Oracle's 20% Returns Could Continue Despite Balance Sheet Risks

In the last 10 years, Oracle Corp. (NYSE:ORCL) has experienced an annual average price return of around 19%, with a median dividend yield of 1.43%. That puts the total investment return at around 20% as an annual average over that period. I expect these returns are quite likely to continue, especially considering favorable future revenue estimates. The largest fundamental risk for the company seems to be its balance sheet.

2024 operations updates

On Jan. 16, Oracle released its first quarterly Critical Patch Update, or CPU, of the year. It addressed an important set of vulnerabilities across its product families. Around 389 new security patches are included, which target 191 common vulnerabilities and exposures, or CVEs. Thirty-seven of the patches are considered critical, focusing on fixing severe security risks.

The company's Financial Services Applications received 71 new security patches. Oracle Communications received 55 patches and Oracle Fusion Middleware received 40 patches. The CPU also addresses potential security weaknesses in MySQL, Java SE and the E-Business Suite.

These updates are crucial at a time when advanced technology companies like Oracle are expanding and adapting toward artificial intelligence and facing a range of threats from criminal organizations that are also utilizing such technologies. The updates should maintain the company's market position and keep clients' trust after a difficult period of heightened cybercrime. By 2025, worldwide cybercrime costs are estimated to reach a staggering $10.5 trillion annually, according to Cybersecurity Ventures.

The company's investments in advanced technology seem to be paying off, driving revenue growth and positioning it well in the cloud services industry. For the first quarter of fiscal 2024, Oracle reported a year-over-year total revenue increase of 9%. In the second quarter, it reported a year-over-year total revenue increase of 5%. The growth in the second quarter was largely driven by a 25% surge in cloud revenue, both IaaS and SaaS. The company has also been aggressively expanding into cloud data centers. Chief Technology Officer Larry Ellison has noted that this reflects Oracle's commitment to high demand for cloud services.

Financial analysis

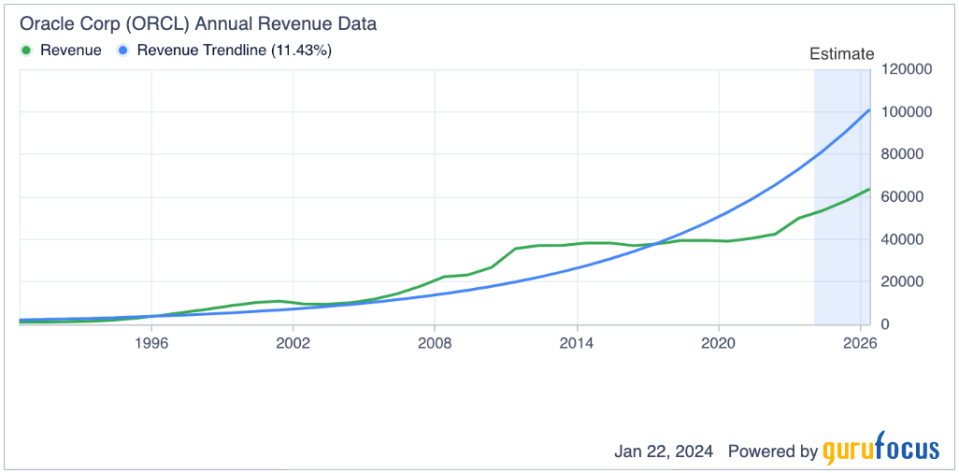

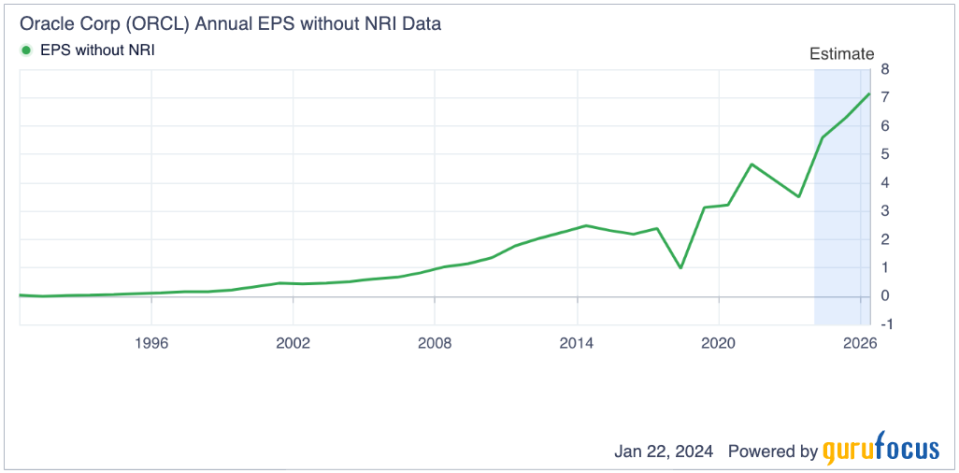

Oracle has particularly strong earnings growth as opposed to revenue growth historically. The chart below shows around a decade of plateaued revenue growth, which has now begun to increase. The second chart shows reliable earnings per share without non-recurring items growth over the last decade, albeit with periods of volatility.

Because the company has focused on high-margin products, including databases and enterprise software, this can support earnings growth even when revenue increases are lacking. Oracle's continued shift toward cloud computing services is expected to contribute to revenue growth in the future. The recurring revenue model associated with cloud services leads to steady and predictable revenue streams that could contribute to maintaining around 20% annual total investment returns for shareholders over the next decade.

Oracle has a high net margin compared to its industry peers. At 19.64%, the major competitors that beat it on this metric are Adobe (NASDAQ:ADBE) at 27.97%, Synopsys (NASDAQ:SNPS) at 21.05% and Fortinet (NASDAQ:FTNT) at 22.25%. However, this should not undermine the company's strength in this area, as its net margin is ranked better than 90.93% of companies in the software industry, according to GuruFocus.

To help drive net margin growth, the company has been focusing on artificial intelligence, specifically through its Oracle Cloud Infrastructure, or OCI. Nvidia (NASDAQ:NVDA) and other leaders in the field have endorsed OCI's GPU clusters for AI infrastructure, reflecting strength in the area. In addition, Oracle is forming partnerships to focus on private and secure AI cloud services, which should further drive top-line growth and, more significantly, make it more efficient, creating further opportunities for net margin expansion.

Oracle has a strong record of repurchasing stock, doing so every single year on record since 2008. While its repurchasing rates have varied from under $1 billion in 2010 to $36.64 billion in 2019, the continuous effect of such financial management is highly beneficial for shareholders who are interested in price returns from the stock as opposed to dividends.

Valuation

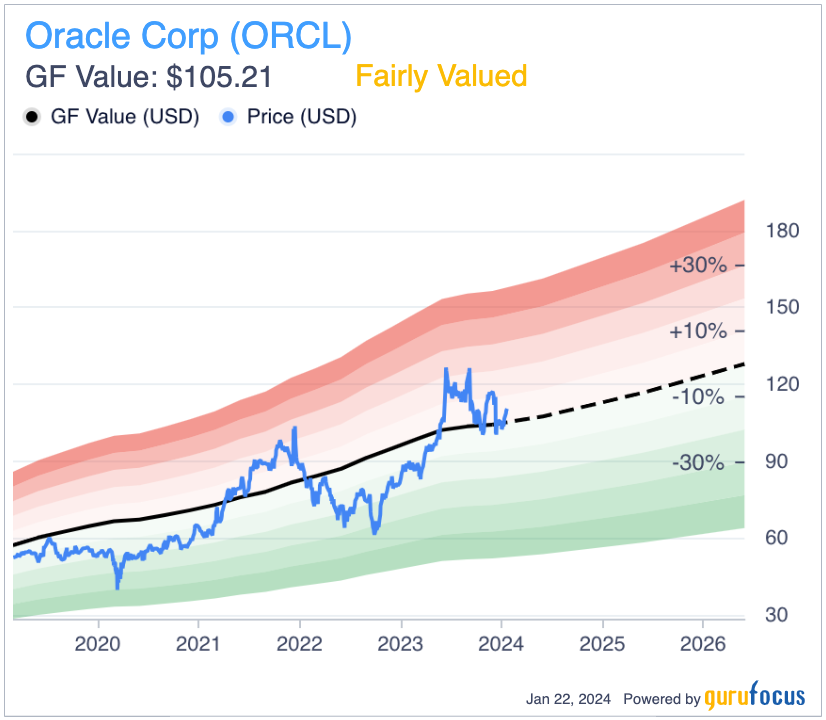

Oracle does seem highly valued at the moment. Even with the GF Value line showing it to be fairly valued, I think the stock's valuation is a risk that investors need to consider.

It has a price-earnings ratio of around 30.50 and a forward price-earnings ratio of around 20, which is more or less average for the industry it is in. However, if there is any slowdown in growth due to regulatory pressures surrounding its cloud infrastructure and AI services, the stock could see unwarranted volatility. This is true insofar as these regulatory risks are not already priced in. My perspective is they are not fully accounted for, leading to a potential slight overvaluation in the stock at present.

To get some perspective on the company's price-earnings ratio relative to its major industry peers, Adobe has a forward ratio of around 34, Synopsys of around 37 and Fortinet of around 37.

Balance sheet and competitive risks

Oracle's balance sheet is one of the largest risks for the stock as its total liabilities have risen from 43.71% of assets in 2012 to 96.74% in the last trailing 12 months. Around 61.39% of assets are balanced by long-term debt right now, and the company issues debt on a regular basis, with only two years of no issuance since 2015. However, its cash flow from financing is usually negative due to the regular repurchase of common stock. I think this shows a financial management team far more focused on growth than the balance sheet; my only concern with this strategy is that too far an overextension could result in more moderate growth long term as a matter of equilibrium. The company might find itself needing to divert its resources to servicing debt, leaving less available for growth strategies and shareholder returns. During a severe economic crisis, the company's current level of debt would make it less agile to deal with the challenges.

The company is also going to face significant competition in cloud infrastructure, including Amazon (NASDAQ:AMZN) Web Services, Microsoft (NASDAQ:MSFT) Azure and Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Compute Engine. These companies have IaaS offerings and cloud solutions like private servers, bare metal servers and cloud-based object storage services. AWS is known for its extensive range of options, like EC2 and CloudFormation, providing security and tailorable compute capacity and resource management. Microsoft Azure has a global network of data centers and strong scaling capacity, while Google Compute Engine has notable security benefits and elastic load balancing.

The competition in these areas is fierce, and whether Oracle will be a dominant player is yet to be seen in many respects. It remains positioned for continued growth, but like all of the major organizations working in artificial intelligence and cloud solutions, specific niches are integral to maintaining market share.

Conclusion

Overall, Oracle is a buy for me. Whether the company's annual stock returns will average at around 20% over the next decade is speculative, but the company is positioned operationally to have strong performance ahead. However, the balance sheet and competition risks, in particular, make me skeptical about allocating a large amount to the investment. I feel less confident investing in Oracle than I do in Microsoft and Google, yet the stock remains on my watchlist for when I next allocate to the technology section of my portfolio.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance