Outlook for Eurozone inflation is uncertain, warns Mario Draghi

The outlook for inflation in the Eurozone is still uncertain, according to Mario Draghi, president of the European Central Bank.

Recent volatility in exchange rates had made the inflationary picture particularly hard to read, Mr Draghi told the committee on Economic and Monetary Affairs (ECON) at the European Parliament in Brussels.

“Overall, we are becoming more confident that inflation will eventually head to levels in line with our inflation aim, but we also know that a very substantial degree of monetary accommodation is still needed for the upward inflation path to materialize,” Mr Draghi told the parliamentary committee.

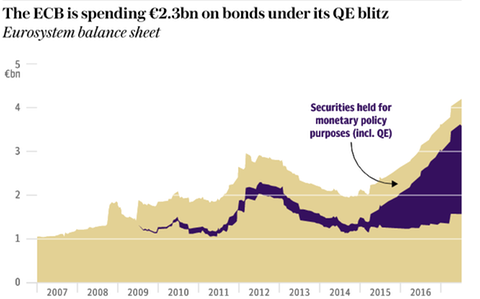

The committee meeting came as expectation mounts that the ECB will reduce, or taper, its programme of €60bn (£52.7bn) monthly stimulus spending.

Mr Draghi confirmed that decisions about how the “bulk” of this quantitative easing will be cut back would be made from October onwards.

Inflation figures, due to be released on Friday, will be carefully scrutinised as the debate on when to taper the ECB’s bond-buying programme rests largely on these numbers: June’s figure of 1.3pc inflation fell short of the ECB target of 2pc, a level the IMF does not expect it to reach until 2020.

Thursday will also see the publication of the European Commission’s economic sentiment survey, considered a useful measure for Eurozone GDP activity. Economists expect the index to show sustained growth, building on positive numbers in August, which recorded that GDP had risen by 2.2pc over the previous 12 months.

Today’s parliamentary meeting follows an interrogation earlier this month of Elke König, chairwoman of the Single Resolution Board, which was set up to manage the failure of banks in the Eurozone in such a way as to limit their impact on the wider economy.

Ms Konig defended the handling of Spanish bank Banco Popular, which was rescued by Santander earlier this year, saying the resolution had resulted in “no contagion and tax payers were safe as well as depositors”.

Yahoo Finance

Yahoo Finance