OPKO Health (OPK) Q4 Loss Narrower Than Estimates, Sales Up

OPKO Health, Inc. OPK incurred adjusted loss of 6 cents per share in the fourth quarter of 2019, narrower than the Zacks Consensus Estimate of a loss of 8 cents. The company had incurred a loss of 8 cents a year ago.

For 2019, loss per share was 53 cents compared with a loss of 27 cents a year ago. The figure was wider than the Zacks Consensus Estimate of a loss of 43 cents.

Fourth-quarter revenues of this Zacks Rank #3 (Hold) company totaled $224.3 million, which surpassed the Zacks Consensus Estimate by 3.5%. Also, the top line rose 1.1% on a year-over-year basis.

Revenues were $901.9 million, down 8.9%. The metric however outpaced the Zacks Consensus Estimate of $894.4 million.

Segmental Revenues in Q4

Revenues from Services grossed $177.9 million in the reported quarter, down 2.8% year over year.

Revenues from Products rose 26% to $32 million. Per management, revenues from products include $7.4-million contributions from RAYALDEE.

Revenues from Transfer of intellectual property came in at $14.4 million, up 7.5% year over year.

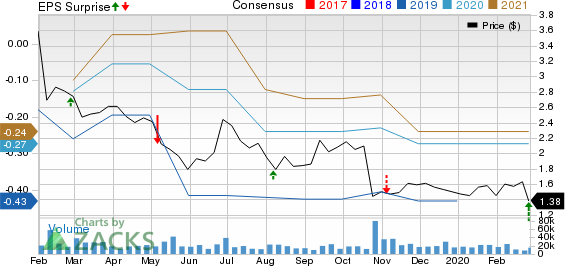

OPKO Health, Inc. Price, Consensus and EPS Surprise

OPKO Health, Inc. price-consensus-eps-surprise-chart | OPKO Health, Inc. Quote

RAYALDEE Update

Per management, total RAYALDEE prescriptions reported by IQVIA improved 89% year over year in the fourth quarter. Further, the open-label Phase 2 trial for RAYALDEE in hemodialysis patients has been progressing and the initial data is anticipated in first-quarter 2020.

Margin Analysis

Gross profit in the reported quarter came in at $82 million, up 13.4% from the prior-year quarter. Gross margin was 36.6% of net revenues, expanding 400 basis points (bps) year over year.

Selling, general and administrative expenses totaled $79.1 million, down 16.8% year over year. Research and development expenses amounted to $23 million, down 30.9% year over year.

Operating loss in the fourth quarter was $112.4 million, noticeably wider than the year-ago quarter’s loss of $76.1 million.

Guidance

OPKO Health did not issue any guidance. Nonetheless, the company estimates revenues from Services between $168 million and $173 million in the first quarter of 2020. For the full year, revenues are expected within $715-$740 million.

Revenues from Products are anticipated in the range of $30-$32 million in the first quarter. This includes revenues from RAYALDEE between $9.3 million and $10.5 million. Full-year revenues are expected between $130 million and $150 million.

Revenues from Transfer of intellectual property are projected in the range of $20-$30 million for 2020.

Summing Up

OPKO Health exited the fourth quarter on a strong note. Contribution from RAYALDEE has been significant in the quarter under review. Further, the company’s utilization of the 4Kscore remains strong.

Furthermore, OPKO Health and Pfizer announced positive top-line results from its pediatric global Phase 3 trial comparing once weekly somatrogon to once daily GENOTROPIN. Moreover, BioReference Laboratories continues to make progress toward its objective to boost earnings and revenues. Expansion in gross margin is heartening.

Meanwhile, sluggishness in revenues from Services remains a concern. OPKO Health also faces cut-throat competition in the MedTech space.

Earnings of Other MedTech Majors at a Glance

Some better-ranked companies, which reported solid results this earnings season, include Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker reported fourth-quarter 2019 adjusted earnings per share (EPS) of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company carries a Zacks Rank #2 (Buy).

Accuray reported second-quarter fiscal 2020 adjusted EPS of a penny against the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the consensus mark by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

OPKO Health, Inc. (OPK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance