Outlook on the Aseptic Processing Global Market to 2030 - Technological Growth is Likely to Boost the Market

Aseptic Processing Market

Dublin, June 17, 2022 (GLOBE NEWSWIRE) -- The "Aseptic Processing Market by Packaging, Material, and End User: Global Opportunity Analysis and Industry Forecast, 2021-2030" report has been added to ResearchAndMarkets.com's offering.

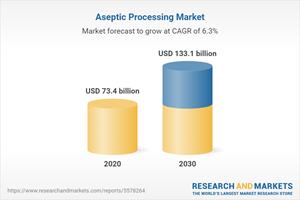

The aseptic processing market was valued at $73.4 billion in 2020, and is expected to reach $133.1 billion by 2030, registering a CAGR of 6.3% from 2021 to 2030. Aseptic processing is a process in which a pharmaceuticals, cosmetics, beverages and food product, such as ultra-high temperature (UHT) milk, complex liquid drug and its package both are sterilized or disinfected discretely and then fused and sealed under sterilized atmospheric conditions.

Aseptic processing involves utilization of plastic, glass, paperboard, or metal for packaging. These materials are extensively used to form cans, containers, cartons, and other aseptic packages. Plastic is among one of the highly used materials for aseptic processing due to its innovative visual appeal and various usage. Aseptic processing offers unique benefits, which include increased shelf life, eco-friendliness, maintains quality of contents, and no preservatives, which acts as a boon for the global aseptic processing market.

The market is majorly driven by the increased growth in the pharmaceutical industry majorly in emerging markets such as China and India. In addition, the pandemic has created an enormous demand for serialized packaging all around the world. Therefore, the production of the COVID-19-vaccine at a massive scale in numerous nations across the globe has considerably impacted the market scenario. In addition, key players in the major countries such as Serum Institute of India, Pfizer are among other several pharmaceutical & biotechnology manufacturing companies which are consistently undertaking R&D and are developing vaccines with greater efficiency against the novel corona coronavirus, which is therefore leading to high rise in demand for aseptic processing in the countries.

Furthermore, the government of various countries has aimed to vaccinate majority of their residents by the end of 2021. Therefore, the rapidly growing pharmaceutical industry around the globe is leading to rise in demand for aseptic processing. Moreover, the rise in intricacy of drugs and the surge in number of patients suffering with diseases such as diabetes, leads to rise in demand for vials and ampoules. According to the World Health Organization (WHO), approximately more than 422 million of patients are suffering from diabetes globally. Therefore, rise in health issues majorly in the highly populated countries leads to rise in demand for hygienic processing, which drives the market growth in the process.

Surge in global consumption of food & beverages fuels demand for aseptic processing, which propels the aseptic processing market. Moreover, developing packaging recycling rates worldwide fuels the aseptic processing market growth. In addition, aseptic processing is widely used in the beverages industry due to its cost-effectiveness, eco-friendliness, and recyclability nature. However, one of the significant restraints for the global aseptic processing market is uncertain prices of raw materials such as metals and plastics. On the contrary, rise in e-commerce sales offers lucrative growth opportunities for the global aseptic processing market. The global aseptic processing market is segmented on the basis of material, packaging type, end-user, and region. By material, the market is categorized into glass, metal, plastic, and paper & paperboard.

The plastic segment is anticipated to hold majority of the market share in 2020. According to the packaging type, the market is categorized into carton, bags & pouches, and bottles & cans, vials & ampoules, pre-filled syringes and others. The vials & ampoules segment is projected to dominate the global aseptic processing market throughout the forecast period.

Competition Analysis

The major players profiled in the Aseptic processing market include Robert Bosch GmbH, Du Pont De Nemours and Company, Tetra Laval International S.A, SPX FLOW, Inc., IMA S.p.A, Becton, Dickinson and Co, Amcor Limited, GEA Group, Greatview Aseptic Packaging Co., Ltd, JBT Corporation, Sealed Air Corporation, Sig, Combibloc Group AG, Schott AG. Major companies in the market have adopted strategies such as business expansion, partnership, acquisition, and product launch to offer better products and services to customers in the aseptic processing market.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging aseptic processing market trends and dynamics

In-depth aseptic processing market analysis is conducted by estimations for the key segments between 2021 and 2030

Extensive analysis of the market is conducted by following key product positioning and monitoring of top competitors within the market framework

A comprehensive analysis of four major regions is provided to determine the prevailing opportunities

The market forecast analysis from 2021 to 2030 is included in the report

The key market players operating in the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industry

Key Topics Covered:

Chapter 1: Introduction

Chapter 2: Executive Summary

Chapter 3: Market Overview

3.1. Market Definition and Scope

3.2. Key Findings

3.2.1. Top Investment Pockets

3.3. Porter's Five Forces Analysis

3.4. Market Dynamics

3.4.1. Drivers

3.4.1.1. Increase in Government Expenditure on Healthcare

3.4.1.2. Improved Recycling Rates for Packaging

3.4.1.3. Low Cost of Plastics

3.4.1.4. Surge in Adoption of Automation in the Production of Aseptic Processing

3.4.1.5. Many Complex Drug Products Are Not Amenable to Terminal Sterilization, Leading to Increased Demand for Aseptic Processing

3.4.2. Restraint

3.4.2.1. Uncertain Prices of Raw Materials

3.4.2.2. Large Investment Required to Bring An Aseptic System on Line

3.4.3. Opportunities

3.4.3.1. Rise in E-Commerce Sales Globally

3.4.3.2. Growth Opportunities in the Emerging Markets

3.4.3.3. Technological Growth is Likely to Boost the Market

3.5. Covid-19 Impact Analysis

Chapter 4: Aseptic Processing Market, by Type

4.1. Market Overview

4.1.1. Market Size and Forecast, by Type

4.2. Carton

4.2.1. Key Market Trends, Growth Factors, and Opportunities

4.2.2. Market Size and Forecast, by Region

4.2.3. Market Analysis, by Country

4.3. Bags & Pouches

4.3.1. Key Market Trends, Growth Factors, and Opportunities

4.3.2. Market Size and Forecast, by Region

4.3.3. Market Analysis, by Country

4.4. Bottles & Cans

4.4.1. Key Market Trends, Growth Factors, and Opportunities

4.4.2. Market Size and Forecast, by Region

4.4.3. Market Analysis, by Country

4.5. Vials & Ampoules

4.5.1. Key Market Trends, Growth Factors, and Opportunities

4.5.2. Market Size and Forecast, by Region

4.5.3. Market Analysis, by Country

4.6. Pre-Filled Syringes

4.6.1. Key Market Trends, Growth Factors, and Opportunities

4.6.2. Market Size and Forecast, by Region

4.6.3. Market Analysis, by Country

4.7. Others

4.7.1. Key Market Trends, Growth Factors, and Opportunities

4.7.2. Market Size and Forecast, by Region

4.7.3. Market Analysis, by Country

Chapter 5: Aseptic Processing Market, by Material

5.1. Market Overview

5.1.1. Market Size and Forecast, by Material

5.2. Paper & Paperboard

5.2.1. Key Market Trends, Growth Factors, and Opportunities

5.2.2. Market Size and Forecast, by Region

5.2.3. Market Analysis, by Country

5.3. Plastics

5.3.1. Key Market Trends, Growth Factors, and Opportunities

5.3.2. Market Size and Forecast, by Region

5.3.3. Market Analysis, by Country

5.4. Metal

5.4.1. Key Market Trends, Growth Factors, and Opportunities

5.4.2. Market Size and Forecast, by Region

5.4.3. Market Analysis, by Country

5.5. Glass

5.5.1. Key Market Trends, Growth Factors, and Opportunities

5.5.2. Market Size and Forecast, by Region

5.5.3. Market Analysis, by Country

Chapter 6: Aseptic Processing Market, by End-user

6.1. Market Overview

6.1.1. Market Size and Forecast, by End-user

6.2. Food

6.2.1. Key Market Trends, Growth Factors, and Opportunities

6.2.2. Market Size and Forecast, by Region

6.2.3. Market Analysis, by Country

6.3. Beverages

6.3.1. Key Market Trends, Growth Factors, and Opportunities

6.3.2. Market Size and Forecast, by Region

6.3.3. Market Analysis, by Country

6.4. Pharmaceuticals

6.4.1. Key Market Trends, Growth Factors, and Opportunities

6.4.2. Market Size and Forecast, by Region

6.4.3. Market Analysis, by Country

6.5. Cosmetics

6.5.1. Key Market Trends, Growth Factors, and Opportunities

6.5.2. Market Size and Forecast, by Region

6.5.3. Market Analysis, by Country

Chapter 7: Aseptic Processing Market, by Region

Chapter 8: Competition Landscape

8.1. Top Winning Strategies

8.2. Product Mapping

8.3. Competitive Dashboard

8.4. Competitive Heat Map

8.5. Key Developments

8.5.1. Business Expansion

8.5.2. Product Launch

Chapter 9: Company Profiles

9.1. Amcor Limited

9.1.1. Company Overview

9.1.2. Key Executives

9.1.3. Company Snapshot

9.1.4. Operating Business Segments

9.1.5. Product Portfolio

9.1.6. R&D Expenditure

9.1.7. Business Performance

9.1.8. Key Strategic Moves and Developments

9.2. Dickinson and Co

9.2.1. Company Overview

9.2.2. Key Executives

9.2.3. Company Snapshot

9.2.4. Operating Business Segments

9.2.5. Product Portfolio

9.2.6. R&D Expenditure

9.2.7. Business Performance

9.2.8. Key Strategic Moves and Developments

9.3. Dupont De Nemours, Inc.

9.3.1. Company Overview

9.3.2. Key Executives

9.3.3. Company Snapshot

9.3.4. Operating Business Segments

9.3.5. Product Portfolio

9.3.6. R&D Expenditure

9.3.7. Business Performance

9.4. Gea Group

9.4.1. Company Overview

9.4.2. Key Executives

9.4.3. Company Snapshot

9.4.4. Operating Business Segments

9.4.5. Product Portfolio

9.4.6. R&D Expenditure

9.4.7. Business Performance

9.5. Greatview Aseptic Packaging Co. Ltd

9.5.1. Company Overview

9.5.2. Key Executives

9.5.3. Company Snapshot

9.5.4. Operating Business Segments

9.5.5. Product Portfolio

9.5.6. Business Performance

9.6. Ima Group

9.6.1. Company Overview

9.6.2. Key Executives

9.6.3. Company Snapshot

9.6.4. Product Portfolio

9.7. Jbt Corporation

9.7.1. Company Overview

9.7.2. Key Executives

9.7.3. Company Snapshot

9.7.4. Operating Business Segments

9.7.5. Product Portfolio

9.7.6. Business Performance

9.8. Robert Bosch GmbH

9.8.1. Company Overview

9.8.2. Key Executives

9.8.3. Company Snapshot

9.8.4. Operating Business Segments

9.8.5. Product Portfolio

9.8.6. R&D Expenditure

9.8.7. Business Performance

9.9. Schott AG

9.9.1. Company Overview

9.9.2. Key Executives

9.9.3. Company Snapshot

9.9.4. Operating Business Segments

9.9.5. Product Portfolio

9.9.6. R&D Expenditure

9.9.7. Business Performance

9.10. Sealed Air Corporation

9.10.1. Company Overview

9.10.2. Key Executives

9.10.3. Company Snapshot

9.10.4. Operating Business Segments

9.10.5. Product Portfolio

9.10.6. R&D Expenditure

9.10.7. Business Performance

9.11. Sig Combibloc Group AG

9.11.1. Company Overview

9.11.2. Key Executives

9.11.3. Company Snapshot

9.11.4. Operating Business Segments

9.11.5. Product Portfolio

9.11.6. R&D Expenditure

9.11.7. Business Performance

9.12. Spx Flow, Inc.

9.12.1. Company Overview

9.12.2. Key Executives

9.12.3. Company Snapshot

9.12.4. Operating Business Segments

9.12.5. Product Portfolio

9.12.6. R&D Expenditure

9.12.7. Business Performance

9.13. Tetra Laval International

9.13.1. Company Overview

9.13.2. Key Executives

9.13.3. Company Snapshot

9.13.4. Product Portfolio

9.13.5. Business Performance

For more information about this report visit https://www.researchandmarkets.com/r/leilyq

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance