Over 10,000 Covid-19-related complaints received so far by financial ombudsman

More than 10,000 Covid-19-related complaints have been received by the financial ombudsman, which is hearing from people who are unhappy with their lender’s response after facing financial difficulties.

This includes over 5,900 coronavirus-related complaints made between July and September.

The Financial Ombudsman Service (FOS) is encouraging lenders to ensure they are responding effectively and fairly to their customers.

The FOS steps in to resolve issues when consumers have already complained to a financial firm but they are unhappy with the outcome.

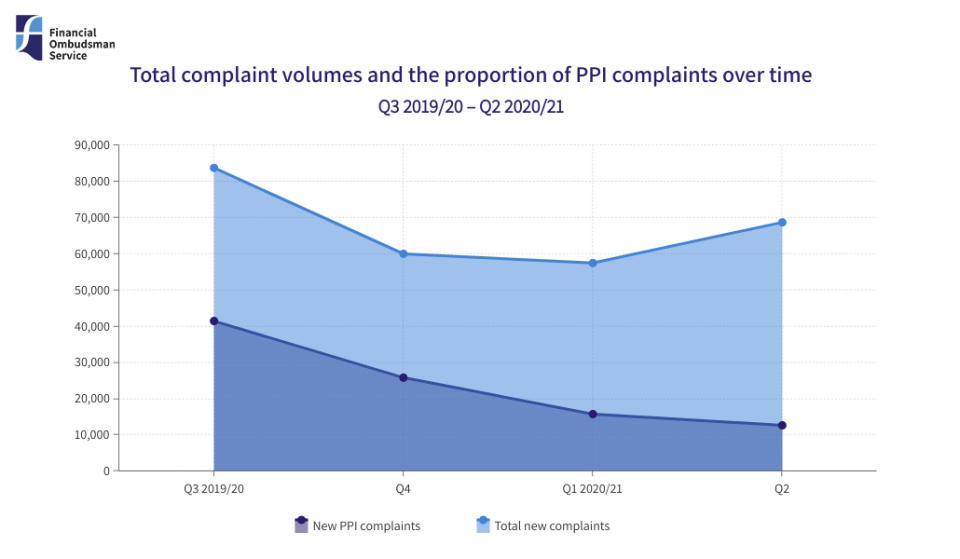

In total, the service received 68,735 complaints between July and September.

This was up by nearly a fifth (19%) compared with the previous quarter.

The FOS said: “Complaints arising from Covid-19… continued to reach us, reflecting the wide-ranging impact of the pandemic on people’s lives.”

City regulator the Financial Conduct Authority (FCA) has put wide-ranging guidance in place for lenders on how they should support borrowers impacted financially by Covid-19.

Struggling borrowers have been given payment holidays or had interest waived, for example.

But the FOS said that it is hearing from people “who’ve fallen into financial difficulty and aren’t happy with the way their lender has responded”.

It added: “The rules and guidance around lending and supporting people in financial difficulty are well-established – and we encourage lenders to ensure that they’re responding effectively and fairly to their customers’ concerns.”

The FOS also said that between July and September, it continued to see an increase in complaints from people who borrowed money, who then felt the debt was unaffordable.

It said complaints about guarantor loans increased by 296% in the latest quarter, complaints about home credit jumped by 97% and complaints about credit cards increased by 26% when compared with the previous quarter.

Meanwhile complaints about credit cards have continued to increase. Quarter-on-quarter, new complaints were up by 26% and compared with the same quarter a year earlier new complaints about credit cards have increased by two thirds (66%).

Although the ombudsman service receives fewer complaints about PPI (payment protection insurance) than it once did, PPI remains the most complained about product with just under 12,800 complaints made in the second quarter.

The deadline for complaining to a firm about PPI was in August 2019.

But people have still been able to take their PPI complaint to the ombudsman after this time if they complained to the firm by the deadline but were then unhappy with its decision.

Overall, the service upheld around a third (32%) of complaints in consumers’ favour in the second quarter. Excluding PPI, the uphold rate was higher at 41%.

Yahoo Finance

Yahoo Finance