What You Need To Own In Your Portfolio

Companies such as Epwin Group and New Century AIM VCT 2 are potentially attractive investments. This is because their stocks have desirable characteristics in terms of, for example, stock value, past track record, or future growth potential. Below is a list of stocks which provide investors with two or more favourable aspects, making them popular investments .

Epwin Group PLC (AIM:EPWN)

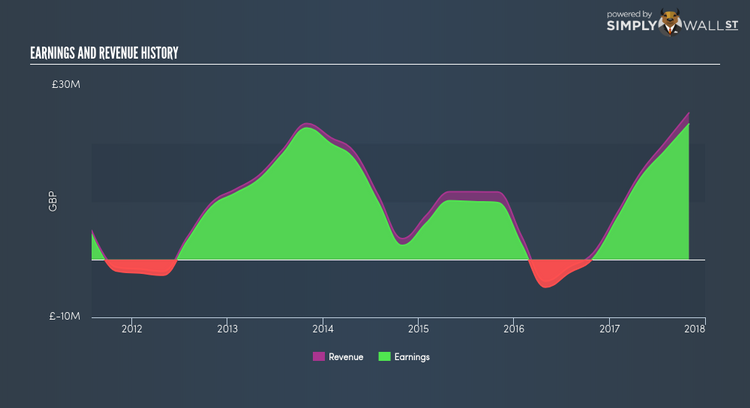

Epwin Group Plc manufactures and sells building products in the United Kingdom, rest of Europe, and internationally. Established in 1976, and currently headed by CEO Jonathan Bednall, the company now has 2,542 employees and has a market cap of GBP £114.48M, putting it in the small-cap group.

EPWN’s upcoming commitments are met by its short-term assets, and its total debt is well-covered by its cash flows, portraying its strong financial capacity. Moreover, EPWN’s shares are now trading at a price below its true value based on its discounted cash flows, and also on its price-to-equity metric, so potential investors can purchase the stock below its value. Dig deeper into Epwin Group here.

New Century AIM VCT 2 PLC (LSE:NCA2)

New Century AIM VCT 2 PLC is a venture capital trust specializing in investments in unlisted companies and qualifying companies primarily quoted on AIM. New Century AIM VCT 2 was founded in 2007 and has a market cap of GBP £2.72M, putting it in the small-cap stocks category.

NCA2’s upcoming commitments are met by its short-term assets, and the business has no debt on its books, portraying its strong financial capacity. NCA2 is currently trading below its true value in terms of its discounted cash flows, and its relative PE ratio compared to its industry, so potential investors can purchase the stock below its value. What’s more is, NCA2’s increasing dividend payment over the past decade makes it one of the best dividend companies in the market. Interested in New Century AIM VCT 2? Find out more here.

Henderson Opportunities Trust plc (LSE:HOT)

Henderson Opportunities Trust plc is a closed-ended equity mutual fund launched and managed by Henderson Investment Funds Limited. Henderson Opportunities Trust was formed in 1985 and with the stock’s market cap sitting at GBP £85.81M, it comes under the small-cap category.

HOT’s earnings growth in the past year reaching triple-digits, producing an outstanding triple-digit return to shareholders, is what investors like to see. HOT has an appropriate 14.40% debt-to-equity, and its interest on debt is adequately covered by its net income, portraying its strong financial capacity. Likewise, HOT’s shares are now trading at a price below its true value based on its discounted cash flows, and its relative PE ratio compared to its industry, so potential investors can purchase the stock below its value. Continue research on Henderson Opportunities Trust here.

For more fundamentally-robust companies with industry-beating characteristics to enhance your portfolio, explore this interactive list of big green snowflake stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance