'I own just three stocks': how one investor turned £80k into £1.3m

Telegraph Investing readers are a passionate group, often sharing in great detail their stock market views and debating investment strategies among each other – and with us.

But no commentator is more prolific than Bogdan Bransilov, always quick to bring his expertise on topics and lay out in full his investment approach.

He talks the talk, claiming to have grown his pension 17 times since 2009, but many readers doubt whether he really walks the walk.

We caught up with Mr Bransilov, who uses a pseudonym, to verify his claims and get under the bonnet of his investment strategy.

Who is Bogdan Branislov?

Mr Bransilov is retired from a management job in the chemicals industry, in his mid 50s, and has never worked in the investment industry. He took voluntary redundancy in 2012, aged 47, and decided to focus full time on investing while working part time.

“I’m self-taught and never had a technical background. My skill is that I am inquisitive," he said.

Since he began actively managing his pension in 2009, he has turned £80,000 into around £1.3m, equivalent to 17 times returns. In comparison, the FTSE All Share is up around 2.5 times and the American S&P 500 5.5 times, including dividends.

His investment gains paid for a new house, worth £700,000, in April 2020. He now has around £600k still invested.

How did he do it?

Mr Branislov takes a “value” approach to investing, finding firms trading below their worth and are ripe for a recovery. He prefers to invest in a small number of companies where he has conviction it will turn around.

A number of landmark investments propelled him on his road to over £1m in his Sipp. His first major success was buying aircraft components group Senior Plc in 2009, where he turned £8,500 into £28,400, a 234pc gain.

“I thought the market had over reacted about the effects of the financial crisis on Senior. It had some debt but nothing too threatening and its price-to-earnings ratio was very low. It was priced to fail but I did not think that was likely at all,” he said.

Another key moment was buying housebuilder Barratt Developments in early 2011, selling his initial £55,000 stake for over £100,000 three years later.

“Barratt was one of the builders that was badly caught out in 2008. But by 2011, the company was stable and management was confident of moving back into profit in the first half of 2011 and then becoming increasingly profitable going forward,” he said.

Mr Branislov got the tip from a Questor columnist Gary White, who said at the time that “Barratt is priced for armageddon, but armageddon is not coming".

“I agreed, I owe Gary a pint,” said Mr Branislov.

Another big win was Inland Homes, a housebuilder and land remediation specialist. He bought £200,000 worth of shares in early 2013 which he then sold for £310,000 two years later.

“I had been involved a little with land remediation when working in the waste industry. It is a complex, heavily regulated and a tightly legislated niche. A lot of money can be made from land remediation if you are good at it,” he said.

Where does he invest today?

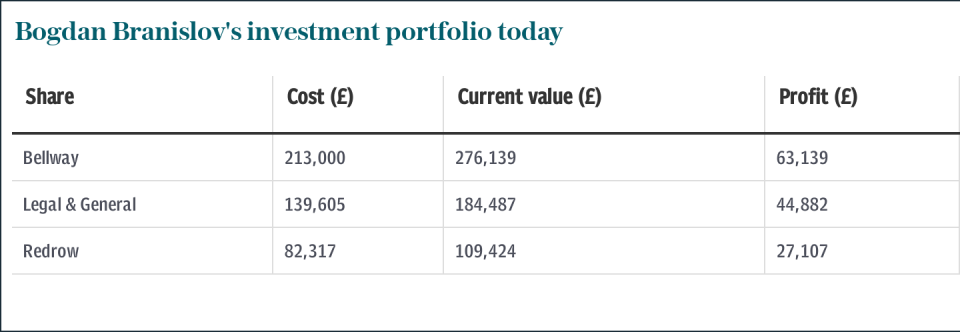

Mr Branislov’s portfolio is split between just three companies: insurer Legal & General and housebuilders Redrow and Bellway.

"The valuation is most attractive on Bellway and Redrow. They have good profit margins and we have a fundamental housing shortage, which is good for demand," he said.

“Legal & General's share price could double from where it is today," he added. "It was at a similar valuation in 2009 and then went up fourfold. It is a phenomenal company, with very reliable earnings, and crucially it is underpriced,” Mr Branislov said.

Having such a concentrated portfolio comes with lots of risk and a huge psychological burden, but Mr Branislov said the key was to leave money invested and trust the process.

“Yes you could lose 25pc overnight, but that wouldn't ruin my day as long as I understood what had happened,” he said.

However, he did decide to take his money out of the market before the worst of the stock market crash in March 2020 when lockdowns were announced.

"I sold three-quarters of my Sipp in late February, the first time that I had taken so much money out of the market. I thought investors were underestimating the impact of the pandemic and knew that I needed cash for a house purchase.

"My Sipp was worth around £1.2m at the start of 2020 but dropped to around £1m when I sold, so I didn't get out completely unscathed," he said.

Yahoo Finance

Yahoo Finance