Oracle (ORCL) Cloud Enhances Prada Group's Customer Experience

Oracle ORCL implemented its cloud-based retail solutions at Prada Group, a prominent luxury brand. Prada Group aims to integrate its physical and digital channels to gain deeper insights into its customers, and leverage data to provide a more personalized experience.

By deploying Oracle Retail Xstore Point-of-Service and Oracle Retail Customer Engagement Cloud Service on mobile devices, Prada Group can gather valuable information about customer preferences. This data can be analyzed to identify actionable strategies for boosting customer loyalty.

Prada Group has implemented Oracle Retail Cloud Services for Merchandise Financial Planning, Assortment and Item Planning to optimize its merchandising process. This includes improving sales and forecasts, performance analysis, and inventory management and allocation.

By leveraging this data, Prada Group aims to gain a better understanding of its operational processes, improve scenario planning and react more quickly as the market evolves.

Prada Group is set to implement Oracle Retail Demand Forecasting Cloud Service, an enterprise forecasting engine. This solution is part of the Oracle Retail Analytics and Planning suite, and built upon the Oracle Retail AI Foundation.

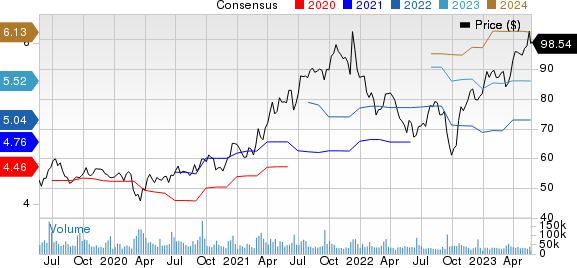

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Oracle’s Expanding Cloud Services Aid Prospects

According to a Apps Run the World report, the Retail applications market size is expected to reach $28.9 billion by 2026 compared with $27.7 billion in 2021, seeing a compound annual growth rate of 3.7%.

The report also states that Adobe ADBE is the market leader with 12.7% market share in license, maintenance and subscription revenues followed by Microsoft MSFT , Salesforce CRM and Oracle.

Customers are adopting advanced capabilities in retail systems, with the intention of replacing their outdated legacy systems. This trend of competitive upgrades and replacements is expected to have a significant influence on future changes in market share.

Oracle has broadened its cloud service offerings with the release of Oracle Retail version 16, which encompasses more than 33 retail services enabled for cloud deployment. Retailers have recognized the importance of establishing businesses that enable customers to shop at their convenience, regardless of time or location.

Oracle Gets a Boost in the Retail Software Market

Shares of Oracle have gained 20.6% year to date compared with the Zacks Computer and Technology sector’s growth of 27.4% in the same period.

This Zacks Rank #4 (Sell) company is growing in the retail software market with notable partnerships with Bed Bath & Beyond, Office Depot, Prada and others.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Oracle expects total cloud growth for the fourth quarter, excluding Cerner, to be above 30% in cc. The company expects growth in operating profit to be double digit. Non-GAAP EPS is expected to grow between 3% and 5%, and between $1.59 and $1.63 in cc.

The Zacks Consensus Estimate for ORCL’s fourth-quarter fiscal 2023 earnings is pegged at a profit of $1.58 per share, indicating year-over-year growth of 2.60%. The Zacks Consensus Estimate for revenues is pegged at $49.86 billion, indicating year-over-year growth of 17.47%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance