Should You Own Applied Materials (AMAT) Ahead of Earnings?

On Thursday, November 16th, Applied Materials (AMAT) will release its fourth quarter earnings results fter the bell. The company is a Zacks Rank 2 (Buy), and have a Value, Growth, and Momentum score of B.

Dave will look at Applied Materials’s past earnings, take a look at what is currently going on with the company, and give us his thoughts on their upcoming earnings announcement.

Furthermore, Dave will uncover some potential options trades for investors looking to make a play on Applied Materials ahead of earnings.

Applied Materials in Focus

Applied Materials, Inc. expertise in modifying materials at atomic levels and on an industrial scale enables customers to transform possibilities into reality. The Company offer consulting, spare parts, services, automation software, upgrades and legacy equipment to improve the performance and productivity of the customer's equipment and fab operations. Applied Materials offers a diverse array of flexible service solutions to increase equipment uptime and factory efficiency, enabling fabs to focus on chip production, while lowering cost per wafer. The Company's display service portfolio has been developed to address the customers' specific needs and offers a variety of services that provide support for every maintenance activity on an Applied Materials display tool. Applied Materials is committed to the success of the customers throughout the product and factory life cycle and their crystalline silicon solar (c-Si) services enable the customers to focus on increasing cell efficiency and meeting factory goals.

Applied Materials is expected to report earnings at $0.90 per share according to the Zacks Consensus Estimate. Last quarter they beat earnings expectations by 3.61%. They reported earnings at $0.86 per share, beating their estimate of $0.83. They have an average earnings surprise of 2.66% over the last 4 quarters.

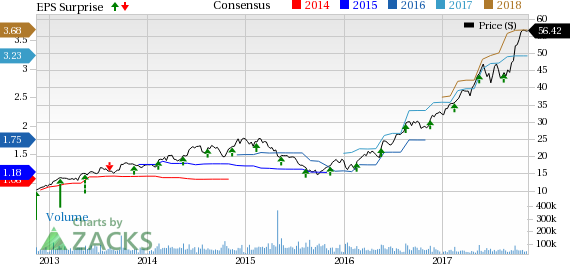

Applied Materials, Inc. Price, Consensus and EPS Surprise

Applied Materials, Inc. Price, Consensus and EPS Surprise | Applied Materials, Inc. Quote

Bottom Line

How should investors play Applied Materials ahead of their earnings report? For insights on the best options trades, then tune in at 1:00pm CST today to see David’s thoughts.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance