OUTFRONT Media (OUT) Sells its Canadian Business to Bell Media

OUTFRONT Media OUT announced the sale of its Canadian business to Bell Media, a wholly-owned subsidiary of BCE Inc. Subject to certain adjustments, the cash purchase price stands at C$410 million.

The sale of OUTFRONT Media's Canadian business highlights the solid demand for out-of-home assets. This strategic move will allow OUTFRONT Media to lower its financial leverage and focus solely on managing its fully domestic business within the United States. OUTFRONT Media had previously entered into an agreement to divest its Canadian business to Bell Media in October 2023.

Apart from strategic disposition, OUTFRONT Media has capitalized on acquisitions to enhance its portfolio. In the first quarter of 2024, the company acquired several assets for nearly $6 million. In 2023, the company acquired several assets for around $33.7 million. With such expansion efforts, it remains poised to grow over the long term.

OUTFRONT Media enjoys a well-diversified portfolio of advertising sites, both geography- and industry-wise, in some of the key markets of the United States. Its efforts to expand the out-of-home advertising platform bode well for long-term growth.

Strategic investments in the digital billboard portfolio and ongoing efforts to convert its business from traditional static billboard advertising to digital displays support its digital revenue growth. Efforts to lower leverage and focus on domestic assets also augur well.

However, elevated operating expenses and high interest rates will likely weigh on its bottom-line growth in the near term. Competition from several advertising channels may hurt the company's pricing power.

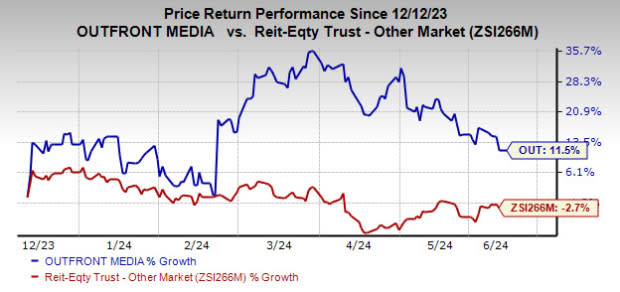

Over the past six months, shares of this Zacks Rank #3 (Hold) company have gained 11.5% against the industry's decline of 2.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Lamar Advertising LAMR and Rexford Industrial Realty REXR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for LAMR’s 2024 funds from operation (FFO) per share has moved 3.7% northward over the past two months to $8.03.

The Zacks Consensus Estimate for REXR’s current-year FFO per share has been raised marginally over the past two months to $2.34.

Note: Anything related to earnings presented in this write-up represents FFO, a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

Rexford Industrial Realty, Inc. (REXR) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance