Can Orex Minerals (CVE:REX) Afford To Invest In Growth?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Orex Minerals (CVE:REX) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Orex Minerals

Does Orex Minerals Have A Long Cash Runway?

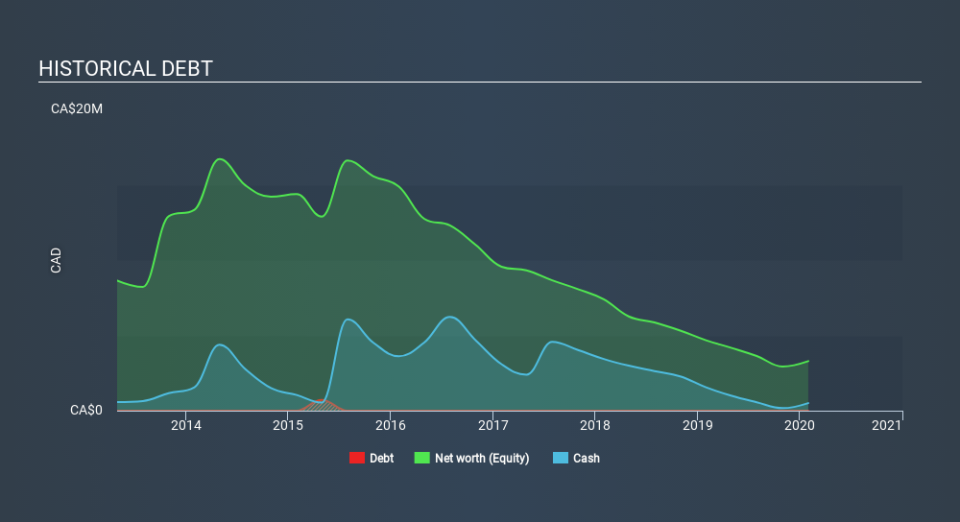

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In January 2020, Orex Minerals had CA$505k in cash, and was debt-free. Importantly, its cash burn was CA$1.8m over the trailing twelve months. Therefore, from January 2020 it had roughly 3 months of cash runway. That's a very short cash runway which indicates an imminent need to douse the cash burn or find more funding. You can see how its cash balance has changed over time in the image below.

How Is Orex Minerals's Cash Burn Changing Over Time?

Because Orex Minerals isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. It's possible that the 12% reduction in cash burn over the last year is evidence of management tightening their belts as cash reserves deplete. Admittedly, we're a bit cautious of Orex Minerals due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Orex Minerals Raise More Cash Easily?

While Orex Minerals is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Orex Minerals has a market capitalisation of CA$9.8m and burnt through CA$1.8m last year, which is 18% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Orex Minerals's Cash Burn A Worry?

On this analysis of Orex Minerals's cash burn, we think its cash burn reduction was reassuring, while its cash runway has us a bit worried. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. Taking a deeper dive, we've spotted 5 warning signs for Orex Minerals you should be aware of, and 3 of them are a bit concerning.

Of course Orex Minerals may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance