PACCAR to Gain From Rising Truck Demand, Competition a Woe

On Jun 15, we issued an updated research report on PACCAR Inc. PCAR.

Driven by a robust economy and strong freight demand, the company witnessed the doubling of Class 8 truck orders in the first quarter of 2018 compared with the prior-year quarter. This has encouraged PACCAR to raise its 2018 Class 8 truck industry retail sales estimates for the United States and Canada to 265,000-285,000 vehicles compared with its prior anticipation of 235,000-265,000 units. Moreover, the newly estimated range is much higher than 218,000 units of retail sales generated in 2017.

In first-quarter 2018, this leading truck manufacturer saw a year-over-year increase in revenues and adjusted earnings. Moreover, both earnings and sales surpassed the respective Zacks Consensus Estimate. Furthermore, a strong balance sheet and outstanding long-term earnings are enabling PACCAR to invest in innovative products and new technologies. In 2018, the company aims to invest $300-$320 million under research and development expenses, to develop new truck models and powertrains, enabled with electric, hybrid and hydrogen fuel-cell technologies.

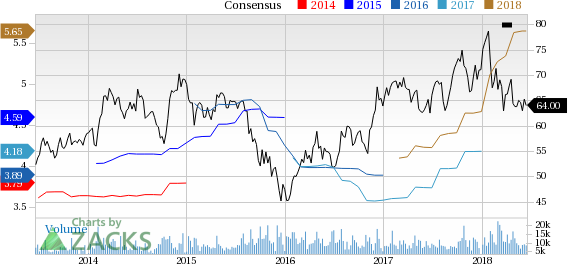

PACCAR Inc. Price and Consensus

PACCAR Inc. Price and Consensus | PACCAR Inc. Quote

Further, PACCAR has been paying regular dividends to its shareholders since 1941. Recently, in May, PACCAR’s board approved 12% increase in the quarterly dividend on common stock to 27 cents. The revised dividend was paid on Jun 5 to shareholders of record as of May 15, 2018. Earlier, in March, the company paid a quarterly dividend of 25 cents.

However, PACCAR faces fierce competition from its peers at the commercial truck market in the United States and Canada. This might hamper the company’s sales and pricing. Also, an increase in the supply of used trucks has led to declining prices, which might be a headwind for PACCAR.

Price Performance

In the past three months, PACCAR’s stock has moved down 3.3%, underperforming 11.2% increase of the industry it belongs to.

Zacks Rank & Stocks to Consider

Currently, PACCAR has a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are Magna International Inc. MGA, Douglas Dynamics, Inc. PLOW and Peugeot SA PUGOY, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Magna has an expected long-term growth rate of 8.5%. Shares of the company have risen 46.7% over the past year.

Douglas Dynamics has an expected long-term growth rate of 15%. Shares of the company have risen 54.7% over the past year.

Peugeot has an expected long-term growth rate of 19.2%. Shares of the company have risen 21.6% over the past year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6% and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

PEUGEOT SA (PUGOY) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Douglas Dynamics, Inc. (PLOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance