PACCAR (PCAR) Declares 12% Hike in Quarterly Stock Dividend

PACCAR Inc. PCAR announced that its board has approved a 12% increase in the company's quarterly dividend on common stock to 28 cents per share from the earlier payout of 25 cents per share. The revised dividend will be paid on Jun 5 to shareholders of record as of May 15, 2018.

Per management, increase in dividend showcases its continuing exceptional business performance. Further, the company has been paying regular dividends since 1941 and increased the payout by 40% in past five years.

In first-quarter 2018, the company’s net income was $512 million due to increased truck deliveries in Europe and North America, along with a strong performance by the aftermarket parts segment across the globe.

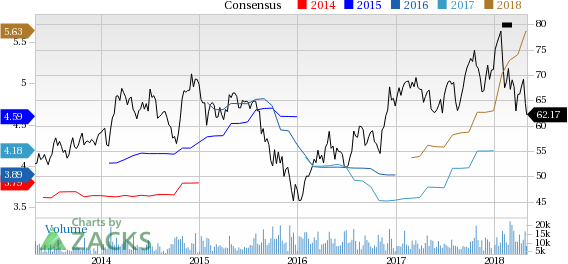

PACCAR Inc. Price and Consensus

PACCAR Inc. Price and Consensus | PACCAR Inc. Quote

An excellent balance sheet and strong operating cash flow enabled PACCAR to pay regular dividends while boosting shareholder value. Earlier in Dec 2017, it paid an extra cash dividend of $1.2 per share to shareholders. In addition to this, the company paid its usual quarterly dividend of 25 cents on Mar 6, 2018.

PACCAR engages in designing and manufacturing of premium light, medium and heavy-duty trucks. Further, the company also manufactures advanced diesel engines and distributes truck parts related to its principal business.

Price Performance

In the last six months, PACCAR’s stock has depreciated 11.9%, underperforming the 8.4% decline of the industry it belongs to.

Zacks Rank & Other Stocks to Consider

PACCAR currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the auto space are Visteon Corporation VC, Wabash National Corporation WNC and Fiat Chrysler Automobiles N.V. FCAU. Visteon and Wabash National carry a Zacks Rank #2, while Fiat Chrysler sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Visteon has expected long-term growth rate of 16.6%. In the last three months, shares of the company have gained 3.8%.

Wabash National has expected long-term growth rate of 21.5%. Shares of the company have risen 5.2% in the past six months.

Fiat Chrysler has expected long-term growth rate of 23.7%. In the last six months, shares of the company have gained 24.8%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Fiat Chrysler Automobiles N.V. (FCAU) : Free Stock Analysis Report

Visteon Corporation (VC) : Free Stock Analysis Report

Wabash National Corporation (WNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance