Otis Worldwide Corp (OTIS) Q1 Earnings: Solid Service Growth and Margin Expansion

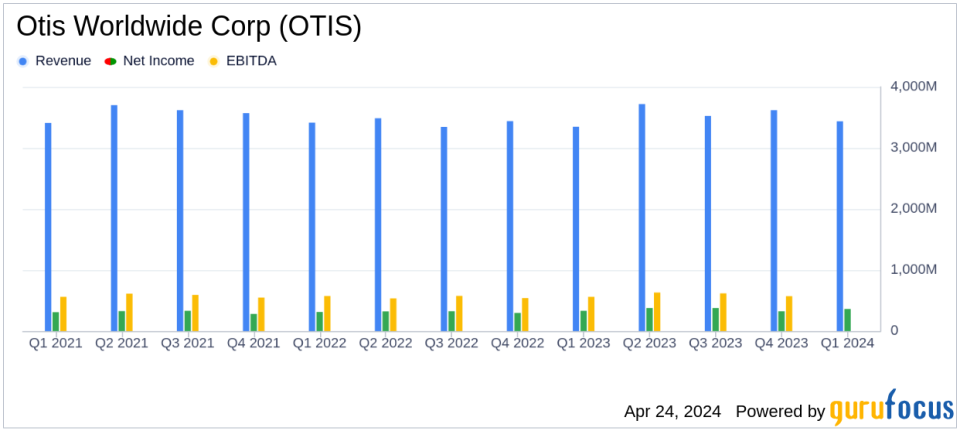

Net Sales: Reported at $3.4 billion, marking a 2.7% increase year-over-year, slightly below the estimated $3.455 billion.

Net Income: Reached $353 million, up 6.6% from the previous year, falling short of the estimated $358.46 million.

Earnings Per Share (EPS): GAAP EPS rose to $0.86, up 8.9% year-over-year, just below the estimate of $0.87; Adjusted EPS was $0.88, surpassing the estimate.

Operating Profit Margin: GAAP operating profit margin expanded by 50 basis points to 15.8%, and adjusted operating profit margin increased by 80 basis points to 16.3%.

Service Segment Growth: Service net sales increased by 5.8%, with organic sales growth of 6.5%, driven by strong performance in maintenance and modernization.

Cash Flow: GAAP cash flow from operations was $171 million, a decrease from the previous year, with adjusted free cash flow also down to $155 million.

Full-Year Outlook: Adjusted EPS forecast raised to $3.83 to $3.90, with a target for share repurchases set at $1 billion.

On April 24, 2024, Otis Worldwide Corp (NYSE:OTIS) disclosed its first-quarter results for 2024 through its 8-K filing, revealing a mixed performance with strong service sector growth and a slight downturn in new equipment orders. The company, a global leader in elevator and escalator manufacturing and services, reported a net sales increase of 2.7% to $3.4 billion, closely aligning with analyst expectations of $3.455 billion.

Company Overview

Otis Worldwide Corp, established in 1854 by Elisha Graves Otis, revolutionized safety in elevator design and remains the largest global elevator and escalator supplier by revenue. The company boasts a significant market share of approximately 18% globally. Otis operates a comprehensive business model that spans the installation, maintenance, and eventual replacement of elevator units, managing an extensive service portfolio of over 2 million units worldwide.

Financial Performance Insights

The first quarter saw Otis achieve a GAAP earnings per share (EPS) of $0.86, an 8.9% increase year-over-year, and an adjusted EPS of $0.88, up by 10.0%. These figures are in line with the analyst EPS estimate of $0.87 for the quarter. The adjusted operating profit margin expanded by 80 basis points to 16.3%, driven by favorable segment performance and a robust service mix.

Despite the positive growth in service net sales, which saw a 5.8% increase and organic sales growth of 6.5%, the company faced challenges in the new equipment sector. New equipment orders decreased by 10% and the backlog was down by 2%, although it remained flat at constant currency. This contrasted with a 13% increase in modernization orders and a 14% increase in backlog, highlighting a shift towards modernization services.

Operational and Strategic Developments

Otis' operational strategy continues to emphasize service excellence and modernization, with the maintenance portfolio units growing by 4.1%. The company's CEO, Judy Marks, noted the strength of the service-driven business model and the successful margin expansion both year over year and quarter over quarter. The updated full-year outlook anticipates an adjusted EPS range of $3.83 to $3.90, reflecting confidence in continued operational performance and an increased share repurchase target of $1 billion.

Cash Flow and Capital Allocation

The company reported a GAAP cash flow from operations of $171 million, a decrease from the previous year, primarily due to changes in working capital. However, Otis remains committed to rewarding shareholders, evidenced by a 14.7% increase in the quarterly dividend and substantial share repurchases totaling $300 million during the quarter.

Looking Ahead

While Otis faces some headwinds in new equipment sales, particularly influenced by market conditions in China and the Americas, the company's strong service segment and focus on modernization are expected to continue driving growth. The revised full-year guidance and strategic focus on shareholder returns underscore management's confidence in the company's long-term strategy amid evolving market dynamics.

For detailed financial figures and further information, readers are encouraged to refer to the full earnings filing.

Explore the complete 8-K earnings release (here) from Otis Worldwide Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance