Online Marketplace Stocks Q1 Teardown: eHealth (NASDAQ:EHTH) Vs The Rest

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the online marketplace industry, including eHealth (NASDAQ:EHTH) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 15 online marketplace stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 4.2%. while next quarter's revenue guidance was 2.4% above consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and online marketplace stocks have had a rough stretch, with share prices down 6.3% on average since the previous earnings results.

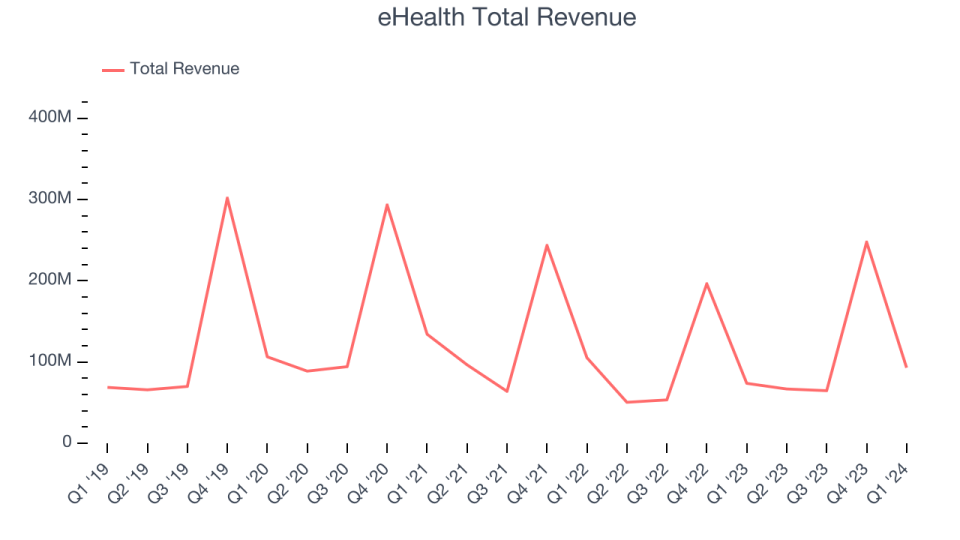

eHealth (NASDAQ:EHTH)

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

eHealth reported revenues of $92.96 million, up 26.1% year on year, exceeding analysts' expectations by 15.3%. Overall, it was an ok quarter for the company with solid revenue growth but a decline in its users.

eHealth pulled off the biggest analyst estimates beat of the whole group. The company reported 1.18 billion users, down 4.7% year on year. The stock is down 9.8% since reporting and currently trades at $4.32.

Is now the time to buy eHealth? Access our full analysis of the earnings results here, it's free.

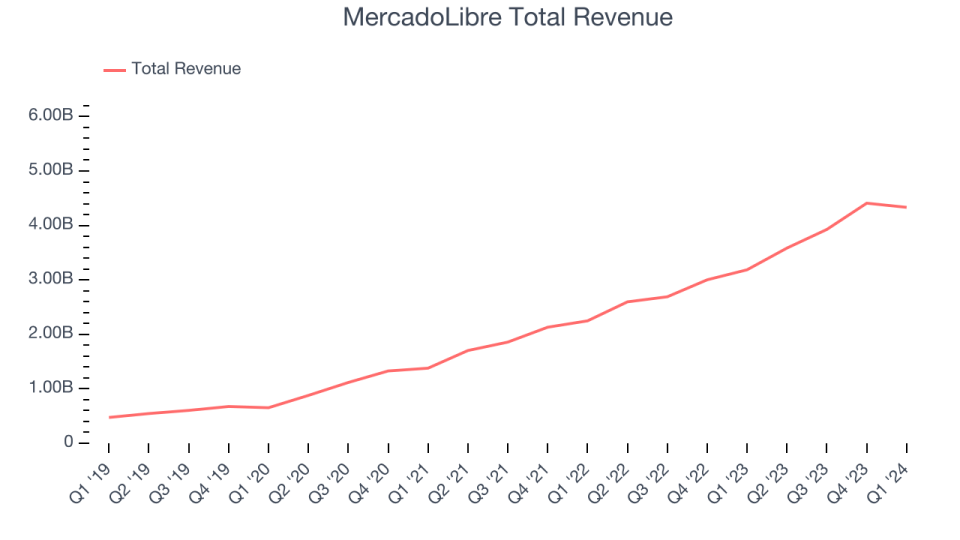

Best Q1: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $4.33 billion, up 36% year on year, outperforming analysts' expectations by 12.1%. It was a stunning quarter for the company with exceptional revenue growth.

The market seems happy with the results as the stock is up 13% since reporting. It currently trades at $1,703.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Slowest Q1: CarGurus (NASDAQ:CARG)

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ:CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

CarGurus reported revenues of $215.8 million, down 7% year on year, in line with analysts' expectations. It was a weak quarter for the company with slow revenue growth and underwhelming revenue guidance for the next quarter.

Interestingly, the stock is up 10.2% since the results and currently trades at $24.54.

Read our full analysis of CarGurus's results here.

EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $91.07 million, down 16.6% year on year, surpassing analysts' expectations by 13.4%. Looking more broadly, it was a very strong quarter for the company with optimistic revenue guidance for the next quarter.

EverQuote had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $21.46.

Read our full, actionable report on EverQuote here, it's free.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ:ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $646 million, flat year on year, in line with analysts' expectations. Looking more broadly, it was a weaker quarter for the company with slow revenue growth.

The company reported 96.39 million active buyers, up 0.9% year on year. The stock is down 18.1% since reporting and currently trades at $57.13.

Read our full, actionable report on Etsy here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.