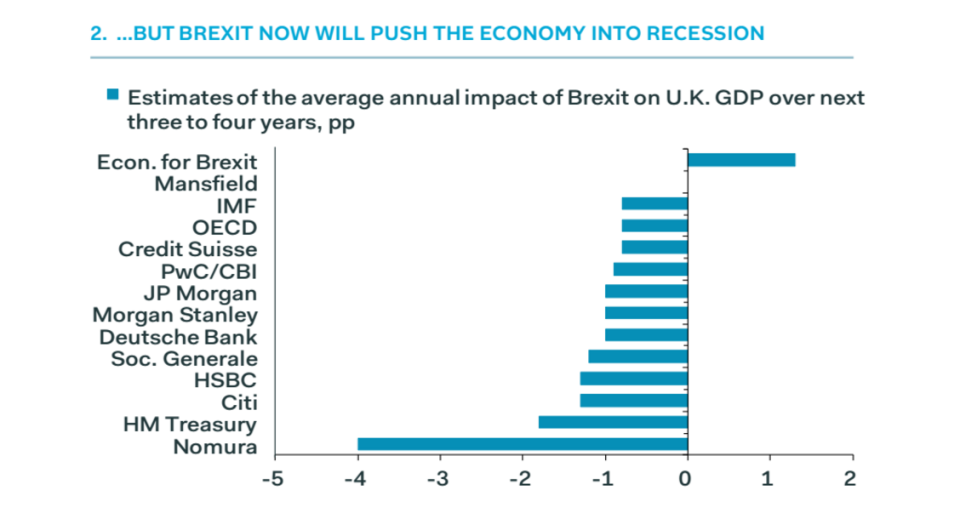

Carney's view is being echoed across the financial sector, and predictions about a coming recession are now widespread, with some banks estimating that Brexit could wipe an average of 4% off the UK's previous growth estimates over the next three to four years.

To show just how bad things could be for the economy in the coming few years, research firm Pantheon Macroeconomics has compiled a list of the GDP forecasts of major banks and international organisations, and to say its bleak would be an understatement.

Here is the chart:

Flickr / Mick_tn

Perhaps unsurprisingly, the only group — cited by Pantheon at least — which predicts anything other than a recession in the next few years is Economists for Britain, a pro-Brexit group of economists who during the referendum campaign criticised remainers for "scaremongering and often economic illiteracy." Led by Patrick Minford, a former economic advisor to Margaret Thatcher, Economists for Britain also stressed that: "The UK does not need a trade deal to trade! The UK already trades heavily with many countries across the globe with which it has no trade deal."

Interestingly, the second most bearish of all predictions about the state of Britain's economy comes from the Treasury. Whether that reflects excessive caution on the government's part, or a terrifying economic reality is unclear.

See Also:

SEE ALSO: CARNEY: 'One uncomfortable truth is that there are limits to what the Bank of England can do'

DON'T MISS: UBS: Here's how to escape the pain of Brexit

Yahoo Finance

Yahoo Finance