Oriental Weavers Carpets Company (S.A.E) Leads Three Key Dividend Stocks

As global markets navigate through a period of mixed signals with technology stocks gaining on AI enthusiasm and unexpected inflation data, investors are closely monitoring the economic landscape for stable investment opportunities. In this context, dividend stocks like Oriental Weavers Carpets Company (S.A.E) offer potential for steady income amidst market fluctuations, aligning well with current economic conditions where reliability is particularly valued.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.45% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.58% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.63% | ★★★★★★ |

Globeride (TSE:7990) | 3.75% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 5.01% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.48% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.16% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.55% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

Click here to see the full list of 1977 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Oriental Weavers Carpets Company (S.A.E)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oriental Weavers Carpets Company (S.A.E) is a global manufacturer and seller of carpets, rugs, and related raw materials, with a market capitalization of approximately EGP 14.75 billion.

Operations: Oriental Weavers Carpets Company (S.A.E) generates its revenues primarily from the manufacture and sale of carpets and rugs across various global markets.

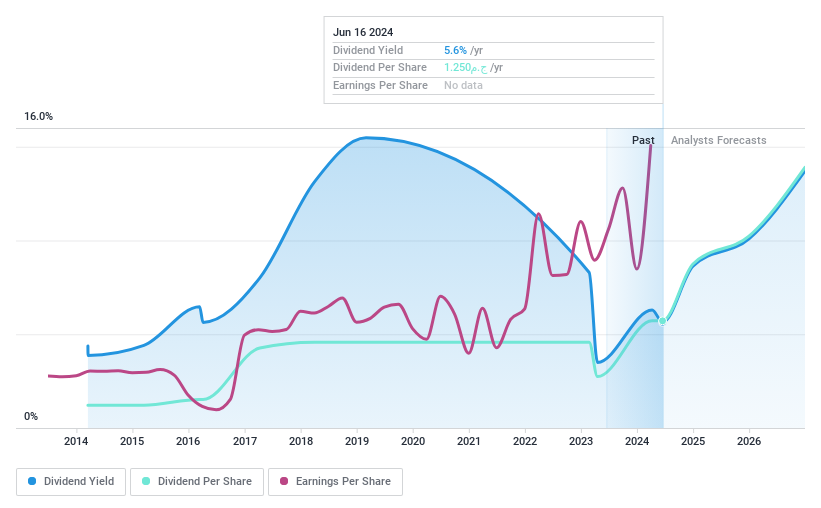

Dividend Yield: 5.6%

Oriental Weavers Carpets Company reported a solid performance in Q1 2024 with sales rising to EGP 5.04 billion from EGP 4.14 billion year-over-year and net income increasing to EGP 427.42 million. The company declared a cash dividend of EGP 1.25, reflecting a stable but modest yield of 5.64%. Despite this yield being lower than the top quartile of Egyptian market dividends, the payout is well-supported by both earnings and cash flows, with payout ratios at 44.2% and 29.9%, respectively, ensuring sustainability and reliability in its dividend distributions over the past decade.

PC Partner Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics, with a market capitalization of approximately HK$1.35 billion.

Operations: PC Partner Group Limited generates revenue primarily through the design, manufacturing, and trading of electronics and PC parts and accessories, amounting to HK$9.17 billion.

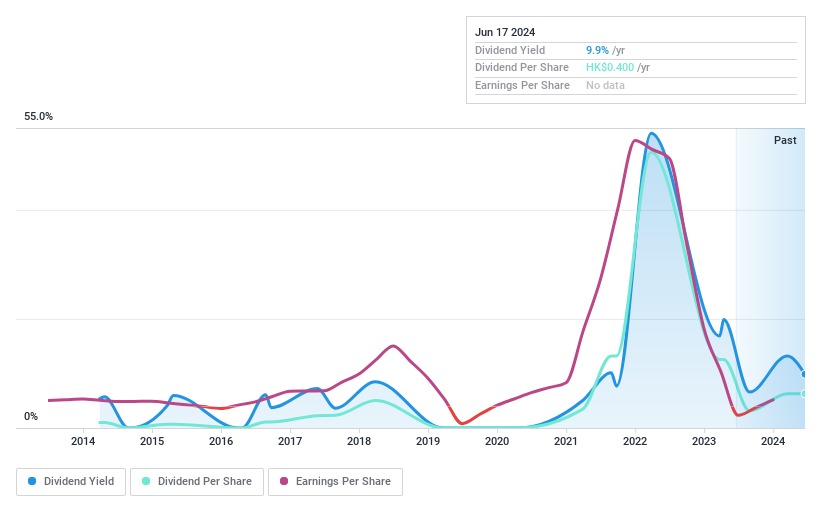

Dividend Yield: 9.9%

PC Partner Group offers a high dividend yield of 9.85%, ranking in the top 25% in the Hong Kong market. However, its dividend sustainability is questionable with a payout ratio of 191.2%, indicating dividends are not well covered by earnings. Additionally, the company's dividends have shown volatility over the past decade, lacking consistency in growth and stability. Despite trading at a significant discount to estimated fair value and having dividends backed by cash flows (cash payout ratio at 4.4%), its profit margins have declined from last year, posing risks to future dividend reliability.

Get an in-depth perspective on PC Partner Group's performance by reading our dividend report here.

Our valuation report here indicates PC Partner Group may be undervalued.

King Yuan Electronics

Simply Wall St Dividend Rating: ★★★★★☆

Overview: King Yuan Electronics Co., Ltd. is a Taiwan-based company that specializes in the design, manufacture, sale, testing, and assembly of integrated circuits across Taiwan, Asia, North America, and other international markets with a market capitalization of approximately NT$117.26 billion.

Operations: King Yuan Electronics Co., Ltd. generates NT$33.48 billion from its contract electronics manufacturing services.

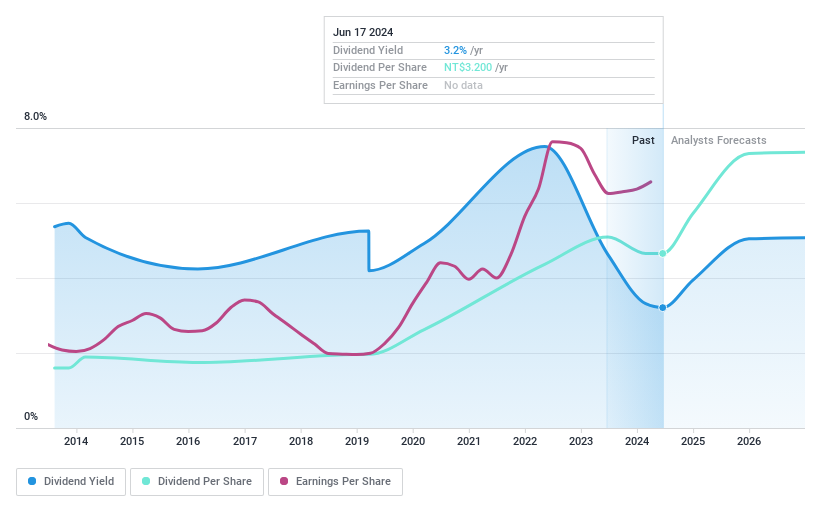

Dividend Yield: 3.2%

King Yuan Electronics has shown a consistent increase in dividends over the past decade, with a current yield of 3.21%. Despite being lower than the top dividend payers in Taiwan, its dividends are well-supported by both earnings and cash flows, with payout ratios of 65% and 59.2% respectively. The company's price-to-earnings ratio stands at 20.3x, below the market average of 23x, indicating relative value. Recent corporate actions include amendments to its Articles of Incorporation and leadership changes at its AGM on May 31, 2024.

Taking Advantage

Unlock our comprehensive list of 1977 Top Dividend Stocks by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CASE:ORWE SEHK:1263 and TWSE:2449.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance