OPEC meeting — What you need to know for the week ahead

Last week, the S&P 500 finished almost unchanged and the Nasdaq closed just below a record high.

On Friday, news that the Trump administration would impose tariffs on the import of some Chinese goods — with China announcing swift retaliatory tariffs — sent stocks lower, but the overall market reaction was not severe.

This was in step with the market’s reaction to a week was dominated by central bank talk, with the ECB’s announcement that it would wind down asset purchases by the end of the year and the Federal Reserve’s decision to raise interest rates.

The week’s biggest political event — which was Trump’s meeting with North Korean leader Kim Jong Un in Singapore — came and went with little market reaction.

In the week ahead the economic and political calendar should be more quiet with OPEC’s latest meeting on Friday in Vienna likely to be a major mover in the commodity markets.

In a note to clients last week, analysts at Bank of America Merrill Lynch said they expect OPEC to announce a modest increase to its oil production targets. West Texas Intermediate crude oil prices, the U.S. benchmark, settled just below $65 a barrel last week while Brent crude, the international benchmark, was trading near $73.

The earnings calendar will also remain pretty sparsely populated with Oracle (ORCL), FedEx (FDX), Micron (MU), Kroger (KR), Darden Restaurants (DRI), and Red Hat (RHT) the only notable companies set to report results.

Economic calendar

Monday: Homebuilder sentiment, June (70 expected; 70 previously)

Tuesday: Housing starts, May (+2.1% expected; -3.7% previously); Building permits, May (-1% expected; -1.8% previously)

Wednesday: Existing home sales, May (+1.3% expected; -2.5% previously)

Thursday: Initial jobless claims (220,000 expected; 218,000 previously); Philly Fed manufacturing index, June (29 expected; 34.4 previously); FHFA house price index, April (+0.5% expected; +0.1% previously); Leading index of economic indicators, May (+0.4% expected; +0.4% previously)

Friday: Markit flash manufacturing PMI, June (56.3 expected; 56.4 previously)

It’s a great time to be a college graduate in America

At this time last year, we wrote that it was a great time to be a college graduate in America.

That remains true.

Perhaps even more so.

This past week, Federal Reserve Chair Jerome Powell began his press conference that followed the Fed’s latest policy decision by outlining what he called a plain English summary of how the economy is performing, what the Fed had done at its latest meeting, and what monetary policy tries to accomplish.

“The main takeaway is that the economy is doing very well,” Powell said. “Most people who want to find jobs are finding them, and unemployment and inflation are low.”

As of May, the unemployment rate was sitting at 48-year low of 3.755% (or an 18-year low of 3.8% if you round up the decimal). And the data which we pointed to last year as indicating it being a great time for new entrants to find employment has only improved.

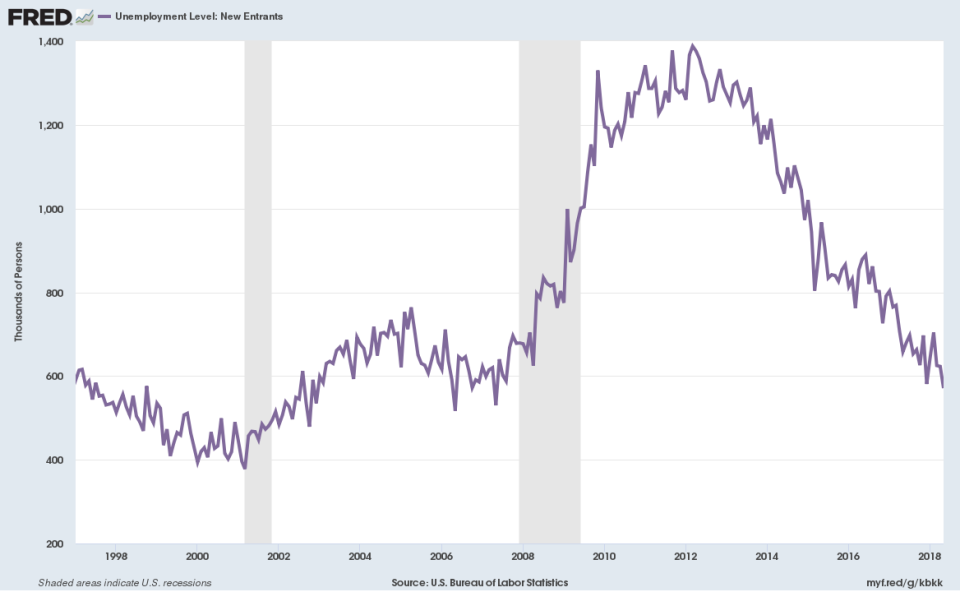

In May, the number of unemployed workers who were new entrants to the workforce (either new graduates who began looking for work or people who had previously been out of the workforce but are now looking for work) totaled 571,000, the lowest since May 2007.

The number of people going from out of the workforce to unemployed is also at the lowest since May 2001. This indicates that those who enter or re-enter the workforce are quickly finding jobs and spending less time officially unemployed.

Given that research has shown graduating into a recession (read: a stagnant labor market) has a negative impact on earnings in their first ten years of work — when workers experience about 70% of their career wage growth — this year’s graduates are getting an advantageous start to their careers.

Great news for those graduates. And their parents.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance