Organic Growth Aids Avis Budget (CAR), Low Liquidity Prevails

Avis Budget Group, Inc. CAR caters to a wide range of mobility needs and is growing its addressable market through organic growth and strategic acquisitions. It offers customers a variety of options through distinct brands that focus on different market segments. However, even with a strong product range, the company is tolled with seasonality in the business.

Avis Budget reported impressive first-quarter 2023 results wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings of $7.72 per share beat the consensus mark but plunged 22.7% year over year. Total revenues of $2.56 billion surpassed the consensus estimate by 2.2% and improved 5.1% year over year. The top line was backed by strong demand and pricing.

Current Situation of CAR

Avis Budget caters to different market segments and complements other brands in respective regional markets. Avis targets corporate and upscale leisure travelers, Budget caters to value-conscious travelers and Zipcar offers an alternative to car ownership. The company’s continued efforts to enhance technology and improve offerings to simplify online interaction and make the platform user-friendly are adding to its organic growth.

Acquisitions have helped enhance the global presence of Avis Budget and improve its range of offerings. The acquisition of multiple licenses and entering into new partnerships over the years are helping the company increase its global footprint.

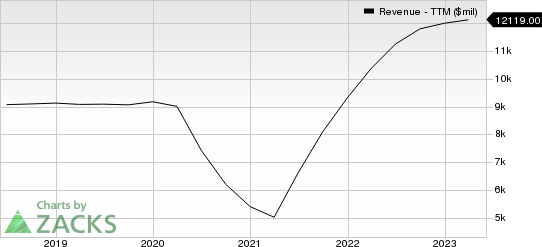

Avis Budget Group, Inc. Revenue (TTM)

Avis Budget Group, Inc. revenue-ttm | Avis Budget Group, Inc. Quote

The company has been rewarding its shareholders through share repurchases. In 2022, 2021 and 2020, the company bought back shares worth $3.33 billion, $1.46 billion and $119 million, respectively.

Some Concerning Points

Avis Budget's current ratio at the end of first-quarter 2023 was pegged at 0.72, lower than the current ratio of 0.73 reported at the end of fourth-quarter 2022. It indicates that the company may have problems meeting its short-term debt obligations.

Customer demand remains comparatively low in the fall and winter seasons and is high during the spring and summer vacation periods in most countries where Avis Budget operates. This forces the company to face seasonality in its rental business.

CAR’s shares have declined 3.6% in the past year, compared with the industry’s 8.7% decline.

Zacks Rank and Stocks to Consider

CAR currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 56.8% plunge to 32 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.1% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%. MMS has a VGM score of A along with a Zacks Rank #2 (Buy).

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.8% year over year to $805.2 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance