Online safety bill ‘will fail to protect millions from cloned websites and ad scams’

The UK government’s online safety bill will “fail to protect millions” by leaving people at risk of falling victim to cloned websites and adverts paid for by fraudsters, experts warned this week.

The bill, included in Tuesday’s Queen’s speech, will “lead the way in ensuring internet safety for all”, according to the government.

Related: Online safety bill: a messy new minefield in the culture wars

However, finance experts said its focus on user-generated content, such as social media posts involving romance scams or fake investment opportunities, left a loophole for criminals.

Debbie Barton, a financial crime prevention expert at the investment firm Quilter, said the bill would have a big impact on protecting investors, particularly young people, from financial harm but there was much further to go.

“The government should now consider including fraud facilitated through advertising, emails or cloned websites,” she said.

“With each day that passes, around £214,000 is lost to UK consumers from clone firm fraud, so the government should not kick the can even further down the road and should take action with this bill.”

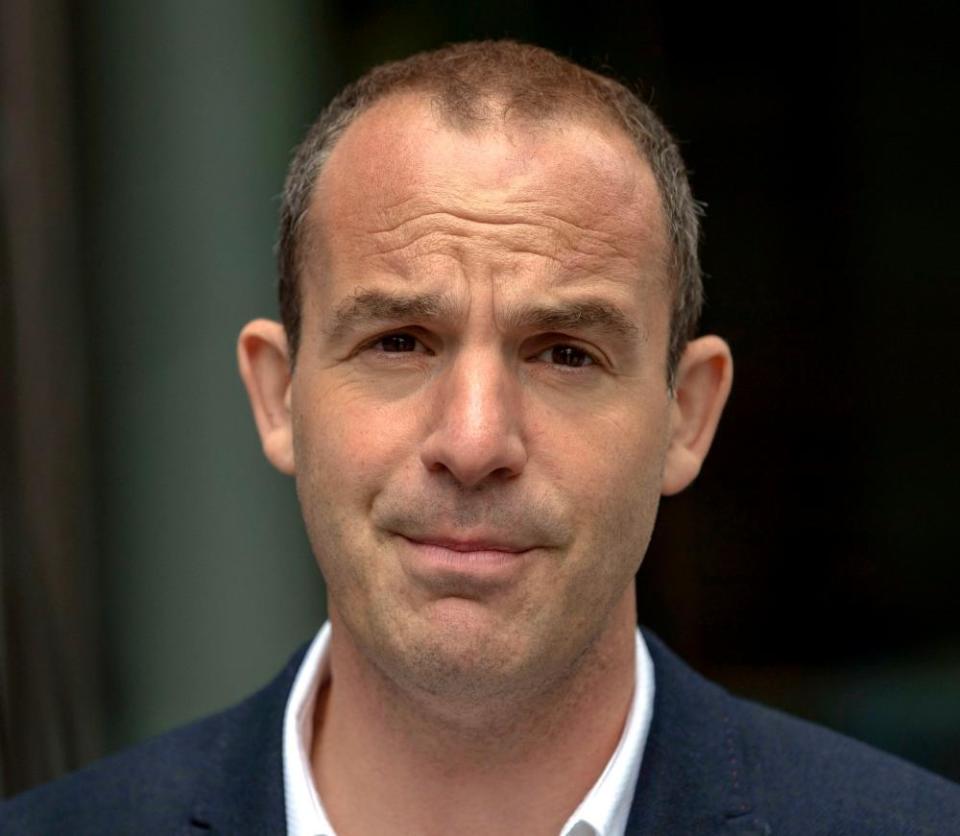

The MoneySavingExpert founder, Martin Lewis, said the government had “stumbled at the first fence”.

He said: “We live in a world where the policing of scams is dangerously underfunded, leaving criminals to get away with fraud with impunity.”

By not making tech companies responsible for the scammers’ adverts they are paid to publish, “the government has failed to protect millions, in the midst of a pandemic, from one of the most damaging online harms to their financial and mental health” he added.

The industry body for banks, UK Finance, said the bill would tackle some aspects of fraud but would not protect people from all scams that take place online.

Its chief executive, David Postings, said: “As more of us have shifted online because of the pandemic, we’ve seen a spike in money mule activity, investment and purchase scams over the last year because criminals can target people directly in their homes across online platforms.

“We encourage government to include all economic crime within the bill when it is formally introduced. Not doing so leaves a large proportion of the public at high risk of being scammed online because criminals are experts in adapting their tactics to exploit any loopholes.”

Yahoo Finance

Yahoo Finance