Outlook on the Urinary Tract Infection Testing Global Market to 2030 - Featuring Accelerate Diagnostics, Bio-Rad Laboratories and Danaher Among Others

Global Urinary Tract Infection Testing Market

Dublin, Aug. 30, 2022 (GLOBE NEWSWIRE) -- The "Global Urinary Tract Infection Testing Market Size, Share & Trends Analysis by Type (Urethritis, Cystitis, Pyelonephritis), by End-Use (Reference Laboratories, General Practitioners, Urologists, Urgent Care), by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

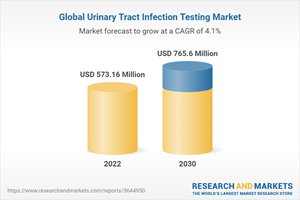

The global urinary tract infection testing market is expected to reach USD 765.6 million by 2030. The UTI testing market is witnessing growth due to factors such as rising disease burden, increasing geriatric population, rapid technological advancements, and high R&D investments by key players to introduce novel & innovative products, such as self-testing & rapid Point-of-Care (PoC) devices products.

Urinary tract infection is becoming a common global concern. According to research studies, UTI occurs in one in five adult women at some point in their life. In the U.S., about 25%-40% of women aged 20-40 have suffered a UTI. In the U.S., about 250,000 cases of pyelonephritis are reported every year. In women aged 18-19, its incidence is about 28/10,000, out of which 7% of cases require hospital admission. Genetic and cultural factors may influence its prevalence; for instance, in South Korea, the incidence of pyelonephritis is around 59/10,000. Its recurrence is more common than other UTIs, with the recurrence rate being 5.7% in men and 9% in women.

Patients with diabetes are at increased risk of developing urinary tract infections such as acute cystitis, and therefore, the increasing global prevalence of diabetes is likely to contribute to cystitis growth. According to an NCBI article, type 2 diabetes raises UTI risk and patients with type 2 diabetes experience frequent & severe UTIs. According to the International Diabetes Federation (IDF) data from 2021, approximately 643 million individuals will have diabetes by 2030 and 783 million by 2045. Moreover, the estimated prevalence of asymptomatic bacteriuria in diabetic females is 26%, compared to 6% in nondiabetic females. Such factors are expected to boost the prevalence of cystitis globally.

However, due to the rise in awareness about such diseases, the demand for specialist treatment has increased in recent years. According to the U.S. Department of Health and Human Services, in the U.S., the number of practicing urologists in 2020 was 4.07 per 100,000 populations. The report further stated that due to the rise in demand, a shortage of urologists was observed, which is likely to exceed nearly 3,600 physicians by 2025. This can impede market growth in the coming years. Moreover, COVID-19 has had a detrimental impact on the industry. Individuals with UTIs have experienced substantial disruptions in testing and emergency care.

Key players are introducing novel products to strengthen their portfolios. For instance, in September 2021, OpGen, Inc. announced initiating clinical trials of the Unyvero Urinary Tract Infection Panel. The panel can analyze a broad range of pathogens and antimicrobial resistance markers directly from a urine sample.

Successful clinical trials and the launch of such technologically advanced & efficient products are anticipated to drive market growth over the coming years. Similarly, in July 2020, Uqora, Inc. (Pharmavite, LLC), a urinary health biotechnology company, launched a UTI diagnostic and management kit. The kit includes a rapid UTI diagnostic device, Clarify, compatible with a PoC and homecare setting.

Urinary Tract Infection Testing Market Highlights

Cystitis dominated the market in 2021, with an estimated market share of 41.56%. This can be attributed to the high incidence & recurrence rate of cystitis, increased number of product approvals, and the high number of diabetes patients who are more prone to cystitis

The general practitioner segment held a share of 12.41% in 2021. It is the primary point of contact for most patients with UTI, and in most cases, uncomplicated UTI is diagnosed and treated by a general practitioner

North America dominated the overall urinary tract infection market in terms of value. This can be attributed to better reimbursement facilities and a rise in the adoption of novel diagnostic products due to increased awareness

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Urinary Tract Infection Market Variables, Trends, and Scope

3.1 Penetration and Growth Prospect Mapping

3.2 Regulatory Landscape

3.3 Industry Analysis - Porter's

3.4 Consumer Behavior Analysis

3.5 PESTEL Analysis (Political & Legal, Economic, and Technological)

3.6 Epidemiology Analysis

3.7 Custom Analysis

Chapter 4 Urinary Tract Infection Market: Segment Analysis, by End-Use, 2017 - 2028 (USD Million) (Volume, Units)

4.1 Urinary Tract Infection Market: End-use Movement Analysis

4.2 General Practitioners

4.2.1 General practitioners Market, 2017 - 2028 (USD Million)

4.2.2 General practitioners Market, Instruments, 2017 - 2028 (USD Million)

4.2.3 General practitioners Market, Instruments, 2017 - 2028, Volume (Units)

4.2.4 General practitioners Market, Consumables, 2017 - 2028 (USD Million)

4.2.5 General practitioners Market, Consumables, 2017-2028, Volume (Thousand Units)

4.3 Urologists

4.3.1 Urologists Market, 2017 - 2028 (USD Million)

4.3.2 Urologists Market, Instruments, 2017 - 2028 (USD Million)

4.3.3 Urologists Market, Instruments, 2017 - 2028, Volume (Units)

4.3.4 Urologists Market, Consumables, 2017 - 2028 (USD Million)

4.3.5 Urologists Market, Consumables, 2017-2028, Volume (Thousand Units)

4.4 Urogynecologists

4.4.1 Urogynecologists Market, 2017 - 2028 (USD Million)

4.4.2 Urogynecologists Market, Instruments, 2017 - 2028 (USD Million)

4.4.3 Urogynecologists Market, Instruments, 2017 - 2028, Volume (Units)

4.4.4 Urogynecologists Market, Consumables, 2017 - 2028 (USD Million)

4.4.5 Urogynecologists Market, Consumables, 2017-2028, Volume (Thousand Units)

4.5 Reference Laboratories

4.5.1 Reference Laboratories Market, 2017 - 2028 (USD Million)

4.5.2 Reference Laboratories Market, Instruments, 2017 - 2028 (USD Million)

4.5.3 Reference Laboratories Market, Instruments, 2017 - 2028, Volume (Units)

4.5.4 Reference Laboratories Market, Consumables, 2017 - 2028 (USD Million)

4.5.5 Reference Laboratories Market, Consumables, 2017-2028, Volume (Thousand Units)

4.6 AccounTable Care Organizations

4.7 Hospital Laboratories

4.7.1 Hospital Laboratories Market, 2017 - 2028 (USD Million)

4.7.2 Hospital Laboratories Market, Instruments, 2017 - 2028 (USD Million)

4.7.3 Hospital Laboratories Market, Instruments, 2017 - 2028, Volume (Units)

4.7.4 Hospital Laboratories Market, Consumables, 2017 - 2028 (USD Million)

4.7.5 Hospital Laboratories Market, Consumables, 2017-2028, Volume (Thousand Units)

4.8 Urgent Care

4.8.1 Urgent Care Market, 2017 - 2028 (USD Million)

4.8.2 Urgent Care Market, Instruments, 2017 - 2028 (USD Million)

4.8.3 Urgent Care Market, Instruments, 2017 - 2028, Volume (Units)

4.8.4 Urgent Care Market, Consumables, 2017 - 2028 (USD Million)

4.8.5 Urgent Care Market, Consumables, 2017-2028, Volume (Thousand Units)

4.9 Hospital Emergency Departments

4.9.1 Hospital Emergency Departments Market, 2017 - 2028 (USD Million)

4.9.2 Hospital Emergency Departments Market, Instruments, 2017 - 2028 (USD Million)

4.9.3 Hospital Emergency Departments Market, Instruments, 2017 - 2028, Volume (Units)

4.9.4 Hospital Emergency Departments Market, Consumables, 2017 - 2028 (USD Million)

4.9.5 Hospital Emergency Departments Market, Consumables, 2017-2028, Volume (Thousand Units)

4.10 Others

4.10.1 Others Market, 2017 - 2028 (USD Million)

4.10.2 Others Market, Instruments, 2017 - 2028 (USD Million)

4.10.3 Others Market, Instruments, 2017 - 2028, Volume (Units)

4.10.4 Others Market, Consumables, 2017 - 2028 (USD Million)

4.10.5 Others Market, Consumables, 2017-2028, Volume (Thousand Units)

Chapter 5 Urinary Tract Infection Market: Segment Analysis, by Type Scope, 2017 - 2028 (USD Million)

5.1 Urinary Tract Infection Market: Type Scope Movement Analysis

5.2 Urethritis

5.2.1 Urethritis Market, 2017 - 2028 (USD Million)

5.3 Cystitis

5.3.1 Cystitis market, 2017 - 2028 (USD Million)

5.4 Pyelonephritis

5.4.1 Pyelonephritis Market, 2017 - 2028 (USD Million)

Chapter 6 Urinary Tract Infection Market: Segment Analysis, By Region, 2017 - 2028 (USD Million)

Chapter 7 Urinary Tract Infection Market: Competitive Analysis

7.1 Recent Developments and Impact Analysis, by Key Market Participants

7.1.1 New Product Launches

7.1.2 Mergers and Acquisitions

7.1.3 Partnerships and Strategic Collaboration

7.2 Company Categorization

7.2.1 Innovators

7.2.3 Market Leaders

7.3 Vendor Landscape

7.3.1 List of key distributors and channel partners

7.4 Key Customers

7.5 Key Company Market Share Analysis, 2020

7.6 Public Companies

7.6.1 Company market position analysis

7.6.2 Competitive Dashboard Analysis

7.6.3 Market Differentiators

7.7 Private Companies

7.7.1 List of key emerging companies

7.7.2 Regional Network Map

7.8 Company Profiles

7.8.1 QIAGEN

7.8.1.1 Company overview

7.8.1.2 Financial performance

7.8.1.3 Product benchmarking

7.8.1.4 Strategic initiatives

7.8.2 Accelerate Diagnostics, Inc.

7.8.2.1 Company overview

7.8.2.2 Financial performance

7.8.2.3 Product benchmarking

7.8.3 Bio-Rad Laboratories, Inc.

7.8.3.1 Company overview

7.8.3.2 Financial performance

7.8.3.3 Product benchmarking

7.8.4 F. Hoffmann-La Roche Ltd.

7.8.4.1 Company overview

7.8.4.2 Financial Performance

7.8.4.3 Product Benchmarking

7.8.4.4 Strategic initiatives

7.8.5 Danaher Corporation

7.8.5.1 Company overview

7.8.5.2 Beckman Coulter

7.8.5.3 Financial Performance

7.8.5.4 Product benchmarking

7.8.5.5 Strategic initiatives

7.8.6 Siemens Healthcare GmbH

7.8.6.1 Company overview

7.8.6.2 Financial performance

7.8.6.3 Product benchmarking

7.8.6.4 Strategic initiatives

7.8.7 Randox Laboratories Ltd.

7.8.7.1 Company overview

7.8.7.2 Product benchmarking

7.8.8 Thermo Fisher Scientific, Inc.

7.8.8.1 Company overview

7.8.8.2 Financial performance

7.8.8.3 Product benchmarking

7.8.8.4 Strategic initiatives

7.8.9 bioMerieux SA

7.8.9.1 Company overview

7.8.9.2 Financial performance

7.8.9.3 Product benchmarking

7.8.9.4 Strategic initiatives

7.8.10 T2 Biosystems, Inc.

7.8.10.1 Company overview

7.8.10.2 Financial performance

7.8.10.3 Product benchmarking

7.8.10.4 Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/x4oakb

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance